Few newcomers to Vietnam’s stock exchanges in 2022

Few newcomers to Vietnam’s stock exchanges in 2022

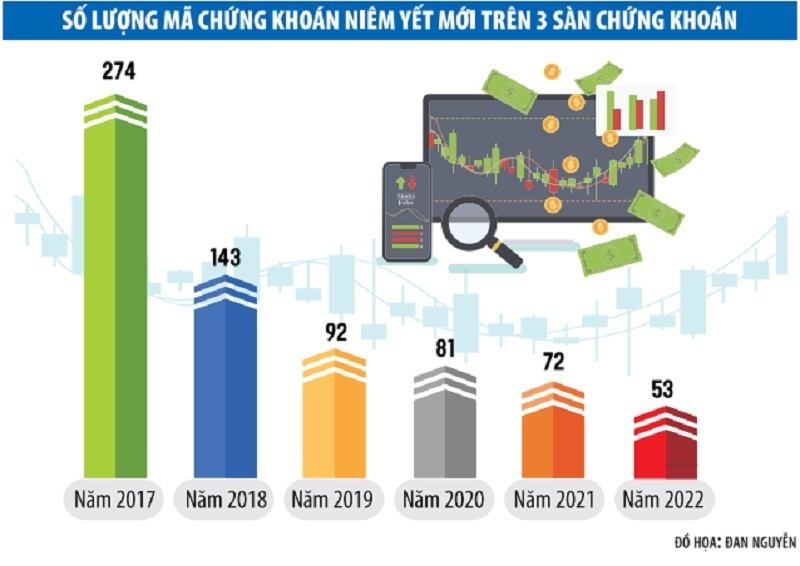

The number of fresh players on the stock exchange in 2022 continued to fall back, with only just over 50 new stocks added to the list of nearly 1,700 on the Ho Chi Minh City and Hanoi stock exchanges and UPCoM.

GC Food is the latest face to enter the stock market after registering to trade 26 million GCF shares on the Unlisted Public Company Market (UPCoM) on December 20.

Since the beginning of the year, UPCoM has welcomed a total of 36 stocks. With two listed exchanges, the number of newcomers is only half that, including 16 new stocks and 2 ETF certificates.

With only one week left until the end of 2022, the number of new newcomers on the three exchanges just amounted to 54 units, down 26 per cent compared to 2021.

In 2021, Vietnam's stock exchanges welcomed a total of 79 newcomers, also down nearly 20 per cent over the previous year.

The gloom of 2021 partly came from the complicated situation of the pandemic and when the old system's ability to handle order-matching transactions on HSX failed to keep up with exciting transactions in the market.

More careful reviews of the records submitted by firms and the changing market situation have caused many businesses planning to issue new shares to fall significantly behind schedule, with some even choosing to postpone their plans.

This year, although the above factors have basically been fixed, events such as the massive bond issuances related to the notorious Tan Hoang Minh Group and the sharp decrease in stock market cash flows have led transactions between investors, new issuances, and listing activities to be negatively affected.

More careful reviews of the records submitted by firms and the changing market situation have caused many businesses planning to issue new shares to fall significantly behind schedule, with some even choosing to postpone their plans.

In just one week, the Ho Chi Minh City Stock Exchange announced it would stop considering the registration documents for listing shares of Bao Chau Pharmaceutical Group and Nova Consumer because the dossiers have not yet been amended with the requested supplements.

Along with the downward trend of stocks, the gloom in the market as the number of newcomers continued to shrink caused the stock market capitalisation in 2022 to shed an estimated 30 per cent on-year.

Statistics from the Ministry of Finance show that the size of the stock market is currently only equivalent to 64.2 per cent of GDP.

The fact that VNG JSC – deemed Vietnam's tech unicorn – is about to prepare for stock trading registration on UPCoM promises to be a remarkable highlight on the listing landscape in 2023.

The company has just completed its shareholder meeting with the approval to sell all of its over 7.1 million treasury shares held by VNG, which accounts for 24.7 per cent of total outstanding shares, at an average price of $7.73 apiece.

Despite having just modest charter capital of around $15.6 million, VNG's equity as of September 30 approximated $242.6 million.

The company’s market capitalisation calculated at the treasury share selling price reached $277.2 million, yet climbs to $2.2 billion if calculated at the price that Temasek Holdings – an investment fund from the Singapore government – purchased in 2019.