VN-Index surge is cause for concern

VN-Index surge is cause for concern

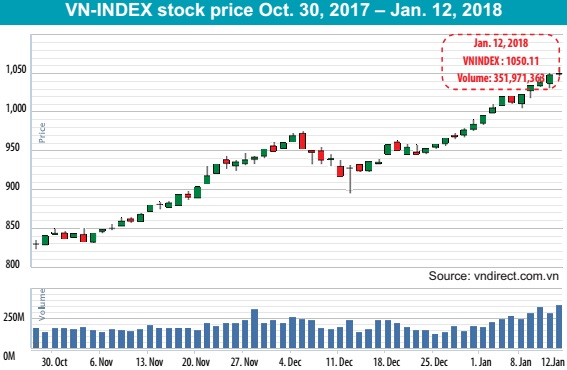

As the VN-Index breaks the 1,000-point mark and paints a rosy outlook for the rest of 2018, questions have arisen on whether Vietnam is getting too expensive for foreign investors.

A New Year’s high

The Vietnamese stock market got off to a good start in 2018. Its main gauge, the VN-Index, crossed the 1,000-point threshold on January 3 and has returned to its peak 10 years after the speculation bubble burst and crippled the market. Over the past fortnight, the index remained above the 1,000 mark and closed at 1,048 points on Friday morning.

In 2017, Vietnam’s main index grew by 48 per cent, fuelled by strong gains in blue chips, news of state divestments, and increasing attention from foreign investors. Le Duc Khanh, head of Investment Advisory at PetroVietnam Securities Inc., said that the market was buoyed by Vietnam’s stable macro-economics, steady foreign exchange rates, and major foreign investment deals.

“The Vietnamese economy is embarking on a new growth cycle. I believe that if positive news continues, the VN-Index can hit 1,200 points in the first quarter of 2018 and possibly reach 1,400 by the second or third quarter,” Khanh said.

The analyst then listed some of the upcoming share sales that may shake up the market and lure foreign capital into Vietnam, including the sales of PV Oil, PV Power, and Binh Son Refinery – all scheduled for the first quarter of 2018. Major companies such as Genco 1 and 2 as well as Vietnam’s Rubber Group are also up for public listings.

Moreover, the Ministry of Industry and Trade recently announced the list of divestments for 2018, which includes industry heavyweights such as Petrolimex, Vietnam National Textile and Garment Group (Vinatex), Vietnam Steel Corporation (VNSteel), and Vietnam Pharmaceutical Corporation (VinaPharm). The Airports Corporation of Vietnam, managed by the Ministry of Transport, is also up for further state divestments, along with the approved plans for Binh Minh Plastics, Tien Phong Plastics, and Domesco Pharmaceutical.

In the private sector, various banks are also being listed and selling shares to foreign investors, the most recent one being HDBank. TPBank, LienVietPostBank, and Techcombank have also revealed plans to list or raise external capital this year.

These back-to-back deals are expected to draw the attention of overseas investors, be they strategic partners or investment funds.

Too steep a cost?

Despite the rosy outlook, there are also concerns that due to the ongoing rally of the stock market, Vietnam is getting more expensive in foreigners’ eyes, eroding the appeal of Vietnam as a cheap frontier market.

In fact, the current price-over-earnings ratio of Vietnam is 20.2x, placing it higher than Thailand’s 18x, and significantly above Pakistan’s 8x and China’s 16x. According to Mac Quang Huy, CEO of Maritime Securities, this means Vietnam is no longer an affordable market when compared to its neighbours in the region.

“Rising prices mean that Vietnam cannot rely on its cheap valuations to attract overseas investors anymore. It’s time to focus on other factors such as the business results of listed firms, which are forecast to grow by 20 per cent this year. In addition, we need more state divestments and major share sales to increase the supply of stocks for investors,” said Huy.

Nguyen Duc Hung Linh, head of Retail Research and Investment Advisory at Saigon Securities Inc., also acknowledged that the Vietnamese market is no longer a cheap destination for foreign capital. According to Linh, the stock exchange welcomed many high-profile newcomers in 2017, such as shopping mall operator Vincom Retail and budget carrier Vietjet Air, which helped to boost the VN-Index.

“The market was on a bull run last year as these new stocks appreciated a lot in value. I expect a similar occurrence this year, as we have many state divestments and listings coming up,” Linh noted.

In the first week of 2018, foreign investors net bought $73 million of securities in Vietnam, including $45 million in stocks and $28 million in bonds. The National Financial Supervision Council expected stocks in banking, retail, consumer goods, and aviation to lead the gains in 2018.

In its latest report, the council also expected overseas investors to continue flocking to Vietnam despite external factors, such as the US Federal Reserve raising rates or geopolitical pressures around the world.