VN stocks plummet over margin policy

VN stocks plummet over margin policy

Vietnamese shares plummeted yesterday as investors realised short-term profits. Worries remained that the adjusted policy on margin lending could take effect early next month.

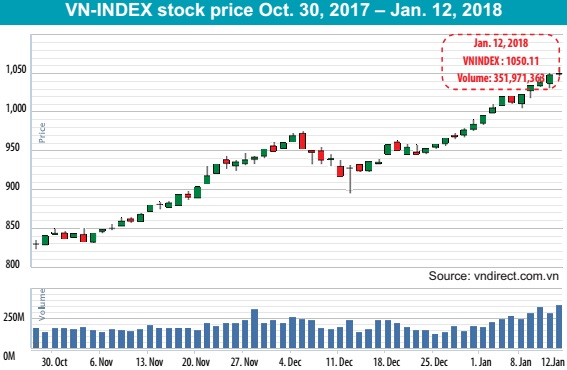

The benchmark VN Index on the HCM Stock Exchange plunged 2.66 per cent or 28.27 points to close at 1,034.69 points, extending its decline from a slight decrease on Tuesday.

The latest drop also erased all gains the benchmark VN Index had made since January 9.

The index had the biggest loss in percentage terms since December 11, 2017, when it fell 2.42 per cent.

The benchmark’s declining rate on Wednesday was still below a dive of 3.07 per cent made on January 18, 2016.

The minor HNX Index on the Ha Noi Stock Exchange dropped 0.96 per cent to end at 120.42 points. The northern market index has declined a total 1.3 per cent after the last two sessions.

The two local exchanges were dominated by declining stocks, which outnumbered gainers by 341 to 136 and 120 remaining stocks finished flat.

Market trading liquidity remained high with more than 409.3 million shares being traded on the two local exchanges, worth VND9.85 trillion (US$437.9 million).

The trading figures were slightly up in volume, but rose 7.2 per cent in value compared to the previous session.

All 20 sectors on the stock market ended in negative territory. Industry indices fell between 0.4 per cent and 4.5 per cent.

The worst performing sectors included banks, brokerage firms, construction-material producers, insurance companies and food and beverage suppliers. The worst decliners dropped at least 5 per cent each.

They included Vietcombank (VCB), Vietinbank (CTG), HDBank (HDB), Sai Gon-Ha Noi Securities (SHS), VNDirect Securities (VND), Vinacafe Bien Hoa JSC (VCF) and steel producer Hoa Sen Group (HSG).

The large-cap VN30 Index that tracks the performance of the 30 largest stocks by market capitalisation also plunged 3 per cent to 1,030.00 points with 90 per cent of the stocks included in the index falling.

According to Sai Gon-Ha Noi Securities (SHS), the sharp drop of the benchmark VN Index proved investors had become less confident in the hope the benchmark index would overcome the level of 1,065 points.

“As the benchmark index has increased substantially in the recent weeks and offered profits for investors, it will likely trigger investors to increase selling to lock in profits,” SHS said in its daily report.

VPBank Securities Company (VPBS) attributed the market slump to investor concerns over the possibility that the amended policy on tightening margin lending at securities firms would be released in early February.

“Though the State Securities Commission has raised its voice over the issue to cushion investor confidence, market sentiment will not get back to its normal status as the absorption of the market towards local stocks would decline substantially and investors are discouraged from participating in the market,” VPBS said.