Cambodia’s retail loan balance hits $16.39 billion in Q4 2025

Cambodia’s retail loan balance hits $16.39 billion in Q4 2025

The rise in loan balances reflects both improving consumer confidence and the expanding role of credit in supporting household consumption and economic activity, says CBC report.

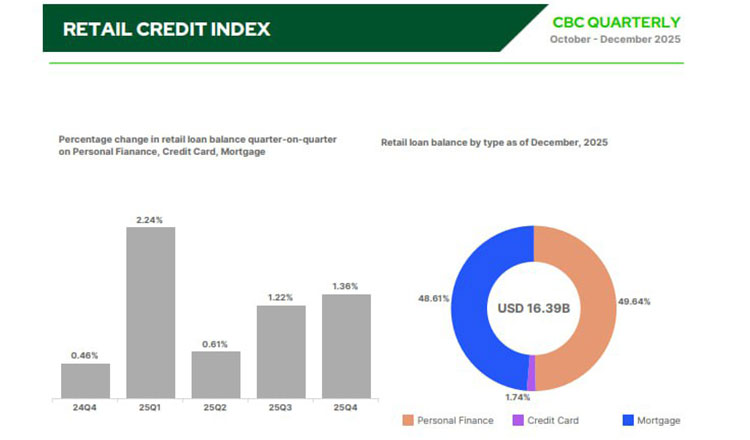

Cambodia’s retail credit market showed renewed momentum in the final quarter of 2025, with total outstanding retail loan balances reaching $16.39 billion, according to the latest Quarterly Retail Credit Index released by Credit Bureau Cambodia (CBC) yesterday.

The October-December 2025 report indicates a 1.36 percent quarter-on-quarter increase in overall retail loan balances, reflecting steady growth in consumer borrowing despite lingering economic pressures and cautious lending conditions.

CBC data show that the number of retail loan accounts expanded by 7.88 percent quarter-on-quarter, signalling continued demand for credit among households. Personal finance, credit cards and mortgage loans all contributed to the increase, with personal finance remaining the dominant product segment in terms of account volume.

In terms of applications, retail credit demand rebounded strongly during the quarter. Personal finance applications surged by 76 percent, while credit card applications declined by 25 percent, and mortgage applications posted a modest 6 percent increase compared to the previous quarter. CBC noted that retail credit applications represent consumer intent to acquire credit and are often an early indicator of future lending trends.

Regionally, loan balance growth was observed across all major economic zones, including the plain, coastal, plateau and Tonle Sap regions, underscoring broad-based participation in the credit market. CBC reported that the overall increase in loan balances was driven mainly by personal finance and mortgage lending, while credit card balances saw more moderate growth.

On credit quality, the report highlighted mixed trends. The ratio of loans overdue by more than 90 days (90+ DPD) stood at 10.30 percent for personal finance, 4.65 percent for credit cards, and 6.38 percent for mortgages as of December 2025.

While these figures suggest manageable risk levels, CBC cautioned that close monitoring remains necessary, particularly for borrowers holding multiple loan relationships, who accounted for nearly 30 percent of late repayment cases.

CBC said the Quarterly Retail Credit Index is designed to provide a comprehensive snapshot of Cambodia’s consumer credit market, covering credit applications, performance and quality. The bureau added that the continued rise in loan balances to $16.39 billion reflects both improving consumer confidence and the expanding role of credit in supporting household consumption and economic activity.

Launched in 2012 with support from the National Bank of Cambodia and industry stakeholders, Credit Bureau Cambodia plays a central role in promoting financial stability by providing real-time credit information to banks, microfinance institutions and consumers across the Kingdom.

- 07:58 04/02/2026