European business confidence reaches highest in seven years

European business confidence reaches highest in seven years

EuroCham released the Q4 2025 edition of its Business Confidence Index (BCI) on January 13, recording its highest level in seven years and marking a decisive shift in European business sentiment.

|

Rising sharply to 80.0 points, the index signals a return to strong confidence after nearly a decade marked by disruption, volatility, and prolonged neutrality – even as global trade tensions and geopolitical uncertainty continue to weigh on the international environment.

The Q4 2025 BCIsurged by 13.5 points to reach 80.0, ending a seven-year period of successive shocks, from the pandemic to global trade frictions, which repeatedly tested sentiment despite Vietnam's solid economic fundamentals.

This rebound represents one of the strongest upward movements since the BCI's launch in 2011 and reflects broad-based improvements across both current business conditions and future expectations. In Q4 2025, 65 per cent of respondents rated their current business situation as positive, while 69 per cent expressed confidence in their outlook for Q1 2026.

Critically, realised business conditions in Q4 exceeded expectations set in the previous quarter: while only 56 per cent had anticipated positive conditions for Q4, when surveyed in Q3, the actual outcome reached 65 per cent, pointing to better-than-expected performance.

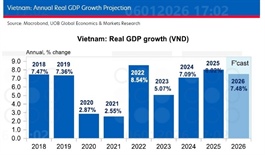

This shift closely mirrors Vietnam's macroeconomic trajectory. GDP growth in Q4 2025 reached 8.46 per cent (the fastest quarterly expansion since Q4 2007) and exceeded projections from major international institutions. “Our latest BCI confirms what many of us have felt intuitively,” said EuroCham chairman Bruno Jaspaert. "After years of hovering around the mid-line, reaching 80 tells us that confidence is now grounded in delivery – in factories running, orders returning, and investments being executed. We are seeing a structural shift where Vietnam is quickly transforming into a powerful growth engine, on track to rank among the top three economies in ASEAN."

Vietnam as “the place to be”

Beyond short-term gains, the Q4 2025 BCI reveals exceptionally strong confidence in Vietnam's medium-term outlook. An overwhelming 88 per cent of respondents expressed optimism about their organisation's prospects in Vietnam over the 2026-2030 period, including 31 per cent who described themselves as “very optimistic”. Chairman Jaspaert noted, "88 may sound like a lucky number, but it is much more than a fortune cookie: for our members, it is a rational one. Over the next five to seven years, provided it plays its cards right, Vietnam is destined to become the place to be, rising to enter a golden era of growth and transformation."

This sentiment is reinforced by performance trends. 60 per cent of companies reported improved business results in 2025 compared to 2024, while 82 per cent expect further improvement in 2026, signalling confidence that current momentum will carry forward.

Vietnam's appeal is further reinforced by strong peer endorsement. 87 per cent of respondents say they are likely to recommend Vietnam as an investment destination to other foreign businesses, with confidence highest among larger employers with substantial on-the-ground operations.

Global trade tensions: pressure felt, but resilience holds

While sentiment is improving, global trade concerns continue to weigh on business operations. In 2025, 42 per cent reported a net negative impact from global trade concerns, compared with 24 per cent who reported a positive impact, while 34 per cent experienced little or no effect.

Xavier Depouilly, general manager of DXL Research and Consulting, said, "Despite global challenges, European businesses remain highly confident about Vietnam. However, we see a distinct divergence in resilience. While large multinational corporations are capitalising on their scale to double down on the long term, small- and medium-sized enterprises (SMEs) are operating without the same buffers against external shocks. Smaller firms are disproportionately exposed to volatility, forcing them to prioritise immediate revenue and survival rather than the expansion we see at the top of the market."

Among the sources of global tension, US tariff policies and trade disputes are cited most frequently, mentioned by 46 per cent of respondents. The impact is felt primarily through demand shifts and revenue uncertainty (43 per cent), followed by higher operating costs (16 per cent), resulting in direct pressure on profitability.

In response, businesses have adopted a range of strategic adjustments. Cost optimisation is the most common response, pursued by 41 per cent of firms, followed closely by increased use of technology, automation, and AI (35 per cent). A smaller share has diversified operations outside Vietnam (23 per cent) or adjusted investment plans (19 per cent) and expansion strategies (17 per cent). Notably, 20 per cent report making no operational changes, suggesting that for some, the impact of global tensions remains moderate or might fade out over time.

Importantly, despite these pressures, 56 per cent of businesses report increased optimism about Vietnam as a place to operate or invest. “This is growth despite the global turbulence and the economic integrity it involves,” added Jaspaert. "After the so-called 'Liberation Day' tariffs announcement, many questioned whether Vietnam would need to revise its 8 per cent growth ambition. What we saw instead was economic resilience translated into results. Vietnam closed 2025 with GDP growth of 8.02 per cent – not because headwinds were absent, but because fundamentals were strong enough to absorb them. Even those that want to debate the validity of the growth have to admit that these numbers are very strong, especially in view of the state of the global economy."

Reform momentum: early signals, mixed impacts

Recent reform initiatives are beginning to register, although their impact remains uneven. Resolution 68, issued in May 2025, is viewed positively in principle, but its practical effects are still emerging. Resolution 68 seeks to elevate the private sector through reduced bureaucracy, digitalised procedures, a shift from pre-approval to post-audit regulation, and stronger safeguards for fair competition.

Businesses broadly welcome this direction, while calling for clearer and more consistent implementation. By Q4 2025, 25 per cent of respondents reported some improvements in their operating environment, including 8 per cent citing major improvements. However, 61 per cent report no noticeable impact yet, reflecting the early stage of implementation, while 5 per cent said it has introduced new challenges.

Key drivers of future performance

Looking ahead, infrastructure development and public investment are widely seen as key growth drivers over the next 12-18 months, particularly for construction, trade, logistics, and consumer-facing sectors. Improved connectivity, transport capacity, and land access are expected to unlock long-term opportunities.

Equally critical are faster approvals and more predictable administrative processes. While global tensions are seen as confronting, unresolved regulatory inefficiencies are viewed as the more immediate constraint on growth.

As confidence improves, European businesses are entering 2026 with a clear set of strategic priorities. Business development and portfolio diversification top the agenda, cited by 50 per cent of respondents. Talent remains a close second, with 45 per cent prioritising retention and recruitment, underscoring continued pressure on skilled labour availability and the importance of human capital in sustaining growth.

At the same time, 41 per cent of respondents highlighted greater use of technology, automation, and AI, pointing to a parallel focus on efficiency, productivity, and long-term competitiveness.

- 10:17 13/01/2026