M&A seen as strategic lever for Việt Nam businesses in uncertain global economy

M&A seen as strategic lever for Việt Nam businesses in uncertain global economy

As global economic rules shift, mergers and acquisitions are emerging as a key tool for Việt Nam to restructure businesses and sustain growth.

The forum marked a watershed moment for Việt Nam’s M&A sector, with the Ministry of Home Affairs formally approving the establishment of the Vietnam M&A Association. — VNS Photo Mai Hương |

Việt Nam's mergers and acquisitions (M&A) community gathered on Wednesday to map out strategies for corporate consolidation as the country navigates global economic turbulence.

At the Spring M&A Forum 2026, held by the Vietnam M&A Association (VMAA), Nguyễn Đức Kiên, former head of the Prime Minister's economic advisory group, said the era of deep globalisation is giving way to bilateral arrangements focused on national interests and supply chain security.

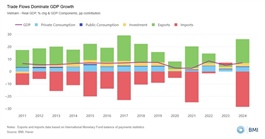

This structural shift is creating what Kiên described as a "prolonged state of uncertainty" in both policy formulation and business strategy. Traditional economic centres like the United States and European Union are adapting to the rapid rise of BRICS+ nations and emerging economies, fragmenting the global balance of economic power.

"For Vietnamese enterprises, this presents both significant challenges and opportunities," he said.

The challenges include mounting competitive pressure, rising capital costs and increasingly stringent requirements for digital transformation and governance standards. But opportunities exist for businesses that can restructure quickly, scale up operations and leverage capital and technology through strategic M&A transactions.

Although full-year figures have yet to be released, Việt Nam recorded around 220 M&A deals in the first ten months of 2025, with disclosed values totalling approximately US$2.3 billion.

More recently, a Grant Thornton report showed that the market saw 31 transactions in December alone, with disclosed and estimated deal values of about $1.3 billion. The figures reflect ongoing recovery and corporate restructuring momentum in Southeast Asia's fastest-growing economy.

Kiên highlighted domestic business dynamics that underscore the need for more active M&A markets. More than 155,000 new businesses were established in 2025, while over 102,000 resumed operations after temporary suspensions. However, more than 114,000 businesses temporarily halted activities for restructuring, and nearly 36,000 exited the market entirely.

The forum marked a watershed moment for Việt Nam’s M&A sector, with the Ministry of Home Affairs formally approving the establishment of the Vietnam M&A Association. — VNS Photo Mai Hương |

"The data shows that alongside the economy’s positive performance, there is ample momentum for mergers and acquisitions to expand strongly," he said.

According to him, M&A helps reallocate assets, transfer technology, standardise governanc, and enhance competitiveness. Rather than allowing social resources to fragment or waste away, M&A creates mechanisms for efficient reorganisation that improve overall economic growth quality.

The forum also marked a watershed moment for Việt Nam’s M&A sector, with the Ministry of Home Affairs formally approving the establishment of the Vietnam M&A Association after more than three years of sustained advocacy by the business and investment community.

According to Phạm Thùy Dương, head of the association's steering committee, the association's creation represents more than just professional organisation. It signals expectations for a more professional, transparent and standardised M&A market.

The body will connect businesses, advise on policy, develop transaction standards, share post-merger management experience and strengthen confidence among domestic and foreign investors.

"We want to create direct connection mechanisms between regulators, businesses, investors and advisory firms to remove bottlenecks around legal frameworks, capital access and growth strategies through M&A," she told Việt Nam News.

Dương, whose company is pursuing M&A in real estate by consolidating old townhouses for larger development projects, acknowledged that lack of systematic training and professional certification remains the biggest market barrier.

"Most deals still rely heavily on personal experience and intuition," she said. "The association will provide foundations for professional training programmes to elevate capabilities across the sector."

She noted that while new land and housing laws contain positive elements, ongoing administrative reorganisation has created procedural obstacles that slow deal progress.

"These are transitional difficulties requiring time to resolve," she said.

As 2026 unfolds with both opportunities and challenges, M&A is increasingly seen as a key channel for corporate restructuring and economic renewal in Việt Nam. Under a transparent institutional framework and guided by long-term investors, M&A can move beyond individual deals to become a meaningful driver of sustainable growth.

However, experts caution that M&A is not a cure-all. Without proper oversight and regulation, it can be abused for market manipulation, asset stripping or transfer pricing, undermining the business environment. Strengthening the legal framework, empowering intermediaries and improving transparency are therefore critical to ensuring healthy market development.

- 22:44 21/01/2026