Vietnam powers up as prime data centre investment destination

Vietnam powers up as prime data centre investment destination

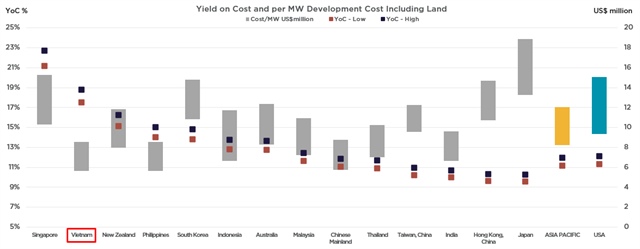

Vietnam is fast becoming a prime hotspot for data centre investment in Asia-Pacific, offering the region’s second-highest yield-on-cost after Singapore, according to a new report from Cushman & Wakefield.

The Asia-Pacific Data Centre Investment Landscape report from July 10 found Yield on Cost (YoC) on data centre investments in Vietnam to be in the range of 17.5 to 18.8 per cent, behind Singapore’s 21 to 23 per cent.

This positions Vietnam as one of the most attractive emerging markets, driven by surging demand, competitive development costs, and proactive government support.

Report author and head of Insights and Analysis for Cushman & Wakefield’s Asia-Pacific Data Centre Group, Pritesh Swamy, said that Vietnam’s recently introduced policy change allowing foreign investors to acquire land, and to own and operate data centres without a local partner, has demonstrated the government’s commitment to boosting digital infrastructure across the country.

"Data centres have been classified as 'high-priority technology' for development and investment, and we expect to see further interest from international investors in the months to come," said Swamy.

Yield on cost and per MW development cost including land, 2025. Source: Cushman & Wakefield |

The average development cost, including construction and land costs, per MW of data centre capacity in Vietnam is approximately $7.1 million. This is significantly below the regional average of $10.1 million/MW and nearly half the cost of development in Japan, which is the region’s the most expensive market at $16.1 million/MW.

By 2030, the total capital expenditure (CapEx) requirement for planned data centre projects in Vietnam is estimated at $755 million.

While this figure is modest compared to major markets such as Japan ($47 billion), Australia ($21 billion), or Malaysia and India ($20 billion each), it underscores the market’s early-stage growth and high return potential.

Vietnam’s current capitalisation rate ranges from 7 to 8 per cent, well above the regional average of 5.8 per cent, offering an attractive risk premium for forward-looking investors.

Vietnam’s infrastructure shortfall is part of a broader regional trend, highlighting robust demand amid constrained supply.

The Asia-Pacific region averages over 350,000 people per MW of colocation capacity, several times higher than the US.

In Vietnam, this figure exceeds 1.77 million people per MW, among the highest in the region. Even if all under-construction and planned projects are completed by 2030, the country would still face a significant shortfall, with a projected density of more than 690,000 people per MW.

Vietnam’s macroeconomic fundamentals further support the sector’s growth. Although the country has yet to reach a $1 trillion GDP like some regional peers, it is among the fastest-growing economies with strong breakout potential.

Cushman & Wakefield’s analysis shows that markets with GDPs under $1 trillion, including Vietnam, the Philippines, Thailand, Taiwan, and New Zealand, account for 7 per cent of regional GDP but only 5 per cent of total data centre capacity, indicating substantial headroom for expansion.

- 15:27 11/07/2025