Five strategic priorities to help businesses strengthen operational resilience

Five strategic priorities to help businesses strengthen operational resilience

Vietnamese firms must shift from optimism to action, with a UOB study outlining five strategic priorities to boost resilience amid global uncertainty and fragmented economic dynamics.

As the global economic landscape becomes increasingly volatile, businesses face rising pressures to recalibrate their strategic focus. Optimism must be backed by resilience that is rooted in nimble operations, adaptable corporate structures, and regional connectivity.

|

At the closed-door dialogue ‘Vietnam Business Outlook 2025: Strategic Readiness in a Fragmented World’, co-hosted by UOB Vietnam and EuroCham on July 4, Lim Dyi Chang, country head of commercial banking at UOB Vietnam, underscored the structural tensions underlying Vietnam’s business sentiment and strategic preparedness.

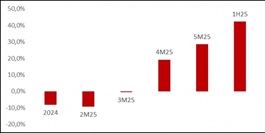

Referencing the UOB Business Outlook Study 2025 (Vietnam), Lim noted a significant divergence that while 80 per cent of Vietnamese firms expressed optimism at the start of 2025, sentiment dropped sharply to 48 per cent following the announcement of US tariffs. This indicates a persistent gap between perceived opportunity and actual strategic preparedness.

“Optimism may serve as a starting point,” said Lim. “But it is readiness that determines whether a business can thrive amid volatility.”

At the event, Lim also shared key insights from the UOB Business Outlook Study 2025, highlighting five critical pillars that businesses must focus on to strengthen operational readiness amid growing uncertainties.

|

From optimism to adaptability: Confidence must translate into response capability.

From broad-based digitalisation to outcome-driven execution: Further digital investments should be more specific outcome-driven, not checklist-based.

From ESG compliance to sustainable advantage: Environmental, social, and governance (ESG) efforts must serve as a driver of long-term value, beyond regulatory obligations.

From domestic supply chains to regional trade connectivity: Supply chains must evolve from domestic optimisation to regional integration, tapping into intra-ASEAN trade flows to enhance resilience and responsiveness.

From market expansion to strategic endurance: Expansion strategies must capture clear intentions to withstand market volatility.

“These are not merely observations,” Lim emphasised. “They are pivot points for business strategy. Whether domestically focused or FDI-backed, firms must reassess their priorities at these inflection points.”

During the in-depth dialogue, business leaders shared practical experiences aligned with the five strategic pillars highlighted in the UOB Business Outlook Study.

In addition to internal efforts and government support, the discussion underscored the growing need for financial partners with strategic advisory capabilities, those able to help enterprises effectively implement their growth ambitions.

|

According to the fresh study, 89 per cent of Vietnamese businesses plan to expand overseas, the highest rate in ASEAN.

Yet, most still lack fully integrated operating models to support sustainable international expansion. This highlights the critical need for partners that can enable businesses to translate intent into action.

“At UOB, we are committed to supporting Vietnamese enterprises on their long-term growth journey through practical, purpose-driven solutions,” said Lim.

Along with this, UOB focuses on helping businesses drive sustainable transformation through green financing and ESG-aligned solutions; optimise operations and investments via an integrated digital ecosystem; and strengthen working capital and liquidity through financial supply chain management solutions.

The bank also plays a part in unlocking regional opportunities through UOB’s ASEAN network and dedicated FDI advisory capabilities.

“The survey results are just the beginning,” Lim concluded, citing that “What matters more is the ability to translate insights into concrete actions. In a volatile landscape, businesses that are agile and prepared will be best positioned to gain a long-term strategic advantage.”

|

The main research for the UOB Business Outlook Study was conducted in January, surveying around 4,200 businesses across ASEAN and Greater China, including 532 from Vietnam. Following the announcement of US tariffs, a follow-up dipstick survey was conducted from April 9-12 with approximately 800 businesses. To access the full UOB Business Outlook Study 2025 - Vietnam Market Report, please visit: |

- 11:00 10/07/2025