Foreign room expansion opens new opportunities for banks

Foreign room expansion opens new opportunities for banks

The latest move to expand the foreign ownership limit in select commercial banks marks a pivotal step in banking sector reform by offering capital-raising opportunities, boosting market liquidity, and signalling a new phase of strategic investor engagement.

The government has a issued decree effective from May 19 allowing adjustments to the foreign ownership ratio in commercial banks that have undertaken the compulsory acquisition of weak banks.

This regulation creates opportunities for joint-stock commercial banks such as Military Bank (MB), VPBank, and HDBank, which have accepted mandatory transfers of weak banks, to increase their foreign ownership limits up to 49 per cent. Vietcombank, however, is excluded from the list due to the State Bank of Vietnam’s 74 per cent stake.

In the context of net foreign outflows exceeding $1.2 billion from banking stocks since early 2024, the new policy is expected to draw fresh foreign capital and potentially trigger a sharp rebound in stock prices.

According to ACB Securities (ACBS), Decree 69 enables banks to raise capital through issuances to foreign investors, particularly when these institutions require additional capital to support weak banks and accelerate restructuring.

“This not only strengthens equity capital but also brings in advanced technology and management experience, potentially boosting stock prices in the short term. With the current need for momentum in the stock market, this policy is expected to enhance liquidity and draw back foreign capital,” noted ACBS.

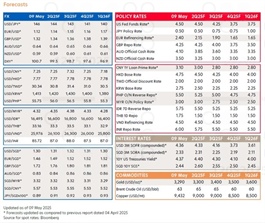

ACBS highlighted MB as a standout candidate with a solid financial foundation as market capitalisation of $5.75 billion, total assets of $46.28 billion, and equity of $4.95 billion. Its non-performing loan (NPL) ratio stands at 1.8 per cent, well below the sector average of 2.8 per cent, reflecting superior credit quality.

Its capital adequacy ratio (CAR) under Basel II is 13.8 per cent, providing robust risk resistance. In terms of profitability, MB posts a return on assets (ROA) of 2.3 per cent and return on equity (ROE) of 22.6 per cent, both above industry averages.

Notably, MB’s stock is attractively valued with a price to earning ratio (P/E) of 5.8 and a price to book ratio (P/B) of 1.2, compared to the sector averages of 7.8 and 1.2, respectively, making it a magnet for foreign investors.

However, when asked whether MB is ready to increase its foreign ownership limit to 49 per cent, chairman of MB’s board of directors Luu Trung Thai said the foreign ownership quota is not a major concern for MB.

“Foreign ownership usually aims to attract strategic investors and increase stock value. But for MB at this point, the key lies in internal value and business strength,” he added.

Thai stated that MB has attracted considerable attention from investment funds. “We value their feedback and insights, and MB is also committed to higher standards of transparency to meet their expectations. However, in terms of capital raising or cash from foreign strategic investors, this is not our top priority.”

|

Meanwhile, VPBank presents both potential and challenges. The bank currently has a market cap of $5.39 billion, total assets of $39.76 billion, and equity of $6.05 billion. However, it has the highest NPL ratio among the group at 4.7 per cent.

Despite this, VPBank’s stock valuation is extremely appealing with a P/E of 8.4 and a P/B of 0.9, the lowest in the group. Its ROA and ROE are 1.8 per cent and 15.3 per cent, respectively, indicating moderate performance, although not yet on par with MB.

HDBank, though smaller, presents a highly promising case as it currently lacks a foreign strategic shareholder, creating significant room to draw foreign capital under the new 49 per cent limit.

HDBank's market capitalisation is $2.97 billion, with total assets of $28.45 billion and equity of $2.44 billion. The bank maintains a 2.4 per cent NPL ratio, below the industry average. Its CAR stands at 11.2 per cent, compliant with Basel II but lower than MB and VPBank.

The standout for HDBank lies in its valuation with a P/E of only 5.3, the lowest among the group. Combined with an ROE of 22.5 per cent, comparable to MB, the stock is well-positioned to attract foreign interest.

“In terms of potential, MB leads with solid credit quality, strong operational efficiency, and attractive valuation, which is ideal for foreign inflows. VPBank has scale and SMBC’s support, but must address bad debt to increase its appeal. HDBank offers the lowest valuation and room for strategic investors but needs to scale up to compete,” an ACBS expert commented. “Expanding the foreign ownership cap could boost stock prices and market liquidity, but actual outcomes will depend on each bank’s strategy.”

Beyond enhancing capital and stock valuations at these banks, ACBS believes this policy also serves as a controlled trial to assess the impacts of loosening foreign ownership limits on financial capacity, governance, and overall banking stability. Restricting the pilot to three banks helps minimise financial and monetary security risks in the event of foreign capital fluctuations.

- 11:29 16/05/2025