UOB forecasts USD to weaken in Q4

UOB forecasts USD to weaken in Q4

Experts from United Overseas Bank (UOB) maintained their view that the USD will continue to weaken against the majors, while the Fed is expected to cut rates three times in the last months of the year.

|

The Global Market and Economic Research Department of UOB, which released a monthly foreign exchange and rates strategy on May 12, said that the USD had a difficult month in April with an entire barrage of emotive de-dollarisation rumours.

Chief among these de-dollarisation theories revolve around the mechanisms of the supposed Mar-a-Lago Accord, which included trade tariffs and a weaker USD. UOB experts postulated, "A more objective reason behind the USD’s sell-off post on Liberation Day was more likely due to the concentrated unwinding of large amounts of USD from exporters who had previously held on to their USD trade proceeds."

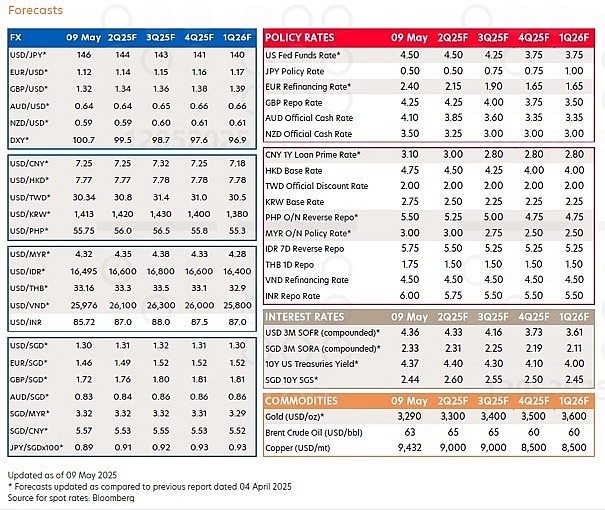

Objectively, the UOB maintains the view that the USD will continue to weaken against the majors. This will result in the USD Index entering a new trading range below 100 and falling further towards 96.9 by the first quarter of 2026. Concurrently, the updated forecast sees €/USD and GBP/USD rising further to 1.17 and 1.39 by the first quarter of 2026.

"As for Asia foreign exchange (FX), while the acute phase of Asia FX weakness and volatility in early April may have passed, key risks remain that may temper with the Asia FX rally. These include considerable uncertainty as to how the trade talks between the US and China will work out, as well as the abrupt Asian FX strength being at odds with weakening economic growth and trade outlook across the region," UOB commented.

Overall, while the current abrupt Asia FX rally may be overdone, compared to the previous monthly forecast, UOB nonetheless marks the previous anticipated peaks in USD/Asia in the third quarter lower to denote the most intense phase of the trade war may have passed.

The VND is the outlier to the strong regional FX recovery in April, with the currency falling 1.6 per cent on the month to 25,990 /USD. Markets probably weighed the economic fallout on Vietnam due to the prohibitive 46 per cent tariff, the second highest after China globally, that the US slapped on Vietnamese goods from July. Purchasing Managers' Index has also plummeted to a two-year low of 45.6 in April, reflecting the caution among factories as they grappled with the prospect that Vietnamese products lose their price competitiveness in the US, its largest export market.

"Absent a trade deal with the US, we think the VND will likely be tethered at the weaker end of its trading band against the USD. Overall, our updated USD/VND forecasts are VND26,100 in the second quarter, VND26,300 in the third quarter, VND26,000 in the last quarter, and VND25,800 in the first quarter of 2026," the report highlighted.

As for the rates outlook, the UOB reiterated the view of further easing from both the Fed. While the timeline of Fed rate cuts has been pushed back, the UOB continues to see 3×25 basis points rate cuts this year. The updated timing of the rate cuts will be 25 basis points each in September, October, and December to bring the Fed Fund Rate down from 4.5 to 3.75 per cent by the end of this year.

Finally, for gold, in view of ongoing safe haven demand, consistent strong allocation by central banks, a supportive tailwind of anticipated weak USD going forward, and possible renewed gold exchange-traded fund demand in the US, the UOB maintained a positive gold view and raised its forecast further to $3,600 per ounce by the first quarter of next year.

- 14:41 13/05/2025