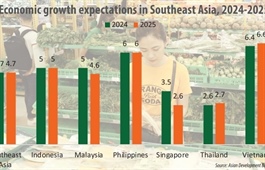

Economic policies to take effect from 2025

Economic policies to take effect from 2025

Starting on Wednesday, January 1, significant economic policies will come into effect, including regulations on contract-based passenger transport businesses, a six-month reduction in value-added tax (VAT), amendments to the 2019 Law on Tax Administration and the discontinuation of VAT exemptions for imported goods valued under VNĐ1 million via express delivery.

Passenger transport businesses

The Government’s Decree No.158/2024/NĐ-CP provides detailed regulations on passenger transport business by contract.

Vehicles providing such services are prohibited from picking up or dropping off passengers at locations not specified in the contract. Transport operators must hold a valid operating licence and affix the 'contract vehicle' label on their vehicles.

Transport contracts must be negotiated and signed in writing before services commence, even for cases involving driver rentals. Importantly, operators are not allowed to sell tickets, collect payments outside the contract or confirm reservations for individual passengers.

This decree aims to strengthen the management of passenger transport activities, ensuring transparency and compliance with the law. It will take effect on January 1, 2025.

Six-month VAT reduction

The National Assembly has approved a 2 per cent reduction in VAT for goods and services, lowering the rate from 10 per cent to 8 per cent from January 1, 2025, to June 30, 2025.

However, sectors including telecommunications, information technology, finance, banking, insurance and real estate will not be eligible for this reduction.

This policy aims to support socio-economic recovery post-pandemic and alleviate financial burdens on citizens and businesses.

Law on Tax Administration amendments

The amendments to the 2019 Law on Tax Administration emphasise taxpayers’ responsibilities to accurately, truthfully and fully declare their tax filings, with legal accountability for the provided information.

The amendments also focus on tax management for e-commerce activities.

Foreign suppliers must register, declare and pay taxes in Việt Nam. E-commerce platforms also are required to withhold and pay taxes on behalf of sellers. These measures enhance tax management amid the rapid growth of e-commerce.

E-invoices for public asset sales

As per Clause 2, Article 95 of Decree No.151/2017/NĐ-CP (amended), all public asset sales must use e-invoices starting January 1, 2025. This policy aims to increase transaction transparency and reduce fraud risks.

Large Taxpayer Department management

Decision No. 2838/QĐ-BTC, issued by the Ministry of Finance on November 27, 2024, designates a list of 303 large enterprises to be directly managed by the Large Taxpayer Department. It will be effective from January 1, 2025.

The General Department of Taxation will review and assess the effectiveness of tax management for large enterprises biennially and report to the Ministry of Finance to adjust the list accordingly.

Termination of VAT exemption for low-value imported goods

The National Assembly has decided to discontinue VAT exemptions for imported goods valued under VNĐ1 million via express delivery starting January 14, 2025. This policy aims to strengthen control of and revenue collection from international trade.