Full-year growth prospects raised

Full-year growth prospects raised

Growth has picked up, supported by domestic demand, rising trade, and sustained public investment, with positive assessments from international organisations.

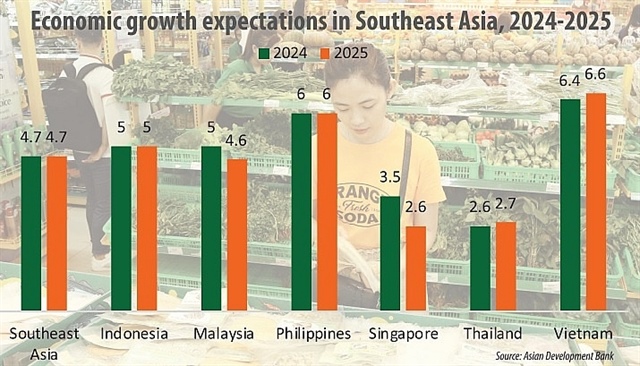

The Asian Development Bank (ADB) last week released the latest edition of its Outlook report, featuring the predicted economic performance of Asian economies for 2024 and 2025. According to the report, Southeast Asia’s growth outlook has been raised to 4.7 per cent from a September forecast of 4.5 per cent, driven by stronger manufacturing exports and public capital spending. The forecast for next year is unchanged at 4.7 per cent. (see chart)

Full-year growth prospects raised |

Vietnam’s growth forecast for 2024 is revised upward to 6.4 per cent – the highest in the region - from 6 per cent predicted in September and for 2025 to 6.6 per cent, up from 6.2 per cent projected in September.

“Stronger-than-expected trade performance, a resurgence in export-led manufacturing, and ongoing fiscal stimulus measures drove Vietnam’s economic growth,” the bank stated. “Accelerated public investment and accommodative fiscal and monetary policies are anticipated to further stimulate domestic demand amid increasing external headwinds.”

From January to December 14, Vietnam’s goods export and import turnover is estimated to have come in at $745.4 billion, up 15.35 per cent on-year. The figure is expected by the government to hit more than $782 billion for the entire year, with a trade surplus of over $23.53 billion.

The General Statistics Office reported that the government’s solutions to boost the development of the domestic market with stimulated consumption in the remaining months of the year has contributed to promoting growth of the service sector.

Total retail sales of consumer goods and services at the current price in November is estimated to have reached $23.4 billion, up 8.8 per cent compared to the same period last year. The 11-month figure is estimated to have hit as much as $242.6 billion, representing the same on-year growth. If inflation is excluded, the on-year rise is 5.8 per cent.

Meanwhile, the total public investment this year was set to be $33.6 billion, including $11.67 billion for the central coffers and $21.93 billion for the local budget.

The government earlier set a target that about 95 per cent of the total public investment must be disbursed for the whole year.

Vietnam’s economic growth stood at 6.82 per cent for the first three quarters of 2024, and the government is expecting 7.5 per cent in Q4 and more than 7 per cent for the whole year.

Though the official growth figure for 2024 will be published on January 6, the ADB remains upbeat about the Vietnamese economic outlook, stating that despite the severe impacts caused by Typhoon Yagi in various parts of the country (see Page 3), the swift government response and recovery efforts limited the impact on growth. “The robust rebound in export-led manufacturing and trade, bolstered by the resilient US economy, is expected to continue supporting GDP growth,” said the ADB.

On December 12, Standard Chartered Bank released its latest macroeconomic updates for Vietnam, expecting strong GDP growth of 6.7 per cent in 2025, with growth easing from 7.5 per cent on-year in H1 to 6.1 per cent in H2.

It said Vietnam’s economic growth has remained resilient. Exports grew 14.9 per cent on-year in the first 10 months of 2024, while imports grew 16.8 per cent; with electronics exports and imports continuing their recovery.

“The manufacturing sector has experienced solid growth, and relatively accommodative monetary policy may have also contributed to the economic recovery year-to-date,” the bank stated. “Foreign direct investment (FDI) appetite remains strong, as indicated by inward flows. Disbursed FDI increased by 8.8 per cent on-year, while pledged FDI rose by 1.9 per cent. The manufacturing sector accounted for 62.6 per cent of total pledged FDI during that period, while the property sector’s share was 19 per cent, increasing from a year earlier.”

In October, Standard Chartered forecasted Vietnam’s 2024 GDP growth to 6.8 per cent (from 6 per cent), reflecting stronger-than-expected Q3 GDP. For Q4, growth is expected to hit 6.9 per cent.

Vietnam’s economic growth momentum has been relatively strong, with improvement across multiple sectors including imports and exports, retail sales, real-estate, tourism, construction, and manufacturing. Trade recovery, increased business activity, foreign investment to be sources of growth in 2025 and beyond.

However, global analysts FocusEconomics said that based on its calculations, after accelerating in Q3, yearly GDP growth is expected to have lost momentum in Q4.

“Available data points in this direction. Private spending growth is likely waning. In October and November, retail sales growth came in below Q3’s average,” FocusEconomics said. “Moreover, industrial output lost some steam in the same two-month period compared to Q3, likely dragged on by Typhoon Yagi, which made landfall in early September. Looking at the external sector, merchandise exports cooled from the previous quarter through November.”

“Our consensus is for GDP growth to broadly match 2024’s projected figure in 2025, at 6.5 per cent. Accelerating fixed investment and private spending growth will sustain momentum, while exports are set to lose some steam,” FocusEconomics said. “Higher US import tariffs under President-elect Trump, extreme weather events and weaker-than-expected Chinese growth are downside risks. FocusEconomics panelists see GDP expanding 6.5 per cent in 2025, which is unchanged from one month ago, and expanding 6.4 per cent in 2026.

FocusEconomics panelists also see Vietnam’s industrial production expanding 8.4 per cent in 2025, and 7.1 per cent in 2026.

Both the ADB and FocusEconomics suggested that to reach higher economic growth, the Vietnamese government should extend administrative reforms and provide more assistance for businesses.

Two weeks ago, the government requested the Ministry of Finance (MoF) to review, assess, and propose policies aimed at extending exemptions, reductions, and deferrals for various taxes, fees, and land rental payments in 2025. The government underlined the need to implement these policies as early as possible.

In 2024, support worth a total $7.9 billion has been offered to businesses and individuals in the form of exemption, reduction, and extension of assorted taxes, fees, charges, and land rental. In 2023, the total values of all policies on exempting, reducing, and extending payment of assorted taxes, fees, and charges, as well as rental for land and water surface hit $8.33 billion, including exemption and reduction of $3.3 billion and extension of $5.04 billion.

The government has drastically concentrated on cutting and simplifying administrative procedures, contributing to reducing compliance costs for enterprises. So far, more than 3,000 business regulations have been removed and simplified, while nearly 700 administrative procedures have been decentralised to localities.