Market requires additional supportive information to recover

Market requires additional supportive information to recover

Despite a strong recovery of over 15 points in the final session of the week, the stock market experienced significant volatility, leading to the VN-Index to record its fourth consecutive weekly decline due to substantial selling pressure earlier in the week.

A trader monitors the stock market. — Photo baotintuc.vn |

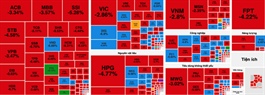

On the Hồ Chí Minh Stock Exchange (HoSE), the VN-Index closed the week at 1,223.6 points, while the HNX-Index on the Hà Nội Stock Exchange (HNX) ended at 229.4 points.

Both indices recorded weekly declines, with the VN-Index dropping by more than 1 per cent and the HNX-Index by 0.9 per cent.

The average daily transaction value across the market was VNĐ17.07 trillion (US$680.2 million) per session, a 6 per cent increase compared to the VNĐ16.1 trillion recorded in the previous week.

Foreign investors returned to their net selling last week, selling on four out of five sessions, with a total net sell value of over VNĐ3.9 trillion on HoSE.

Barry Weisblatt David, head of Research at VNDIRECT Securities Corporation, noted that the Federal Reserve's (FED) expected two interest rate cuts could push the USD Index (DXY) below 100 points in the near future. This would provide the State Bank of Việt Nam with more flexibility to inject liquidity into the market, with full-year credit growth potentially reaching 14 per cent.

"A positive scenario for the VN-Index to close 2024 above the 1,400-point mark, corresponding to a P/E ratio of 14.8, is feasible," Barry said.

In this context, several sectors are expected to offer good investment opportunities for the remainder of 2024, especially banking and steel. According to VNDIRECT experts, although asset quality in the banking sector has declined, it is expected to recover as the economy improves. Banks are currently trading at an attractive P/E ratio of 1.7 times, lower than the five-year average.

In its August 2024 strategy report, Mirae Asset Securities highlighted that the trading activity in the early days of the month reflected investors' risk aversion, especially among domestic individual investors. The risk of a market downturn remains, as general downward pressure in major global stock markets could negatively impact the VN-Index.

"In a less optimistic scenario, the market will find support at the VN-Index's attractive valuation ranges – the 10-year average P/E valuation range of around 1,050-1,150 points. This support level is expected based on the assessment of Việt Nam's macro-economic improvements over the past seven months and the recovery trend of corporate profits in the first half of this year," Mirae Asset analysts wrote.

Meanwhile, according to experts from ACB Securities’ Research Centre, maintaining the VN-Index above the 1,150-1,160 point support zone is seen as a challenge for the market to sustain its medium-to-long-term upward trend.

Excluding the possibility of a US economic recession, the likely scenario for the VN-Index from now until the end of the year is to continue fluctuating within the 1,150-1,300 point range, with stable domestic macro-economic conditions, positive growth and relatively attractive overall valuations.

The August 2024 strategy report from Rồng Việt Securities forecasts that the reasonable P/E valuation range in Q3 could be expected at 14-15 times, corresponding to the VN-Index trading in a balanced range of 1,237-1,325 points.

From now until the end of the year, based on the 14-18 per cent profit growth forecast for listed companies, the market's reasonable range is projected to be 1,236-1,420 points.

"Investment opportunities in the second half of the year are focused on companies that maintain a recovery trend and profit growth in sectors such as consumer goods, steel, banking, industrial zones and seafood.

"Additionally, textiles could be a sector of interest for investors if there is a strong price correction during market downturns, as the industry's profit outlook remains promising," said Rồng Việt experts.