Ho Chi Minh City conference discusses carbon credit pricing, establishment of carbon credit exchange

Ho Chi Minh City conference discusses carbon credit pricing, establishment of carbon credit exchange

Officials and experts gathered at a conference recently held in Ho Chi Minh City to discuss multifaceted aspects related to carbon credit pricing, deliberating on strategies for the establishment of a robust carbon credit exchange platform.

Nguyen Van Minh, head of economics and climate change information at the Department of Climate Change under the Ministry of Natural Resources and Environment, speaks at the ‘Carbon Credit Market - A Driver for Building a Green Vietnam’ conference held in Ho Chi Minh City on April 20, 2024. Photo: Quang Dinh / Tuoi Tre |

The pricing of carbon credits is a topic of public concern, Nguyen Van Minh, head of economics and climate change information at the Department of Climate Change under the Ministry of Natural Resources and Environment, said at the ‘Carbon Credit Market - A Driver for Building a Green Vietnam’ conference held on April 20.

Minh highlighted the significant price fluctuations of carbon credits across countries, ranging from as low as US$1 per metric ton of carbon to as high as $140 per metric ton.

This discrepancy has prompted questions from the public regarding why Vietnam sells carbon credits at a relatively lower price compared to Europe, where the rate can reach up to $100 per carbon credit.

Minh clarified that the European Union primarily trades carbon quotas, not carbon credits.

“Carbon credits primarily trade on the voluntary carbon market,” he said.

“Recently, the prices I checked ranged from $1 to $2, varying depending on the type of carbon credit.”

As for Vietnam’s carbon credit market roadmap, Minh outlined a two-stage plan in accordance with the Law on Environmental Protection.

The initial phase, slated until the conclusion of 2027, is dedicated to formulating regulations concerning carbon credit management, exchange activities, and the functioning of a carbon credit exchange.

It also involves piloting the carbon credit exchange and offset mechanism in promising regions.

The establishment and pilot operation of the carbon credit exchange are slated for 2025.

From 2028, the carbon credit exchange will be put into official operation, regulating activities that connect and exchange domestic carbon credits with regional and global carbon markets.

Eligible participants

Minh outlined the eligible participants in the domestic carbon market as follows:

- Establishments listed in sectors emitting greenhouse gasses that must possess a greenhouse gas inventory authorized by the prime minister

- Organizations engaging in implementing domestic and international carbon credit exchanges and offset mechanisms that comply with relevant laws and international treaties

- Other entities and individuals involved in the investment and trading activities of greenhouse gas emission quotas and carbon credits within the carbon market

|

|

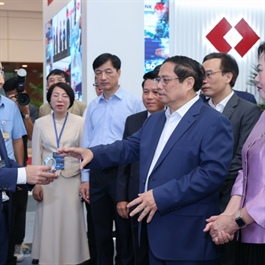

| Delegates attend the ‘Carbon Credit Market - A Driver for Building a Green Vietnam’ conference held in Ho Chi Minh City on April 20, 2024. Photo: Quang Dinh / Tuoi Tre |

Regarding businesses’ rights and responsibilities in the carbon market, Minh emphasized their ability to enact carbon credit exchanges and offset mechanisms, as well as invest in and trade greenhouse gas emission quotas and carbon credits.

However, Minh advised businesses to proactively acquaint themselves with legal regulations on reducing greenhouse gas emissions, understand carbon markets, enhance greenhouse gas inventory capabilities, and strengthen their ability to implement greenhouse gas emission reduction activities, alongside carbon credit exchange and offset mechanisms.

The piloting spearhead

Speaking at the conference, Nguyen Toan Thang, director of the Ho Chi Minh City Department of Natural Resources and Environment, highlighted the city’s proactive approach in aligning with Vietnamese Prime Minister Pham Minh Chinh’s commitment at the 26th United Nations Climate Change Conference of Parties (COP 26) in the UK in 2021 to achieve net-zero greenhouse gas emissions by 2050.

In pursuit of this goal and to effectively combat climate change, the city, including the Department of Natural Resources and Environment, has embarked on a series of initiatives.

Notably, the National Assembly’s Resolution No. 98 paves the way for piloting specific policies and mechanisms tailored to the city’s development.

As per this resolution, Ho Chi Minh City is selected as the inaugural locality trialing the carbon credit exchange and offset mechanism.

Thang underscored that both the Department of Natural Resources and Environment and the Department of Finance have been entrusted with developing a pilot financial mechanism project.

This project is meant to implement measures aimed at reducing greenhouse gas emissions.

“The Department of Natural Resources and Environment has proposed the selection of two promising projects: the replacement of LED street lights and the installation of solar power on public rooftops,” Thang said.

|

|

| Nguyen Toan Thang, director of the Ho Chi Minh City Department of Natural Resources and Environment, speaks at the ‘Carbon Credit Market - A Driver for Building a Green Vietnam’ conference held in Ho Chi Minh City on April 20, 2024. Photo: Quang Dinh / Tuoi Tre |

A door to opportunities

Thang asserted that the proposal for a financial mechanism to implement initiatives targeting the reduction of greenhouse gas emissions via carbon credit exchange and offset mechanisms, alongside the initiation of carbon credit trading activities within the city, offers many opportunities.

Firstly, it serves as a catalyst for reducing greenhouse gas emissions, thereby mitigating the impact of climate change and fostering cleaner living environments for communities.

Secondly, it offers opportunities to attract investments and engage in carbon credit trading, which can spur the development of green projects and generate employment opportunities.

Ho Chi Minh City, with its numerous businesses emitting greenhouse gases and seeking emission reduction solutions, holds significant potential for developing the carbon credit market.

Thirdly, by bolstering its international standing, the city can position itself as a hub for environmental and sustainable development activities, attracting international attention and fostering cooperation.

However, Thang also acknowledged the challenges, particularly within the public sector.

The absence of a detailed legal framework for carbon credit calculation, assessment, and appraisal poses hurdles to effective implementation.

Additionally, the lack of a robust and interconnected trading environment, especially with international markets, restricts the ability to sell credits at optimal prices.

“Given that much of the process, including credit creation, price calculation, and sales, relies on foreign organizations, there’s a risk that the evaluation and trading of credits could compromise the value and autonomy of domestic projects,” Thang noted.

Thang highlighted ongoing efforts by the central government and the Ho Chi Minh City People’s Committee to address these challenges.

He stressed the need for guidance from the Ministry of Natural Resources and Environment, the Ministry of Finance, and other relevant ministries to tackle these issues and get over such challenges effectively.