Self-safeguard growing as a trend shaping future of payments

Self-safeguard growing as a trend shaping future of payments

Businesses and consumers safeguarding themselves against emerging fraud threats is one of three key trends shaping the future of payments in Việt Nam, experts said.

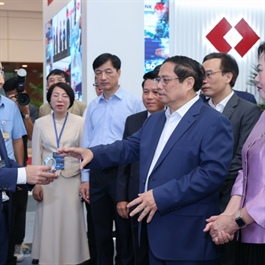

Experts discuss the future of payments in Việt Nam at the Open Payments Forum in HCM City. — Photo Courtesy Visa Vietnam |

A significant trend is the increasing adoption of cashless transactions by consumers. According to Visa’s 2024 Global eCommerce and Fraud Report, refund policy abuse and first-party misuse are the most common forms of fraud affecting nearly half of merchants worldwide. With the growing popularity of e-commerce, customers are demanding secure payment methods and effective fraud prevention measures to maintain trust.

In response to this trend, payment companies have introduced various solutions to enhance security for businesses and consumers. For example, the Visa Acceptance Platform connects merchants to a global network of payment providers and technology solutions. Through tools like tokenisation and fraud detection, merchants using Visa Acceptance Solutions have experienced an average increase in approval rates and a decrease in fraud rates.

Visa reported that merchants using Visa Acceptance Solutions saw an average increase in approval rates of 2.97 per cent and a decrease in fraud rates of 70 basis points.

Another significant trend in e-payment is the evolving payments landscape, which is expected to become more diverse and complex, presenting opportunities for all stakeholders to leverage.

At the Open Payments Forum, which was organised late last week by Visa Vietnam, speakers said that as Việt Nam continues its journey to becoming a cashless society, more participants are expected to join the payment ecosystem, creating a dynamic environment for merchants, financial institutions, fintech companies, and payment facilitators.

Furthermore, customer expectations in e-commerce have evolved, with customers now expecting a more personalised and seamless shopping experience. To meet these changing expectations and align with the cashless and contactless payment trends in Việt Nam, merchants are advised to implement tailored payment solutions and innovative digital experiences.

According to the Open Payments Forum, customer expectations have dynamically shifted as meeting basic expectations for a great user experience and smooth omnichannel journeys has changed.

The future of e-commerce will incorporate a wider range of touchpoints, omnipresent purchasing opportunities, along with innovative digital buying experiences and products. Merchants need to offer tailored payment solutions to meet these changing customer expectations, and to keep pace with the cashless and contactless payment trends in Việt Nam, they said.

The growing need for digitisation in Việt Nam, driven by the desire for businesses to remain competitive, is accelerating the adoption of digital payments in the country. Mobile wallets, online payments, embedded finance, and smart checkout technologies are gaining popularity, following closely behind cash in terms of usage and preference.