Vietnam's non-cash payments reach US$9.8 trillion, 23 times GDP

Vietnam's non-cash payments reach US$9.8 trillion, 23 times GDP

Many of the banking industry's digital transformation goals for 2025 are on track to be met or exceeded.

At the 2024 Digital Transformation in the Banking Sector event on May 8, the State Bank of Vietnam reported that the value of non-cash payments reached about US$9.8 trillion in 2023, 23 times the country's GDP of about US$430 billion last year.

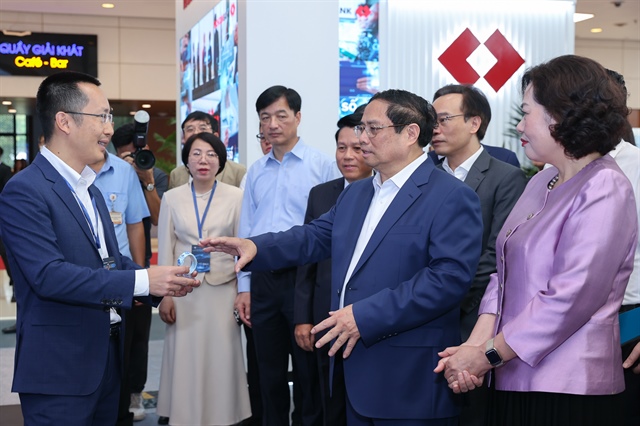

Prime Minister Pham Minh Chinh at the event. Photos: VGP |

Pham Anh Tuan, Head of the Payment Department at the State Bank of Vietnam (SBV), said that according to the development plan for 2025, the value of cashless payments should be 25 times the GDP. Therefore, the current volume has reached about 90% of the plan, he pointed out.

He added that many of the digital transformation goals set for 2025 in the banking sector are being met or exceeded.

According to the SBV, the interbank electronic payment system handles an average of VND830 trillion ($32.7 billion) per day. The financial intermediation and electronic clearing system processes an average of 20-25 million transactions per day. In addition, the ATM and POS network covers all provinces and cities. Vietnam has also completed cross-border QR-enabled payments with Thailand, Cambodia, and soon with Laos.

Today, the percentage of adults with a payment account has reached 87%. This exceeds the 2025 target. Looking at other indicators, non-cash payments continue to grow at a CAGR of more than 50%. There has been a doubling of transactions via mobile phones and a one-and-a-half-fold increase in Internet channels. The percentage of customers using cashless payments exceeded 49%.

Speaking at the conference, Prime Minister Pham Minh Chinh reiterated that digital transformation is a strategic imperative and a top priority at this stage.

He highlighted the national theme for digital transformation this year, which is to develop the digital economy based on four pillars, including the information technology industry, digitizing economic sectors, digital governance, and data. These pillars serve as drivers for rapid and sustainable socioeconomic development.

As the "lifeline of the economy, affecting daily activities in almost every sector and aspect of people's lives and businesses," the head of the government expects the banking sector to take the lead and pioneer digital transformation.

However, he also pointed out some existing challenges and limitations in the digital transformation of the banking sector. Specifically, there are still many obstacles in the institutional framework and policies, such as the timely amendment and supplementation of Decree No. 73/2019/ND-CP on the management of public investment in information technology and the issuance of a new decree on non-cash payments.

In addition, digital infrastructure and platforms have not kept pace with practical needs (5G commercial infrastructure, large-scale data center infrastructure, and others).

There are still many challenges to ensuring security and information safety, as ransomware attacks are becoming increasingly common. Nearly 2,400 cyberattacks were recorded in the first quarter of 2024.

New decree on non-cash payments for Q2

Prime Minister Pham Minh Chinh addresses the conference. |

In terms of the challenges ahead and key solutions, the Prime Minister emphasized the need for the banking sector to refine the legal framework in line with the practicality and requirements of digital transformation and digital economic development.

He emphasized that among the priorities is the urgent issuance of guidelines for the implementation of the 2024 Law on Credit Institutions, which has been approved by the National Assembly.

Furthermore, the Prime Minister reminded the banking sector that the decree on the mechanism of controlled pilot in the banking sector and a new decree on non-cash payments have not been submitted to the government for approval.

He also called for the development of digital infrastructure in the banking sector in line with development trends. This includes continued investment in the modernization and development of electronic payment and credit information infrastructure to ensure seamless, secure, and efficient operations that meet the growing demand for various forms of payment in the economy (online banking, internet payments, mobile payments, and contactless payments).

The next task is to strengthen the development of information systems for the SBV and credit institutions in order to increase competitiveness, especially at the international level.

The Prime Minister asked the banking sector to soon link the national database of bank customers with the national population database.

Close coordination with the Ministry of Public Security is required to effectively use population data, with a focus on using information from chip-based ID cards and VNeID accounts to identify and verify customers and provide secure and convenient banking products and services.

The Prime Minister also emphasized the priority of developing a skilled workforce that meets the requirements of digital transformation in the banking industry. Policies should be implemented to attract and retain high-quality human resources capable of fulfilling the tasks of digital transformation in the banking industry.

In addition, efforts to ensure security and safety should be intensified, and cooperation with the Ministries of Public Security and Information and Communications and other relevant agencies should be strengthened. This cooperation is aimed at preventing crime and safeguarding citizens' lawful rights and interests while providing services in the digital realm, the Premier said.