Experts discuss what to expect on declining banking stocks

Experts discuss what to expect on declining banking stocks

Banking stocks have continuously corrected since the beginning of July, with market analysts forecasting the decline in bank asset quality.

Banking stocks engage the interest of investors |

Sharp decline

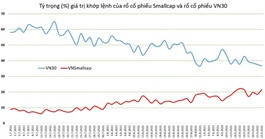

Banking stocks currently account for 29 percent of market capitalization. This group of stocks increased strongly in the first half of the year, but has made a deep correction since the beginning of July, resulting in a decline of the VN-Index.

Shares in the Military Commercial Joint Stock Bank (MB) decreased by more than 36 percent compared to the end of June, currently trading at VND27,900 per share. In the first half of the year, the bank reported a 56 percent increase in before-tax profit, reaching more than VND7.986 trillion. By the end of June, MB’s total bad debt dropped by 22 percent compared to the beginning of the year. Shares in the Lien Viet Post Joint Stock Commercial Bank also experienced a decline of 23 percent at the end of August compared to late June.

Le Quang Minh, investment analysis director of the Mirae Asset Vietnam Securities, attributed the deep correction of banking stocks to lower expectations of economic growth in the second half of the year. Bank profits are strongly affected by the Covid-19’s damage to the economy, Minh said.

The banking sector will benefit from the injection of capital for economic recovery |

Outlook for the final months

Phan Dung Khanh, investment advisory director of the Maybank Kim Eng Securities Company, said an increase in banking stocks depends on many factors, including pandemic control.

With social distancing measures applied in many cities and provinces across the country, credit growth is likely to slow in the third quarter of 2021, and banks will have to prioritize risk management to ensure asset quality. The prolonged pandemic has affected trade and production activities and debt repayment, pressuring banks with handling increasing bad debts. Future bank profits partly depend on banks’ ability to recover debts.

The negative impact of the pandemic on the banking sector is obvious, but much less than on other economic sectors. Despite social distancing, banking operations have been maintained thanks to online trading platforms and non-interest incomes will help banks maintain positive profit growth. When the pandemic is brought under control, trade and production activities will recover and credit demand will increase, benefiting the banking sector. Transactions of banking stocks will become vibrant and continue to lead the market in the final months of the year and beyond.

The State Bank of Vietnam is collecting opinions on amending Circular 01/2021/NHNN on restructuring repayment periods and exemptions and reductions of interests and fees by credit institutions and foreign bank branches to support pandemic-affected customers, creating a positive effect on cash flow.

| Better risk management and diversified financial products will contribute to creating sustainable growth for the banking sector amid the Covid-19 pandemic. |