56 per cent of EU businesses plan to expand in ASEAN

56 per cent of EU businesses plan to expand in ASEAN

As many as 56 per cent of EU businesses have plans to expand operations in ASEAN, a slight decrease from 61 per cent in 2019, according to the sixth Business Sentiment Survey published on October 8 by the EU-ASEAN Business Council, the primary business body for European businesses in ASEAN.

|

Donald Kanak, chairman of the EU-ASEAN Business Council said, “This year’s survey confirms that ASEAN is still seen as the region of best economic opportunity, but as would be expected during the COVID-19 crisis, the outlook for increased trade and investment shows signs of softening.”

This year’s survey asked which regions in the post-COVID-19 era would be the candidates to attract more investment in supply chains. While ASEAN received the most votes, others such as Europe and China also received many. Kanak continued: “Almost half expect supply chains to be reorganised following COVID-19. That makes the unfinished business on the ASEAN economic integration and progress on trade facilitation crucial to ASEAN’s sustainable recovery from the economic downturn.”

Executive director of the EU-ASEAN Business Council, Chris Humphrey, added: “The message from the survey is clear: ASEAN economic integration appears to be at a standstill. ASEAN and its constituents need to pick up the pace to meet the AEC Blueprint 2025 goals. European businesses are now adjusting their business strategy to local environments, rather than waiting for substantial progress in regional economic integration.

European businesses are also very concerned about the lack of progress on further free trade agreements (FTAs) with the ASEAN region, and in particular the long talked about region-to-region FTA which 8 out of 10 see as potentially delivering more benefits than a series of bilateral FTAs. European businesses clearly want the European Commission to step up the pace of negotiations and engagement with Southeast Asia.”

Other key highlights of this year’s survey include:

• 72 per cent of respondents in Vietnam has plans to expand;

• 63 per cent of respondents in Vietnam are satisfied with the government’s COVID-19 response;

• 53 per cent of respondents see ASEAN as the region with the best economic opportunity (2019 – 63 per cent);

• 47 per cent of respondents are considering reorganising supply chains post-COVID-19, with ASEAN, Europe, and China as the top destinations;

• 73 per cent of respondents expect to expand current levels of trade and investment in ASEAN in the next five years (2019 – 84 per cent);

• Only 2 per cent of respondents feel that ASEAN economic integration is progressing fast enough (2019 – 6 per cent);

• Only 4 per cent of respondents find ASEAN customs procedures speedy and efficient (2019 – 8 per cent);

• 62 per cent of respondents that use supply chains reported facing many barriers to the efficient use of supply chains in ASEAN (2019 – 78 per cent);

• 98 per cent of respondents would like the EU to accelerate FTA negotiations with ASEAN and its members (2019 – 96 per cent).

2020 Key Findings

Current Business Environment and Outlook

• 73 per cent of respondents expect to expand current levels of trade and investment in ASEAN in the next five years (2019 – 84 per cent);

• 39 per cent of respondents project an increase in ASEAN profits in 2020 (2019 –60 per cent);

• 53 per cent of respondents see ASEAN as the region with the best economic opportunity (2019– 63 per cent);

• COVID-19 Impact: ASEAN is not the only location being considered for supply chain relocations;

• 47 per cent of respondents are considering reorganising supply chains moving forward;

• Regions/countries receiving the most votes as possible future sources of more supply: ASEAN (34 per cent), Europe (20 per cent), and China (17 per cent).

Trade Agreements

• 98 per cent of respondents would like the EU to accelerate FTA negotiations with ASEAN and its members (2019 – 96 per cent);

• 81 per cent of respondents believe that an EU-ASEAN FTA would deliver more advantages than a series of bilateral FTAs (2019 – 78 per cent);

• 71 per cent of respondents believe the EU should pursue an EU-ASEAN FTA now before bilateral FTAs are concluded (2019 – 67 per cent).

ASEAN Regional and Domestic Policy Frameworks

• Only 2 per cent of respondents feel that ASEAN Economic Integration is progressing fast enough (2019 – 6 per cent);

• Only 14 per cent of respondents found that the number of NTBs to trade in ASEAN have decreased (2019 – 17 per cent);

• Only 4 per cent of respondents find ASEAN customs procedures speedy and efficient (2019 – 8 per cent);

• 62 per cent of respondents that use supply chains reported facing many barriers to the efficient use of supply chains in ASEAN (2019 – 78 per cent).

Government Consultation and Competition Issues

• 50 per cent of respondents feel they are often or sometimes consulted by national governments in ASEAN (2019 – 74 per cent);

• 36 per cent of respondents believe they face unfair competition in the local/regional environment at least occasionally (2019 – 70 per cent);

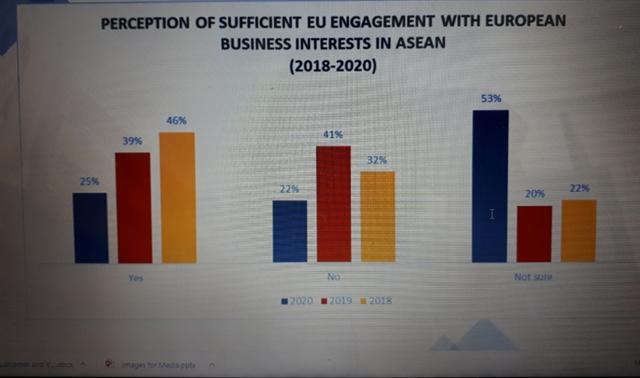

• 25 per cent of respondents feel that there is adequate EU engagement (2019 – 39 per cent);

• The EU-ASEAN Business Council (EU-ABC) is the primary and sole voice for European business covering all of the ASEAN region.

It is recognised by the European Commission and the ASEAN Secretariat and is an accredited entity under Annex 2 of the ASEAN Charter. Independent of both bodies, the Council has been established to help promote the interests of European businesses operating within ASEAN and to advocate for changes in policies and regulations which would help promote trade and investment between Europe and the ASEAN region. The Council works on a sectorial and cross-industry basis to help improve the investment and trading conditions for European businesses in the ASEAN region through influencing policy and decision-makers throughout the region and in the EU, as well as acting as a platform for the exchange of information and ideas amongst its members and regional players within the ASEAN region.

The EU-ABC’s membership consists of large European Multi-National Corporations and the nine European Chambers of Commerce from around Southeast Asia. The EU-ABC represents a diverse range of European industries cutting across almost every commercial sphere from car manufacturing through to financial services and including fast-moving consumer goods and high-end electronics and communications. Members all have a common interest in enhancing trade, commerce, and investment between Europe and ASEAN.