Indirect US investment masks Singaporean impact

Indirect US investment masks Singaporean impact

While Singapore is popping the champagne for being the largest foreign investor in Vietnam in the first three quarters of the year, in reality, much of this capital was made up of indirect investment from the United States.

|

Statistics published by the Foreign Investment Agency (FIA) under the Ministry of Planning and Investment showed that over the period, Singapore pumped the largest amount of capital into the country at $6.77 billion, equivalent to nearly one-third of the total. This was primarily due to the $4 billion Bac Lieu liquefied natural gas (LNG) power project funded by Delta Offshore Energy Pte., Ltd.

However, the parent company of the Singaporean entity is a US conglomerate by the same name which was instrumental in the deal in Vietnam. In fact, the size of the investment warranted involvement by US President Trump, who assigned Secretary of Commerce Wilber Ross and Secretary of Energy Dan Brouillette to provide direct support to the deal. As a strategic aim, the deal would help US-Vietnam trade reach a healthier balance.

“As an American-owned project originator and developer, Delta Offshore Energy has contracted the largest US companies like Bechtel, GE, and McDermott to design and build the first independent power project in Vietnam. This unique operation will preserve and create new US job opportunities,” said Bobby Quintos, managing director of Delta Offshore.

“The corporation is proud to support the president’s agenda to achieve trade balance with Vietnam through the development of a 3,200MW LNG-to-power project,” Quintos added.

This project strengthens economic ties and affirms the US commitment to investing and engaging in the Indo-Pacific region. Delta Offshore’s project is projected to be instrumental in improving bilateral relations between the two countries.

According to Mary Tarnowka, director of the American Chamber of Commerce in Vietnam, Vietnam’s statistics regarding the origin of foreign capital overlook indirect investments. Numerous US groups have invested in Vietnam through their brands and subsidiaries in Hong Kong, Singapore, Malaysia, and the British Virgin Islands, thus their projects are not counted as US investment.

An example is P&G’s $100 million factory down in the southern province of Binh Duong, which is an investment made through P&G Singapore – so this counts as a Singapore investment even though P&G is a famous American company.

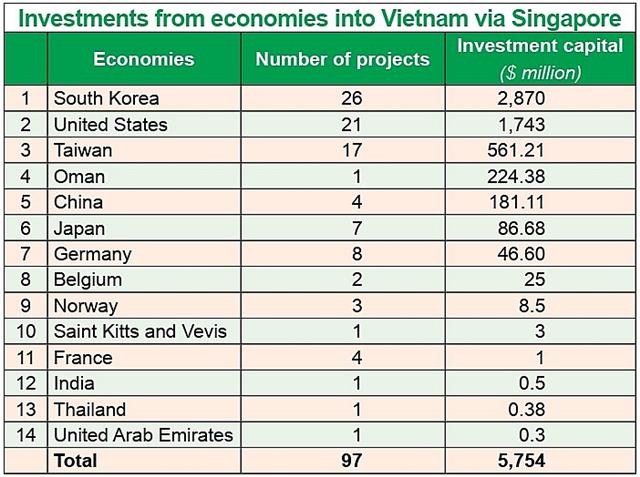

According to the FIA, many world-famous brands have invested into Vietnam through Singapore, including Coca-Cola, First Solar, SK telecom, HEINEKEN, Taewang Power, Fuji Xerox, and Tetra Pak.

Speaking at an investment promotion event in March attended by 45 US groups, Alex Feldman, president of the US-ASEAN Business Council, said that the country remains a magnet for foreign investors, including US businesses. “Numerous technology groups in Silicon Valley plan to invest in electronic equipment manufacturing projects in Vietnam either directly or indirectly,” Feldman said.