Vietnam gov't greenlights Mobile Money

Vietnam gov't greenlights Mobile Money

The regulation on mobile payment will not allow users to recharge from scratch cards but they must conduct deposits and withdrawals from the registered bank account.

Prime Minister Nguyen Xuan Phuc has agreed the deployment of the pilot project on direct carrier billing services, also known as Mobile Money, according to a latest government resolution.

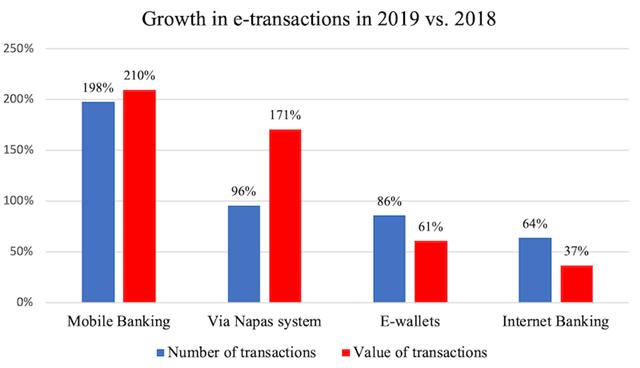

Source: State Bank of Vietnam. Chart: Nhat Minh

|

The State Bank of Vietnam (SBV), the country's central bank, in April submitted the Mobile Money project to the government after completing the pilot scheme allowing online purchases with mobile devices.

In 2019, the government asked the SBV to research and propose a pilot scheme of mobile payment service given the absence of specific regulations on telecom-based financial services and a sharp increase of e-wallet transactions.

According to Pham Tien Dung, head of the Payment Department under the SBV, the regulation will not allow these accounts to recharge from scratch cards but users must conduct deposits and withdrawals from the registered bank account. The transaction limit is set at VND10 million (US$428.9) per month.

Mobile payment in Vietnam is growing rapidly, leading to the stricter requirement on security. The biggest risk in cyber-transactions is anonymity, according to Dung, therefore, customer identification is mandatory.

The similarity between mobile money and e-wallet is the use of an identification account. However, while e-wallet identifiers are provided by banks, in mobile money, users’ identifiers are provided by telecommunication companies. The challenge for telecom companies is how to identify the client correctly in the same ways as banks do, to avoid any fraudulent transactions.

To deal with this problem, up to two-thirds of the draft document on cashless payment, which is set to replace Decree No.101 dated 2012, is being built and focused on management of transaction risks, prevention of cybercrime and money laundering.

Leading telecom carriers including VNPT and Viettel have been granted licenses by the SBV to carry out such services. A national personal database has also been built for issuing personal identification numbers and also adopting e-KYC (electronic Know-Your-Customers).

Statistics from the BIDV Training and Research Institute shows that 90 countries are providing the direct carrier billing service with nearly 870 million subscribers and 272 apps. Daily transactions average US$1.3 billion and over one million accounts remain active for at least 90 days.

At the end of 2019, Vietnam had around 129.5 million mobile subscribers, around half of them using 3G and 4G, while the national smartphone penetration reached 45% of the country’s population or 43.7 million people, the report cited SBV figures released last November.

The government targeted to reduce the ratio of cash payments from 11.3% in 2019 to less than 10% by the end of this year, and 8% by 2025.