Supporting industries await resolution

Supporting industries await resolution

To guarantee the transparent and unified implementation of the country’s investment incentive policy, the Vietnamese government is trying to resolve an impasse around the transitional treatment of tax incentives for projects manufacturing prioritised supporting industry products.

|

While there is a clear law in force governing investment incentives for supporting industry (SI) projects, an inter-ministerial dispute over a particular clause has invited government bodies and corporations to take sides and ensure smoother implementation of the law.

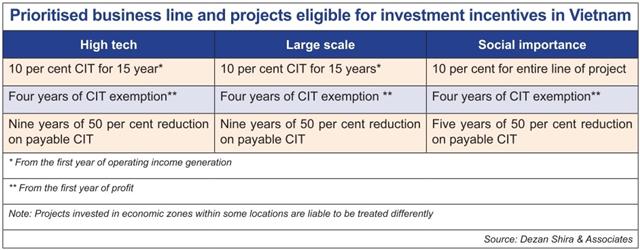

The National Assembly’s Law No.71/2014/QH13 amending and supplementing a number of articles of the Laws on Taxes took effect in 2015 in order to facilitate SI projects. Under the law, Vietnam introduced a corporate income tax (CIT) rate of 10 per cent applicable for 15 years for SI projects, with a four-year tax exemption, and a nine-year tax reduction from the time taxable income is earned.

In addition, Law 71 also provides for the transition of tax incentives for enterprises with investment projects to manufacture products on the list of products of SI prioritised for development prior to January 1, 2015.

Accordingly, in case CIT regulations change and an enterprise meets the tax preference conditions set by the new law, it can choose to keep the incentives it was given at the time of licensing or take the new ones for the remaining period.

Therefore, enterprises that have projects implemented before 2015 in incentivised locations (for example expansion projects at industrial zones in 2009-2013) are entitled for this transitional treatment for the remaining duration of their incentives.

Similarly, enterprises that have implemented projects before 2015 in incentivised business sectors (for example projects manufacturing prioritised SI products before 2015) can also choose incentive regimes.

However, the Ministry of Finance (MoF) has issued official letters and guidance to enterprises saying that the manufacturers of prioritised SI products whose projects were implemented before 2015 are not eligible for newer CIT incentives.

“Such a viewpoint is contrary to the viewpoints of the Ministry of Industry and Trade (MoIT), which has issued the Incentive Confirmation certificate of project manufacturing prioritised SI products to a number of projects implemented before January 1, 2015,” the European Chamber of Commerce stated in its Whitebook 2019. “Moreover, the MoF guidance is also not aligned with the Ministry of Justice’s Official Letter responding to an enterprise that the aforementioned viewpoint of MoF and tax authorities are inappropriate with Law 71 and Law on Investment.”

For instance, Japanese automobile components manufacturer Denso Vietnam had an investment project to expand production of prioritised SI products in 2013 and received the certificate granted by the MoIT for the project of development of supporting industrial products with priority in 2017. However, the company’s request to access new incentives on account of Law 71 was rejected by the MoF.

“Through our own research, we have found that the ministry’s viewpoint is completely inconsistent with the current regulations, from the perspective of the laws on tax, investment, as well as the industry development policies and the development orientations of the Party, the National Assembly, and the Vietnamese government,” Denso noted in a document accessed by VIR.

The MoIT cited Decree No.111/2015/ND-CP dated November 2015 on the development of SI, which states “the transition of the project are the production of industrial products in support of industrial product catalog support development priorities continue to enjoy the incentives we have and enjoy the new incentives as stipulated in this decree,”

Meanwhile, the Ministry of Planning and Investment confirmed that the Law on Investment and guiding documents are there to protect investors.

According to the Government Office, there are different interpretations of the provisions of Law 71, leading to the different opinions of the ministries. In practice, not allowing enterprises to enjoy incentives due to the date of issuance of their investment certificates is not fair and does not match the spirit of attracting long-term investment to Vietnam. Minister, Chairman of the Government Office Mai Tien Dung emphasised that the most encouraging solution should be selected, following the spirit of a “constructive government”.

Denso Vietnam is not the only case as several other SI enterprises including Enkei Vietnam and Sumdenso Vietnam are in the same boat, awaiting the final decision. However, with the majority of local authorities speaking in favour of more encouraging treatment, it seems likely that these enterprises will be able to choose incentive regimes under Law 71.

“We know that in order to promote and encourage domestic and foreign investors to participate in SI prioritised for development, the government of Vietnam has issued many preferential policies to SI projects, particularly in real estate. The production of SI products is eligible to various forms of incentives, the most important and the most coveted one of which is preferential CIT,” Denso stressed.

Home of many global high tech enterprises such as Samsung, Intel, Panasonic, Canon, Vietnam has extended investment incentives to a number of industries and projects that it has identified to be of strategic importance for the country.