Vietnam construction sector forecast to grow over 7% over next decade: Fitch

Vietnam construction sector forecast to grow over 7% over next decade: Fitch

FDI will play a key role for the expansion of Vietnam’s industrial buildings sector, as Vietnam emerges as a global manufacturing hub, stated Fitch Solutions.

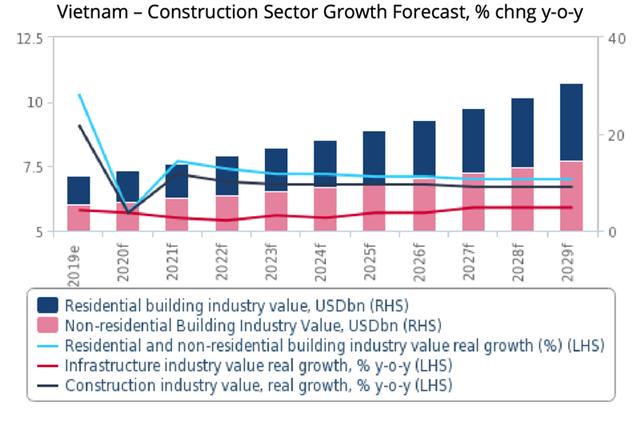

Vietnam’s building construction sector is expected to grow strongly at an annual average of above 7% over the next decade, supported by strong macroeconomic conditions and favorable demographic trends, according to Fitch Solutions.

|

Fitch Solutions, a subsidiary of Fitch Group, forecast the sector to grow at an average rate of 7.2% year-on-year from 2021 to 2029, slightly outpacing the wider construction sector, 6.8%, and the infrastructure construction sector, 5.7%.

Strong economic growth has generally led to rising income levels, which in turn has resulted in an increase in demand for higher-end residential real estate, especially in dense urban areas such as Hanoi and Ho Chi Minh City.

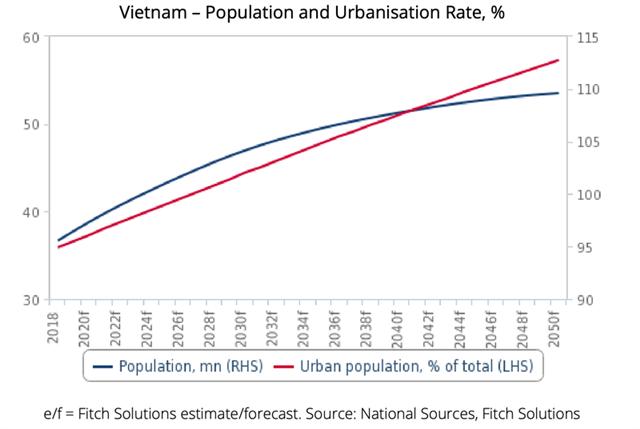

The influx of foreign developers, mostly involved in developments catering to the high-end segment, has resulted in the relative shortage of affordable housing, a situation exacerbated by persistent rural-urban migration trends in the country – Vietnam’s urbanization rate is approximately 36.6% as of 2019, and this figure is expected to rise to 51.2% by 2040.

Urbanization is a primary driver of real estate demand.

|

Vietnam to benefit as multinationals look beyond China

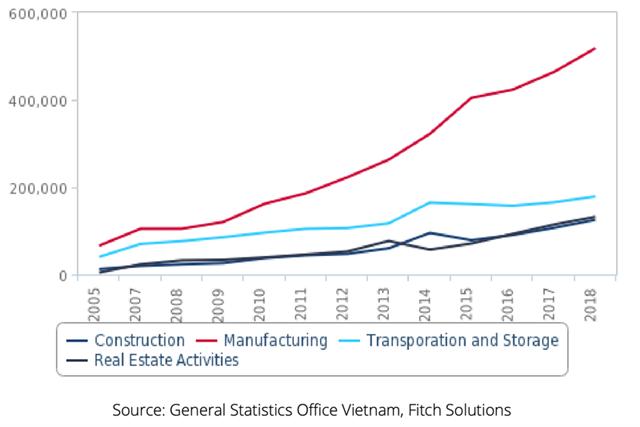

Fitch believed foreign direct investment will play a key role for the expansion of Vietnam’s industrial buildings sector, as Vietnam emerges as a global manufacturing hub.

Vietnam – Total investments by sector, VNDbn.

|

The country’s growing industrial capacity will support Fitch’s forecast for growth of the non-residential buildings segment, with the sector expected to expand, in real terms, by 6.9% per year from 2021 to 2029.

The US-China trade war in 2019 had led to a growing number of low-end electronics and textile manufacturing companies to relocate their factories away from China into Vietnam. Moreover, the Covid-19 pandemic in 2020 which caused massive disruptions to the global supply chain will likely prompt further shifting of production lines away from China, with Vietnam likely to benefit.

Already, South Korean electronics giant Samsung has invested in a facility in Ho Chi Minh City, with other multinational consumer electronics companies such as Denmark’s Sonion and Japan’s Sharp successfully established manufacturing bases in Vietnam. Other companies with plans to set up production lines in Vietnam include Microsoft, Nintendo, Ricoh and Dell.

Reforms to the country’s investment-related laws over the past decade has had a positive effect on FDI inflows, with Vietnam’s ranking in the World Bank’s ease of doing business index improving from 99 in 2013 to 70 out of 190 economies in 2020. However, Fitch noted that Vietnam continues to have a difficult business operating environment, with limits on foreign ownership and investments being governed by multiple laws and decrees.

Vietnam's concurrent investment in infrastructure will further sharpen its competitive edge over other regional peers, including Bangladesh, India, and Cambodia, vying for a larger share of regional manufacturing, and will present tailwinds to industrial construction activity in the upcoming years.

A number of industrial parks established across the country have been successful in attracting foreign investors with a mixture of tax incentives, lower operating costs and accessibility to nearby roads and port infrastructure.

Vietnam’s competitive advantage will continue to increase as work progresses on major infrastructure projects aimed at improving logistics in the country: the construction of the North-South Expressway linking Hanoi and Ho Chi Minh City will increase domestic transportation capacity along a corridor that connects industrial zones with urban centers, ports and the border with China. Efforts to boost capacity and improve the efficiency of major ports like the Cai Mep International Terminal near Ho Chi Minh City will also increase the attractiveness of nearby industrial areas.

Tourism to return as growth driving force in long-term

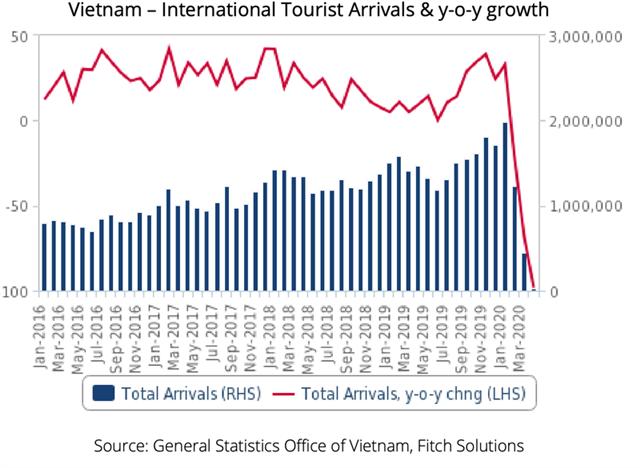

Non-residential buildings sector growth will also be supported by Fitch’s expectations for Vietnam’s tourism and hospitality sector to grow strongly over the next decade, but it noted a short-term slowdown due to the ongoing Covid-19 pandemic.

Pre-Covid 19 tourism arrivals strong.

|

Over the past decade, Vietnam has grown to become a popular tourist destination for regional tourists from Japan, South Korea and China, and tourism has since grown to become an increasingly important contributor to GDP growth.

Strong growth in the tourism sector is expected to experience a temporary slowdown in the short-term, and in the worst-case scenario, smaller hotels face bankruptcy if the Covid-19 situation does not improve. Nevertheless, Fitch continued to hold a positive view of the sector in the long-run, as the government continues to promote the country as a choice tourist destination.

Fitch expected to see more investments increase hotel capacity in Hanoi and Ho Chi Minh City, and also, the construction of holiday resorts in beach destinations such as Danang, Hoi An and Nha Trang.