Foreign capital to flow into non-life insurers on hopes of State divestment

Foreign capital to flow into non-life insurers on hopes of State divestment

State divestment is expected to lure foreign investors into and lift Viet Nam’s non-life insurance market.

Among the major State-owned insurers are PVI Insurance, Bao Minh Insurance and BIDV Insurance.

PVI Insurance was on the list of companies that the National Oil and Gas Group (PVN) had to divest from in 2019.

But the divestment did not happen. The major shareholders in PVI are German firm HDI Global SE and PVN.

The German insurer holds 42.91 per cent while PVN has 35.47 per cent.

HDI Global SE was planning to raise its stake in PVI Insurance when the Government sold its share in the firm, according to BIDV Securities Corp (BSC).

Bao Minh Insurance has been on the must-sell list since 2017 with the divestment expected to be completed in 2020.

The company has made some amendments to its business registration to allow foreign investors to increase their holdings in the firm.

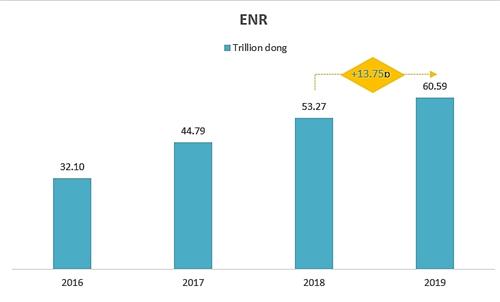

The total insurance revenue of the sector in 2019 was estimated at VND160.2 trillion (US$6.9 billion), up 20.3 per cent on-year.

Of the total figure, non-life insurance sales were worth VND52.4 trillion, an annual rise of 11.6 per cent.

The non-life insurance market had room for further development in 2020, BSC said in a recent report.

Viet Nam’s population was young and the country’s average income grew 7 per cent each year, it said.

The percentage of Vietnamese people buying non-life insurance products was low (1.3 per cent) compared to those in emerging markets (3-4 per cent), BSC said.

Spending on non-life insurance products was only US$21 per capita, which was comparatively low to emerging markets that reached $70 per capita, the brokerage said.

Large-cap firms were actively increasing their market shares and offering new products to win customers, which could help them raise core revenues and market shares during the year, BSC said.

In 2020, businesses were expected to cut corporate management and administration costs, BSC said, adding the non-life insurance market could grow 11 per cent on-year in 2020.

But the outbreak of the coronavirus pandemic, named COVID-19, could dampen corporate earnings in the first three months of 2020, according to the Ministry of Finance.

Insurers may have to extract a part of their earnings this year to hedge the risks for China-invested businesses, which have struggled with the lack of Chinese employees amid travel controls between the two countries.

These controls would also reduce the number of tourists visiting Viet Nam, and insurers may have to take care of contracts signed with local travel businesses.

In addition, after the pandemic was declared over or the situation improved at least in the short term, insurers may face financial claims from customers who want the funding for medical treatment and quarantine expenses.