Prudential Vietnam launches new signature healthcare rider

Prudential Vietnam launches new signature healthcare rider

Vietnam Assurance Private Ltd. (Prudential Vietnam) has launched the healthcare rider “Pru-Hanh Trang Vui Khoe”, a comprehensive solution providing customers with a unique revival benefit. In case of complete exhaustion of the Inpatient Benefit Policy Annual Limit, customers can receive an addition of up to 100 per cent of the initial inpatient benefit policy annual limit for hospitalisation. It is designed to financially protect customers against unexpected health risks and provide them with additional peace of mind.

Phu-Hanh Trang Vui Khoealso by Prudential Vietnam offers other outstanding benefits, including a public hospital allowance of VND250,000-1 million ($10.87-43.48) per day when customers need to be hospitalised in a public hospital, a daily companion bed allowance of VND625,000-2.5 million ($27.17-108.70) per day, and follow-up assistance for customers, in line with the Vietnamese’s tradition of taking care of their loved ones in ill health.

“Pru-Hanh Trang Vui Khoe”, a comprehensive solution providing customers of Prudential Vietnam with a unique revival benefit

|

According to the 2020 Global Medical Trend Rates Report by Aon Plc, medical plan costs in Vietnam are expected to be at 11 per cent in 2020, significantly higher than the average rate of 8.7 per cent in the Asia-Pacific region and the global average of 8 per cent in 2020. The report also indicates that non-communicable diseases such as cardiovascular, cancer, hypertension, diabetes and musculoskeletal diseases are top global medical conditions driving up medical costs. This calls for the Vietnamese people to be financially prepared to cope with a potential crisis caused by unforeseen accidents or illnesses.

Clive Baker, CEO of Prudential Vietnam, said, “Prudential Vietnam’s new healthcare rider Pru-Hanh Trang Vui Khoe provides customers with comprehensive financial protection, helping reduce the proportion of healthcare spent by individuals out of pocket and empowering them to take control of their health and wellbeing. With a stronger ‘We DO Health’ spirit than ever, Prudential demonstrates its firm commitment to accompanying its customers on their life journey and helping them achieve a healthier, improved life.”

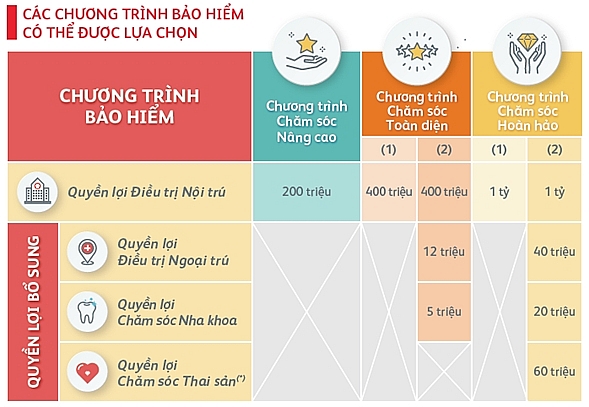

With this new healthcare rider, customers can choose from three insurance plans – Advance Care, Comprehensive Care, and Perfect Care – to fulfil their needs at each stage of life. Customers can choose from a number of competitive benefit packages, which include benefits for inpatient and outpatient care, dental care, and maternity care, as well as enjoy direct billing service with a wide network of hospitals and clinics all over Vietnam and Southeast Asian countries. The new healthcare rider is attached with most of Prudential Vietnam’s main products.

Find more information about the product here.

Prudential Vietnam customers can choose from three insurance plans – Advance Care, Comprehensive Care, and Perfect Care – to fulfil their needs at each stage of life

|