FE Credit caps another stellar year

FE Credit caps another stellar year

FE Credit recently revealed its 2019 unaudited results in an analyst call with VPBank, which shows improvements on various fronts.

FE Credit caps another stellar year

|

Loan book and fund mobilisation maintain healthy growth

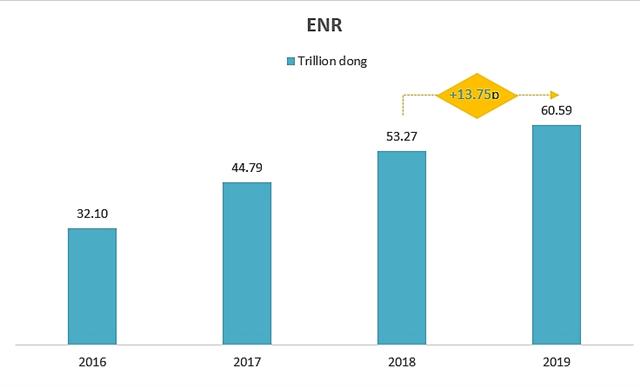

Ending Net Receivables (ENR)has grown by 13.75 per cent in 2019, FE Credit's total loan disbursementreached VND72.5 trillion ($3.15 billion), up 19 per cent compared to 2018. Total mobilisation by the end of 2019 was VND70.6 trillion ($3.1 billion), up 17.4 per cent compared to the end of 2018, 43 per cent of which came from issuing valuable papers, 23 per cent from foreign loans, and 18 per cent from capital. Outstanding loans stood at VND60.59 trillion ($2.63 billion), up 13.75 per cent.

Net interest margin (NIM)in 2019 improved to 31.3 per cent from the 28.4 per cent reported last year. At the same time, Cost Income Ratio (CIR) for the year added 80 basis points to reach 31.3 per cent in 2019. FE Credit's total operating income (excluding other incomes) grew by 29 per cent to VND18.1 trillion ($786.96 million).

Pre-tax profit was VND4.48 trillion ($194.78 million) for the year, noting a growth of 8.2 per cent compared to 2018. Return on average assets (ROAA) and Return On Average Equity (ROAE)were 5.5 and 34.8 per cent, respectively, while non-performing loans remain unchanged from the 6.0 per cent level of 2018.

The big picture

FE Credit's growth this year reveals two important improvements: First, the consumer lender has demonstrated the ability to manage growth effectively while improving cost management.

Second, the consumer finance company’s strategy that focuses on applying cutting-edge technology platforms to its business has shown great results, noted in improved CIR and NIM.

For the year, FE Credit continued to contribute significantly to VPBank’s profit as it adds 43.4 per cent to its mother company’s consolidated figure.