UPCoM capitalisation reaches three folds at HNX

UPCoM capitalisation reaches three folds at HNX

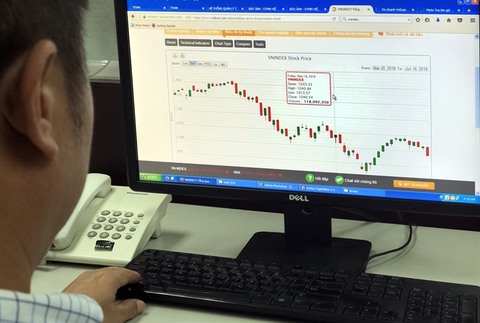

The capitalisation of the Unlisted Public Company Market (UPCoM) has rocketed over 100 times to reach VND656.4 trillion (US$28.8 billion) after nine years of operation.

The number of traded companies has also risen from some 40 in 2009 to 738 in 2018, making the scale of UPCoM three times larger than the listed market on Ha Noi Stock Exchange (HNX).

The secondary market for unlisted companies also recorded a 115-times increase in its daily trading value, which has reached an average of VND462 billion from VND4 billion in 2009.

This is equal to nearly 50 per cent of the average trading value on HNX.

Even in 2017, UPCoM had experienced a trading session with a record trading value of VND1.46 trillion, 2.3 times higher than the average trading value on HNX in 2017.

UPCoM was first launched by HNX on June 24, 2009, to narrow and limit the trading of companies’ shares on the free, unmanaged market and expand the government-managed market.

After nine years of operation, UPCoM has undergone significant changes to draw the attention of businesses and increase its attractiveness to investors by improving its trading criteria and applying the online trading mechanism.

These efforts have helped companies whose shares are traded on UPCoM to become listed companies on the HCM and Ha Noi stock exchanges and raise the transparency of both markets and their businesses.

UPCoM shares are increasingly attracting the interest of foreign investors. In 2016 and 2017, the proportion of foreign trading value always accounted for 15.5-16.5 per cent of UPCoM’s value. There were times when the market fluctuated, with foreign investors being net sellers on the listed market but net buyers on UPCoM.

HNX and efforts to expand UpCoM

HNX has gradually completed the legal framework and supported enterprises to create momentum for the development of UPCoM.

The northern bourse has issued a new mechanism that divides registered stocks on UPCoM into three categories by companies’ market capitalisation to improve trading conditions for the secondary market.

Besides, UPCoM has also created an Investors Warning list, including stocks restricted and suspended for trading, to warn investors before making a decision.

The monitoring of information disclosure of enterprises has also been strengthened, especially for large-scale enterprises.

In addition to this, HNX has helped improve UPCoM’s liquidity.

These mark new efforts of HNX to improve its monitoring and supervision of UPCoM, which has a variety of companies, capitalisation, quality and sectors.