Stocks experiences a volatile trading week

Stocks experiences a volatile trading week

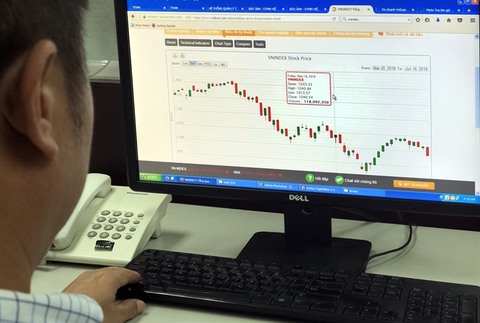

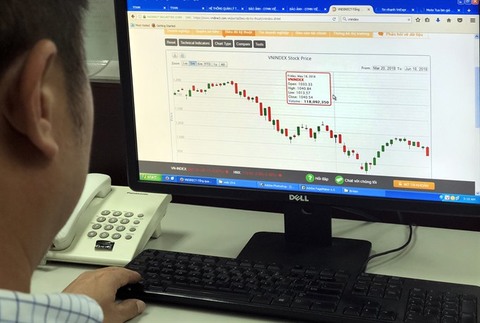

Vietnamese stocks experienced a volatile week with three deep bearish trading sessions among low overall liquidity due to massive sell-offs by foreign investors.

The benchmark VN Index on the HCM Stock Exchange increased by 1.42 per cent to close Friday at 983.17 points, posting a weekly decline of 3.28 per cent.

The HNX Index on the Ha Noi Stock Exchange gained 1.65 per cent to end last week trading at 111.98 points, but falling 3.37 per cent on-week.

Foreign selling pressure weighed on the stock market, negatively affecting the sentiment of domestic investors.

Foreigners sold a net value of over VND480 billion (US$21 million) on the two bourses; VND398.9 billion on the HOSE and VND81.8 billion on the HNX.

According to a report by SSI Research, foreigners were net sellers last week because they had adjusted their investment portfolios to balance their lists by selling out old shares to purchase new ones.

For example, FTSE Vietnam ETF and VNM ETF’s recent reviews of their investment portfolios had been a burden on the stock market and affected the indexes in a systematic way.

Two weeks ago, the US Federal Reserve announced a rate hike decision and signalled two more hikes this year, also resulting in a worldwide withdrawal of foreign capital from emerging and frontier markets.

With investor confidence was down, average trading liquidity fell last week.

More than 206.3 million shares were traded in each session of last week, worth over VND5 trillion (US$219.5 million). The figures were down 0.5 per cent in volume and 16.6 per cent in value from the previous week.

According to Bao Viet Securities Company (BVSC), escalating US-China trade tensions amid the retaliatory actions from both nations had continued to raise concerns about a global trade war.

The volatility of the global stock market had partly affected Vietnamese market sentiment, causing hesitation among investors.

Furthermore, Viet Nam will not be included in a review list for potential reclassification by Morgan Stanley Capital International (MSCI) for the next review period, which, according to the BVSC, will negatively affect investor confidence.

“In general, from our view, the results of the MSCI review indicate a slow pace of improvement in the Vietnamese stock market. In comparison with the other two frontier markets in the region, which are Bangladesh and Sri Lanka, Viet Nam still needs to improve the most,” BVSC said in its daily report.

As a consequence, Viet Nam’s stock market will not been included in the review list for 2018 without breakthrough changes, it said.

But on the positive side, Vietnamese market experienced two rally sessions on Wednesday and Friday due to strong pillar stocks.

BVSC predicted in its daily report that with a rebound in the last session of the week, the VN-Index may see a slight rise early next week. The Q2 income statement and net asset value (NAV) determination of funds could also shore up the index.