Vietnam's biggest fund says tt's time to buy after stock rout

Vietnam's biggest fund says tt's time to buy after stock rout

Vietnam’s largest fund manager is boosting his equity holdings, saying the benchmark gauge’s recent slump to a 13-month low has made stocks attractive.

Andy Ho, managing director and chief investment officer at VinaCapital Group,

said he favors property and consumer companies, as Vietnam’s economy will continue to expand despite the global downturn. He declined to say which companies he’s buying.

“We have been buying and will continue to buy,” Ho, who helps oversee about $1.5 billion, said in a telephone interview on Monday from Ho Chi Minh City. Equities are “undervalued” and the recent slump makes them even cheaper, Ho said.

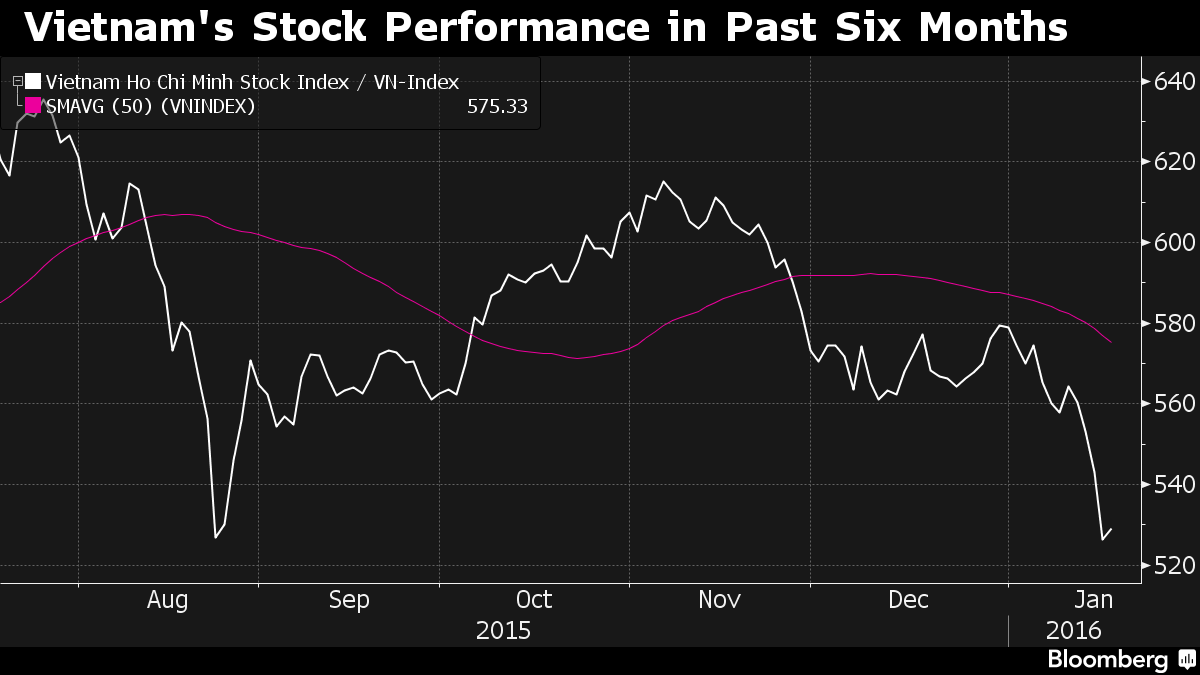

The benchmark VN Index sank 3.1 percent on Monday as energy companies tumbled with oil and foreign selling accelerated before a leadership reshuffle from later this month, sending valuations to the cheapest level since August. Foreign investors have sold a net $24.6 million of Vietnamese shares in January, data compiled by Bloomberg show. The gauge rose 0.6 percent at 11:22 a.m. local time.

Vietnam starts the process of picking its new leaders this month, with the party congress starting on Jan. 20. The once-in-five years political transition comes as the country finds itself balancing its Communist loyalty and economic dependence on China, with increasing concern about that nation’s behavior over islands they both claim in the South China Sea.

While there are no political concerns, the local market’s recent declines were a reaction to global volatility and anxiety over external factors including China’s economy and falling oil prices, according to Ho, who last year said he was considering adding banks to his holdings because of the improving property market and attractive valuations.