Vietnamese stock market awaits foreign cash flow

Vietnamese stock market awaits foreign cash flow

With satisfactory business performance from most listed companies, Vietnam has every reason to place high hopes on strong foreign capital flow in the next quarter.

Vietnam, according to Institutional Investor, a finance journal, has been eyed by foreign investors over the last year.

Foreign investors’ net purchase at the HCM City Stock Exchange alone reached $280 million in the first half of the year, higher than the $263 million of 2013.

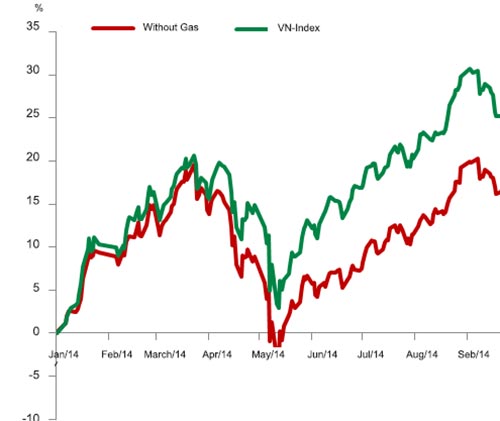

The foreigners’ comeback has helped make the market more bustling. The VN Index increased by 19 percent compared with earlier this year, though it only recently returned to the 600 point threshold. The figure, analysts said, is “admirable” compared to other stock markets around the world.

One of the most attractive characteristics of the Vietnamese stock market at this time is the satisfactory business performance of the majority of listed companies.

A report by Vietstock showed that by October 21, only 33 out of 251 businesses which have submitted their finance reports had declared losses, totaling VND603 billion, or 15 percent of the total profits reported by businesses.

Hoang Anh Gia Lai Group, a business managed by Doan Nguyen Duc, one of the most influential businessmen in Vietnam, for example, reported a huge profit of VND950 billion in the third quarter of 2014 alone, which is four times higher than that of the same period of last year.

The group’s report showed that its main business fields keep bringing huge profits to the group with the gross profit of 45 percent.

In addition to the good business performance by listed companies, foreign investors have also been encouraged by the news that they may be able to obtain higher ownership ratios in Vietnamese companies, though the policy on lifting the foreign ceiling ownership ratios has been postponed for a long time.

Institutional Investor quoted several foreign investment fund management companies as saying that they hope the government of Vietnam would raise the ceiling for foreign ownership to 60 percent from 49 percent. It is expected that the rate of foreign ownership of Vietnamese banks, considered a special type of business, would also be raised by the first quarter of the next year.

The total investment value of foreign institutional investors in Vietnam reportedly makes up 10-15 percent of the Vietnamese total stock market value.

Marc Djandji, a senior executive at VP Bank Securities, noted that the number of fund managers visiting Vietnam has been increasing rapidly. He noted that foreign investors were looking for big investment opportunities in Asia, and especially Southeast Asia, where the ASEAN Economic Community (AEC) is taking shape.

VFMVN30, the first domestic ETF (exchange traded fund) in Vietnam, made its debut with initial capital of VND202 billion, which was double the expected sum.

ETF is the newly launched “product” in the Vietnamese market. Therefore, analysts believe that the successful capital mobilization of VFMVN30 would kickstart a new movement of establishing ETFs.

vietnamnet