International trade emerges as a driver of sustainable growth

International trade emerges as a driver of sustainable growth

With estimated imports and exports of US$920 billion last year, Việt Nam entered the world’s top 15 economies by trade scale, marking a major milestone after decades of global integration and nearly 40 years of "Đổi Mới".

Việt Nam’s total import–export turnover was an estimated $920 billion in 2025, placing the country among the world’s top 15 trading economies. VNA/VNS Photo |

After nearly four decades of đổi mới (renewal)and a steady deepening of global integration, Việt Nam is seeing the long arc of its trade journey come into clearer focus, as expanding cross-border exchanges last year lifted the country into the ranks of the world’s top 15 trading economies, with total imports and exports estimated at US$920 billion.

International trade has long been a central growth engine for the economy and is increasingly viewed as a foundation for sustainable development in the years ahead.

Since joining the World Trade Organisation in 2007 and engaging actively in next-generation free trade agreements, Việt Nam has steadily expanded its footprint in global markets.

By 2025 Việt Nam had trade relations with more than 230 markets and had signed 17 FTAs with 65 economies, placing it among the most active participants in bilateral and multilateral trade frameworks.

Economists note that new-generation FTAs, with their deep and comprehensive commitments, have played a critical role in expanding market access, supporting institutional reform and strengthening national competitiveness.

Professor Võ Xuân Vinh, director of the Institute for Business Research at the HCM City University of Economics, said agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, the EU–Vietnam Free Trade Agreement and the Regional Comprehensive Economic Partnership had helped Việt Nam expand export markets while strengthening its position in global supply chains.

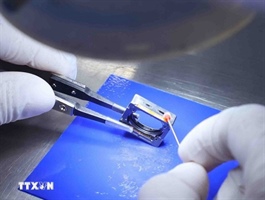

The textile and garment industry is a clear example of effective FTA utilisation.

According to Vũ Đức Giang, chairman of the Việt Nam Textile and Apparel Association, FTAs have enabled the sector to diversify export markets and reduce reliance on a limited number of them.

Vietnamese textile and garment products are now exported to 138 countries and territories, supported by rapid adaptation to new sourcing models and increased investment in technology and automation.

In 2025 textile and garment exports were estimated at $46 billion, up 5.6 per cent from 2024.

The sector also recorded a trade surplus of around $21 billion, its highest ever, reaffirming its role as a key pillar of the nation’s trade.

Overall trade in 2025 was estimated at $920 billion, up 16.9 per cent, equivalent to an increase of $133 billion, from the previous year.

The result highlights the country’s rising stature in global trade and its growing capacity to integrate into international production and supply chains.

At the Global Sourcing Outlook 2025 seminar held in HCM City in November, Global Sources, a Hong Kong-based sourcing platform, identified Việt Nam as an emerging hub in global supply chains, citing its manufacturing capability, skilled workforce, stable investment environment, and extensive FTA network linking it to major markets in the United States, Europe, Japan and the Middle East.

Việt Nam’s total import–export turnover was an estimated $920 billion in 2025, placing the country among the world’s top 15 trading economies. VNA/VNS Photo |

Shifting the model

But despite the strong export performance, experts caution that traditional growth drivers such as low-cost labour, abundant natural resources and large inflows of foreign direct investment are gradually reaching their limits.

So Việt Nam needs to identify new growth engines to sustain competitiveness and improve the quality of economic expansion.

Exports remain one of the economy’s three main growth pillars, alongside the domestic market and public investment, but economist Trần Du Lịch has pointed to the long-standing structural challenge of low domestic value added in exports.

While the economy has maintained growth of around 8 per cent despite global uncertainties, the share of locally sourced inputs remains modest, limiting the value retained within the economy.

Current estimates suggest domestic value added accounts for only about 36.6 per cent of exports.

Experts stress that the priority should shift from rapid expansion in export volumes to improvements in indigenisation and value creation.

Raising the ratio to 40 per cent or even 50 per cent would provide a stronger foundation for the next development phase and support the growth of domestic enterprises, they say.

Adding more value

From a sectoral perspective, the cashew industry illustrates both opportunities and constraints.

Exports reached $4 billion in 2024 and are expected to exceed $5 billion in 2025 for the first time. But domestic supply of raw cashew meets only around 10 per cent of demand, leaving the sector heavily dependent on imports and increasingly exposed to processing competition from African suppliers.

In contrast, the textile and garment industry has made notable progress in raising domestic value added.

In 2025 the indigenisation rate reached 52 per cent, driven by investments in fabric production, dyeing, renewable energy, and circular wastewater treatment systems.

These efforts are essential to meeting the strict rules-of-origin requirements in next-generation FTAs.

Looking ahead, the industry is pursuing a strategy centred on green and digital transformation, aiming to lift indigenisation to 60 per cent and export revenues to $64.5–65 billion by 2030 and maintain average annual growth of 6.5–7 per cent.

If realised, this approach would help ensure international trade continues to serve as a resilient and sustainable driver of Việt Nam’s economic growth.

- 08:25 17/01/2026