GELEX’s credit rating outlook upgraded to 'Positive' by VIS Rating

GELEX’s credit rating outlook upgraded to 'Positive' by VIS Rating

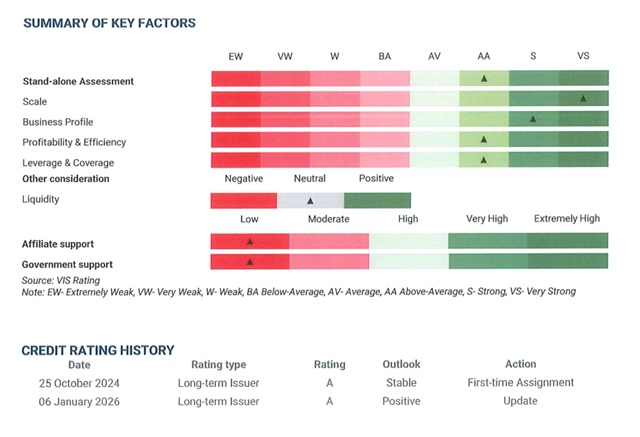

GELEX Group JSC has once again been given a long-term issuer credit rating of A by Vietnam Investors Service Rating (VIS Rating), while its outlook has been upgraded from “Stable” to “Positive”.

GELEX is the first enterprise to receive an outlook upgrade from VIS Rating in the 2025 rating cycle, issued on January 6, and among the rare cases to achieve such an improvement within less than one year. This reflects the group’s above-average pace of improvement in financial quality and operating performance, at a time when credit assessment standards are becoming increasingly stringent. The upgrade also recognises GELEX’s governance capability, adaptability, and potential for further rating improvement in the medium term.

VIS Rating has upgraded GELEX’s long-term A rating outlook from “Stable” to “Positive” |

The maintained A rating, together with the upgraded outlook, reflects expectations that GELEX’s revenue and operating cash flows will continue to strengthen over the next 12-18 months, supported by the solid fundamentals of its core businesses in electrical equipment and building materials.

From 2024 through the first nine months of 2025, GELEX recorded nearly 15 per cent revenue growth, significantly exceeding the average growth rate from 2021-2023. The group’s earnings before interest, taxes, depreciation, and amortisation (EBITDA) margin improved to approximately 23 per cent, indicating continued enhancements in operating efficiency and cost management at the consolidated level.

The electrical equipment segment remains the primary growth driver for GELEX. Through market expansion, new product development, and optimisation of its manufacturing value chain, the group has significantly increased its industry market share.

In particular, CADIVI, GELEX’s key subsidiary in power cables, expanded its presence in northern Vietnam from early 2024, contributing to a higher nationwide market share in the power cable segment. Supported by scale expansion and improved production efficiency, the EBITDA margin of the electrical equipment segment increased sharply from around 13 per cent to over 20 per cent in the first nine months of 2025.

The electrical equipment business continues to be the main contributor to GELEX’s revenue and profit growth |

VIS Rating expects this segment to maintain stable growth momentum, supported by strong demand for electrical products amid robust public and private investment in power infrastructure nationwide.

For GELEX Infrastructure, profitability in the building materials segment is expected to improve, driven by the recovery of the real estate market, easing competition in the construction glass segment following Vietnam’s initiation of anti-dumping investigations on certain imported products in July 2025, and the restructuring of sales channels at several subsidiaries.

The utilities segment, with EBITDA margins exceeding 70 per cent, is forecast to further strengthen the group’s overall growth following the completion of a plan to double water treatment capacity in the first quarter of 2026.

Strong demand for industrial infrastructure is expected to support leasing activities and cash flows in the industrial real estate segment. GELEX Infrastructure plans to commence sales of a new residential real estate project in Haiphong, developed in cooperation with Frasers Property (Singapore), including both low-rise and high-rise components, in Q1.

GELEX subsidiaries also plan to expand residential land banks and develop additional new projects. From 2026-2027, GELEX is expected to achieve average annual revenue growth of approximately 14 per cent, while maintaining an EBITDA margin of around 20 per cent.

Artist’s impression of the ANmaison project in Haiphong |

VIS Rating notes that GELEX’s profitability and operating cash flow (CFO) remain strong, providing a solid foundation for maintaining stable financial safety indicators. Specifically, the EBIT-to-interest coverage ratio stands at approximately 4.5-5.0 times, while the CFO-to-debt ratio has been maintained at 15-20 per cent.

These metrics indicate that GELEX has adequate financial headroom to implement its medium- and long-term investment plans, while maintaining effective control over leverage and liquidity risks amid ongoing volatility in the financial environment.

According to VIS Rating, GELEX’s credit rating could be upgraded in the medium term if the group continues to sustain EBITDA margins above 20 per cent, maintains a CFO-to-debt ratio above 20 per cent, and adheres to a prudent investment strategy with limited reliance on excessive borrowing.

Conversely, overly rapid investment expansion or delays in the implementation of key projects could place pressure on cash flows and liquidity, potentially affecting the group’s rating outlook in the future.

The affirmation of GELEX’s A credit rating and the upgrade of its outlook to “Positive” provide clear evidence of the group’s credit strength, financial governance capability, and sustainable business foundation. This result not only reinforces the confidence of investors and credit institutions, but also gives GELEX a significant advantage in accessing long-term capital at more competitive costs, supporting the realisation of its sustainable growth strategy.

VIS Rating is an independent credit rating agency in Vietnam, licensed by the Ministry of Finance since September 2023, established through cooperation with Moody’s and other partners under a Vietnam Bond Market Association initiative. VIS Rating provides credit risk and financial capacity assessments for domestic enterprises.

- 16:49 06/01/2026