Brokerage competition tightens as market shares narrow

Brokerage competition tightens as market shares narrow

Competition among securities firms intensified last year, with market share gaps narrowing across the brokerage sector.

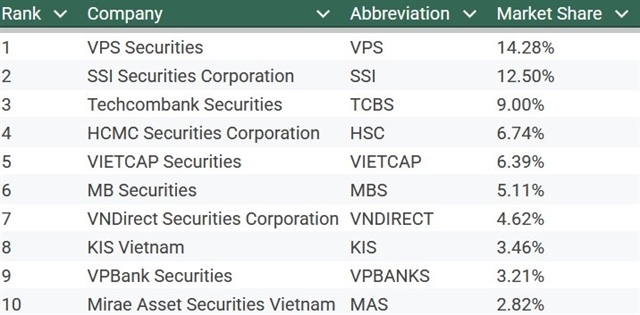

Data released by the Ho Chi Minh City Stock Exchange (HSX) on January 8 showed that leading securities firms continued to dominate trading value in 2025, while competition tightened and VPBank Securities (VPS) entered the top 10 brokerages for the first time. The figures for the fourth quarter and full year confirmed that VPS, SSI Securities, and Techcom Securities (TCBS) retained their positions as the three largest brokers by trading value.

VPS retained first place in the fourth quarter, but its market share slipped to around 14.3 per cent, its lowest level in several quarters. In contrast, SSI strengthened its second-place position as its share rose to 12.5 per cent, marking consecutive quarterly gains and its highest level in five years. TCBS ranked third with a 9 per cent share, a notable increase from previous quarters.

The most significant development in the fourth-quarter rankings was the debut of VPBank Securities, known as VPBankS, in the top 10. Less than four years after operating under its current brand, the firm captured a little over 3.2 per cent share to place ninth, pushing Vietcombank Securities out of the top 10.

HSX brokerage market shares in the fourth quarter of 2025. Source: HSX |

For the full year, the top three firms maintained the same rankings as in 2024, although their respective shares shifted. VPS ended 2025 as the largest broker with an almost 16 per cent share, down from a peak of more than 18 per cent a year earlier. SSI recorded the strongest growth among leading firms, increasing its full-year share to 11.5 per cent from just under 9.2 per cent in 2024.

Overall, the top 10 brokers accounted for around 68.5 per cent of total brokerage market share on HSX in 2025, slightly higher than the 68 per cent from the previous year, indicating continued dominance by large financial institutions. Rankings within the group were largely unchanged, except for a swap between Vietcap and Ho Chi Minh City Securities Corporation in fourth and fifth place.

HSX brokerage market shares in the full year 2025. Source: HSX |

At the close of trading on December 31, the VN-Index ended at almost 1,784.5 points, the highest level in the Vietnamese stock market’s 26-year history. For the full year, the index gained close to 41 per cent, placing Vietnam among the world’s 10 best-performing and Asia’s top three equity markets.

Overall market liquidity rose by about 33 per cent from 2024, reflecting investors’ medium- and long-term expectations around a potential market upgrade, improvements to the regulatory framework for foreign investors, and strong macroeconomic growth.

Against this backdrop, competition in the brokerage sector intensified. Aggressive price competition, including zero-fee trading, advisory quality, and, in particular, the race to strengthen technology platforms and margin lending capacity, continued to be key factors reshaping brokerage market share over the past year.

- 15:19 09/01/2026