Domestic gold price plummets after global price slips below $4,000 per ounce

Domestic gold price plummets after global price slips below $4,000 per ounce

Gold bar prices dropped by VNĐ1.7 million per tael for both buying and selling, down to VNĐ145.7-147.2 million per tael.

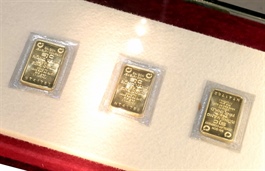

At SJC shops, gold bar prices dropped by VNĐ1.7 million per tael for both buying and selling to VNĐ145.7-147.2 million per tael. VNA/VNS Photo |

Domestic gold prices on Tuesday dropped sharply, after the cost of the metal dipped below US$4,000 per ounce in the global market.

The trend of decreasing gold prices worldwide comes amid cooling geopolitical tensions that have reduced the demand for safe haven assets, including gold.

On Tuesday, gold bar prices listed at all major domestic gold companies fell sharply. At SJC and PNJ shops, gold bar prices dropped by VNĐ1.7 million per tael for both buying and selling, to VNĐ145.7–147.2 million per tael.

Meanwhile, Doji and Phu Quy groups further adjusted their prices, with a VNĐ1.9 million drop to VNĐ145.7-147.2 million per tael in buying and a decrease of VNĐ1.7 million in selling to VNĐ145–147.2 million per tael.

Aside from gold bars, gold jewellery was also experiencing a strong downward trend. 24K gold dropped by VNĐ1.8 million per tael, 18K gold fell by VNĐ1.35 million per tael and 14K gold decreased by VNĐ1.05 million per tael for both buying and selling.

The price drop was also seen in gold rings. At Doji Group, gold ring prices saw the deepest decrease, losing up to VNĐ2.3 million per tael in buying and VNĐ1.8 million per tael in selling, with prices hitting VNĐ144–147 million per tael.

At SJC Company and PNJ, the price of gold rings also decreased by VNĐ1.8 million per tael, to VNĐ144–147 million per tael for both buying and selling.

Gold prices climbed to a record high of $4,381.21 per ounce on October 20, but retreated 3.2 per cent last week and fell below the $4,000 per ounce mark on Monday.

According to finance expert Dr Nguyễn Trí Hiếu, the main reason for the sharp drop in gold prices is that international investors are taking profits after a period of hot growth.

In addition, signs of a thaw in US-China trade tensions also reduced some of the bullion’s safe-haven appeal. There have been hints of easing trade tensions between the world’s two largest economies after negotiators from the US and China on Sunday outlined the framework for a deal to pause steeper American tariffs and defer China’s rare-earth export controls.

Market participants are also awaiting the US Federal Reserve (Fed)’s interest rate decision this week. Experts have predicted a quarter of a percentage point rate cut will come out of the Fed’s meeting on Wednesday. Gold, a non-yielding asset, typically performs well in a low interest rate environment.

While most analysts and investors see further highs for the yellow metal, even bringing $5,000 per ounce into view, some are sceptical about the sustainability of its recent massive rise.

Capital Economics analysts on Monday lowered their gold price forecast to $3,500 per ounce for end-2026, saying that the 25 per cent jump in prices since August is much more difficult to justify than previous moves during the gold rally.

Domestic experts say that it is necessary to be extremely careful when trading, as the market is facing large fluctuations.

Investors who do not have much capital and did not accumulate gold starting at low prices could easily fall into a state of anxiety and panic, because the gap between buying and selling prices is significant, they say.

- 14:22 28/10/2025