Citi eyes Vietnam’s forex trade as investors pile in ahead of market upgrade

Citi eyes Vietnam’s forex trade as investors pile in ahead of market upgrade

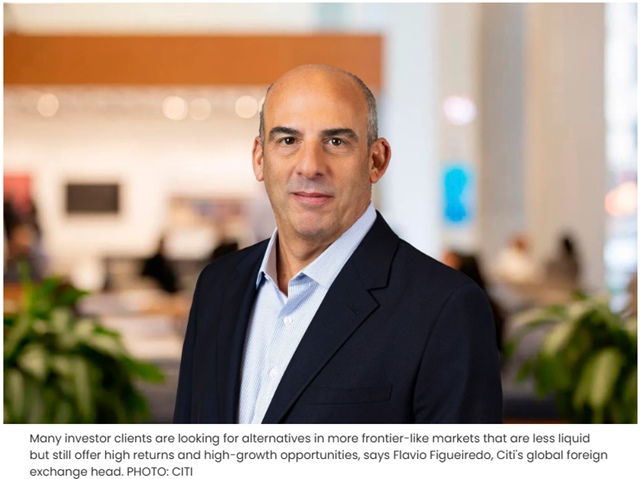

It's been a very active year for the forex trade business, said Citi's global forex head Flavio Figueiredo.

With the global currency market hitting a fresh high of nearly $10 trillion in daily turnover this year, Citi is not missing its slice of the action, posting double-digit growth in trading volumes while taking a shine to Vietnam, where institutional activity is red hot.

|

Inward equity investments have swelled in anticipation of the Southeast Asian nation’s emerging market upgrade, thus buoying Citi’s client trading volumes, said the bank’s global head of foreign exchange (FX) Flavio Figueiredo.

He told The Business Times in a talk on October 15, “There are many corporate clients who have expanded their businesses in Vietnam. And many investor clients are looking for alternatives in more frontier-like markets that are less liquid but still offer high returns and high-growth opportunities.”

FX trading volumes among institutional investors in Vietnam are already up by 150 per cent as of end-September, compared to the same period in 2024, said Citi. The bank expects the momentum to continue through to the end of the year.

Vietnam’s reclassification was confirmed on October 7, almost a decade since it was first added to a watch list. In the months leading up to this date, the country’s benchmark index went on a bull run while economic growth hit multi-year highs.

Citi has also recorded double-digit growth in client trading volumes across the other Southeast Asian markets of Singapore, Malaysia, and Thailand. This momentum has extended across all its FX products, with options being a standout contributor.

“It’s been a very active year for the FX business,” said Figueiredo.

“All the movements in economic data and tariff announcements have created a lot of volatility and uncertainty, and the volumes in the market were very high because investors were trading and hedging more,” he explained.

In particular, hedge funds have become Citi’s largest volume segment, surpassing banks.

Hedge fund activity drove the growth from North America and the United Kingdom as the larger players are based there, said Figueiredo, adding that real money and corporate flows originate mainly from Asia and Western Europe.

Asia up

Broadly, the centre of gravity for global financial activity has been creeping east as capital shifts towards Asian hubs and away from traditional centres in the Americas and Europe.

On whether today’s macroeconomic conditions are accelerating similar trends in FX trading volumes, the Citi executive noted that Asia has historically been the bank’s key driver of growth and the fastest-growing region for its FX business globally.

“There’s a lot of wealth and investment funds in Asia and the Middle East, which is driving the increase in activity,” said Figueiredo.

“We’ve also seen increasing inter-regional trade in Asia (and) trade corridors developing. There’s a lot more commerce happening intra-Asia and that’s driving corporate flows in the region here,” he continued.

Singapore serves as Citi’s main Asian hub. The way Figueiredo sees it, the republic continues to be extremely relevant to Citi’s growth vision in Asia and globally, for its regulatory environment offers security to market players while still leaving room for innovation.

“This is critical for the development of the financial market. You need to have a strong regulatory framework that brings safety, but also flexibility that brings innovation – that combination exists very well in Singapore,” he said.

Middle East rising

Asked about Citi’s acceleration of its Middle East presence and whether this push is reflected in the FX side, Figueiredo pointed to increasing activity in Emirati cities such as Dubai and Abu Dhabi; in Gulf countries like Saudi Arabia; and even in Egypt.

“The Middle East is becoming a relevant financial hub,” he said. “More hedge funds are opening and setting up offices, while others are expanding quite significantly there.”

Yet, these hedge fund players in the Middle East often still prefer to be covered by a London sales force.

“The investors are based in the Middle East, but they’re trading G10 currencies or emerging-market currencies that are not necessarily Middle Eastern currencies, most of which are pegged,” said Figueiredo. “The bulk of the flows we see in the Middle East are from corporate clients that have expanded there and non-Middle Eastern clients going there to find investment opportunities.”

- 11:45 16/10/2025