Cathay United Bank hosts Tax and Investment seminar on tariff impacts and supply chain shifts

Cathay United Bank hosts Tax and Investment seminar on tariff impacts and supply chain shifts

Cathay United Bank - Ho Chi Minh City Branch (CUBHCM) hosted a seminar to discuss the opportunities and challenges facing corporates in Vietnam on September 5 in Hanoi.

The event focused on how businesses can address Vietnam's tax and investment challenges while seizing growth opportunities that arise from global supply chain restructuring.

Benny Miao, executive vice president at Cathay United Bank. Photo: CUB |

“Over the past few months, rising global trade tensions and tariff policies have not only reshaped the strategic direction of major economies, but have also profoundly impacted global supply chains, capital flows, and tax planning,” said Benny Miao, executive vice president at Cathay United Bank.

“Vietnam plays a pivotal role in this transformation. As an emerging manufacturing hub and a key link in global value chains, it is increasingly under the spotlight of international trade policy and corporate strategy,” he noted.

Chi-Chao Lin, chief economist of Cathay United Bank. Photo: CUB |

The seminar also featured insights from Chi-Chao Lin, chief economist of Cathay United Bank, who explained how tariff shocks are rapidly accelerating the restructuring of supply chains across Asia and globally.

Lin noted that Vietnam is well-positioned to benefit from the global supply chain reconfiguration. “We expect to see significant expansion in domestic manufacturing and assembly to increase local added value,” he said. “Vietnam will also accelerate efforts to diversify its export markets, with a focus on the EU, ASEAN, and other regions. At the same time, the government is strengthening its compliance and governance, bolstering enforcement of origin certifications and tightening oversight of labelling and export processes.

VJ Lu, general manager of CUBHCM, emphasised the importance of cross-sector collaboration in navigating today's complex environment.

"This seminar provides a timely platform for dialogue between experts and enterprises. We are honoured to bring together KPMG and other experts from various fields to explore Vietnam's future development and strategic responses. Through collaboration and shared expertise, we aim to help businesses grow sustainably and seize new opportunities in Vietnam."

The seminar exemplifies the bank's ability to combine financial expertise and cross-industry networks, with CUB providing strategic investment insights and KPMG sharing updates on Vietnam's tax reforms and the impact of US tariff policies on local businesses and foreign investors.

CUB first established a branch in Chu Lai in former Quang Nam province (now Danang city) in 2005, before relocating to Ho Chi Minh City in 2022.

Today, the bank operates three offices in Vietnam - its Ho Chi Minh City Branch, Hanoi Representative Office, and Quang Nam Representative Office.

As a core subsidiary of Cathay Financial Holdings, Cathay United Bank leverages the group's strengths and global vision to advance localized development in overseas markets, with Vietnam now considered its second-home market after Taiwan.

The bank has been building its presence in Southeast Asia for many years, offering a full range of corporate and personal financial services in Vietnam. It also organises forums and seminars to help corporate clients explore long-term development opportunities in the market.

Cathay Financial Holdings has served clients in Taiwan for more than 60 years and has expanded across Asia, with 969 branches, 53,000 employees, over 15.3 million customers, and more than $400 billion in assets under management.

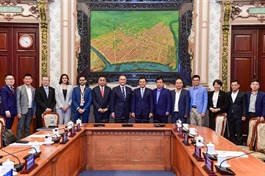

Executive participants pose for a photo at the seminar. Photo: CUB |

Looking ahead, CUBHCM will continue to leverage the group's synergies to capture opportunities from Vietnam's rapid economic growth and industrial transformation.

By deepening local services and strengthening cross-border financial linkages, Cathay United Bank aims to be the strategic partner of choice for enterprises expanding in Vietnam and beyond, in line with its vision of becoming Asia's leading regional bank.

Website: https://www.cathaybk.com.tw/vn/hcmc/en

- 14:00 13/09/2025