Resilience and support offer progress for VN-Index

Resilience and support offer progress for VN-Index

Vietnam’s benchmark VN-Index has soared to a historic peak, raising the question of whether the rally has further momentum or risks running out of steam.

By mid-August, the VN-Index closed at 1,611.6 points, up 27 per cent since the beginning of the year, surpassing its all-time high. This milestone not only marks a breakthrough for Vietnam’s stock market but also reflects a global trend, as major markets such as the US, Japan, and Germany have also reached record highs.

Trinh Ha, financial market analyst Exness Investment Bank |

However, excluding the contribution of Vingroup’s three key stocks, the VN-Index would stand closer to 1,500 points. This raises the question: what factors have fuelled the rally, and does the market still have room to grow in the remainder of 2025?

Corporate earnings remain the strongest driver. Despite concerns over tariffs, Vietnam secured a 20 per cent tax rate in negotiations with the US and is pushing for further reductions. Additionally, importers accelerated shipments ahead of tariff enforcement, benefiting exporters significantly in Q2.

According to Fiinpro, as of July 31, earnings of 970 listed companies representing 97 per cent of market capitalisation grew 33.6 per cent on-year in the previous quarter. Non-financials rose 53.8 per cent, while financials maintained stable growth of 17.5 per cent.

Real estate posted a remarkable 64.7 per cent surge, with leaders such as Vingroup, Becamex, and Sonadezi. Utilities also made a notable contribution.

Macroeconomic conditions also supported the rally. Public investment disbursement in the first seven months jumped 30 per cent on-year, reaching nearly 44 per cent of the annual plan. Credit growth hit 9.8 per cent versus end-2024, the highest since 2022, while GDP expanded 7.52 per cent in H1 – the fastest pace in the 2021–2025 period.

The property sector rebounded as legal bottlenecks were eased, with strong inflows of customer prepayments at major developers, totalling over $860 million.

Foreign investors also returned after heavy outflows earlier in the year. Following a net sell-off of $1 billion by end-Q2, they turned net buyers in July with inflows of $335 million, reversing the $75 million net outflow in June. This shift underscores Vietnam’s attractive valuations and prospects for market upgrade.

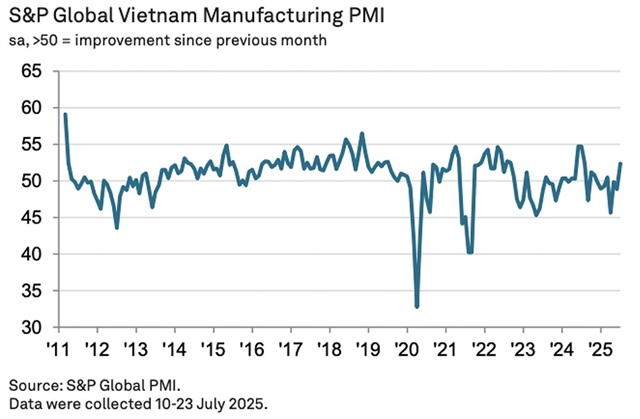

Looking ahead, several drivers remain in play. Vietnam’s manufacturing Purchasing Managers’ Index climbed back above 50 for the first time in four months, signalling improving business conditions and order flows. Credit growth limits are expected to be loosened further, with the central bank hinting at a shift away from quota-based controls to allow banks greater lending flexibility.

|

Meanwhile, upcoming public investment disbursements should inject liquidity into the economy, despite recent short-term strains in interbank markets.

Market upgrade potential is another critical catalyst. Regulators are addressing long-standing barriers such as foreign ownership limits and clearing system reforms, paving the way for a potential reclassification to emerging market status as early as September. Analysts estimate this could attract over $1 billion in fresh foreign inflows.

Vietnam also retains a strategic position in global supply chains. With a 20 per cent US tariff rate, Vietnam is more competitive than India at 25 per cent, and on par with Indonesia, Thailand, and the Philippines, all on 19 per cent. Meanwhile, the 40 per cent tariff on Chinese transshipment creates an opportunity for Vietnam to capture higher value-added production, strengthening industrial growth.

Valuations remain attractive. Bloomberg data shows that while the VN-Index is at a record high, its forward price-to-earnings (P/E) ratio stands at 10.9x – well below the 2021 peak of 15x. Trailing P/E is 15.5x, still under the five- and 10-year averages of 16.7x and 16.6x. With market-wide earnings expected to grow more than 20 per cent this year, valuations are considered reasonable.

That said, short-term corrections are possible, as many stocks have risen far more sharply than earnings fundamentals justify. Yet over the medium to long term, a favourable tax regime, resilient supply chain positioning, and supportive policies suggest that the VN-Index still has room to climb to new milestones.

- 09:52 27/08/2025