Regulatory tailwinds impact aviation PPPs

Regulatory tailwinds impact aviation PPPs

More opportunities are expected to open for private investors in the aviation sector as the country prepares to introduce regulatory support for a public–private mechanism, though further enhancements will be required.

Amendments have been proposed to streamline investment into the country’s aviation arena |

The Government Office on July 15 concluded the Government Standing Committee’s meeting on draft amendments to the Law on Civil Aviation of Vietnam, calling on the Ministry of Construction (MoC) to assess and revise mechanisms to promptly address practical limitations.

Among the key issues, the MoC has been tasked with amending the law to ensure open and enabling conditions to mobilise all economic sectors in developing aviation infrastructure. The state is to invest only in areas unattractive to the private sector, while administrative procedures are to be streamlined and simplified as much as possible.

The MoC has proposed several changes to current regulations, including amendments to policies on investment and operations at airports – especially dual-use facilities with both defence and security functions – and improvements to the public-private partnership (PPP) mechanism.

Aviation lawyer Tuan Nguyen said, “The amendment is a good signal for the business community and the market, although some details still depend on further work from the MoC. PPP airports have generated interest among private sector players. However, barriers prevented them from taking the next steps. Now, they are pinning high hopes on new, positive changes ahead.”

The current Law on Civil Aviation of Vietnam was issued in 2006 and was last amended in 2014. Experts have said it is time for the country to update the law to keep pace with domestic and international socioeconomic changes – especially to resolve long-standing bottlenecks.

Luong Thi Thanh Nga, senior private sector development officer at the Asian Development Bank’s Resident Mission in Vietnam, said, “The key to the success of PPP investment is a consistent and clear legal framework, high political determination, and continuous improvement in the state sector’s capacity to participate.”

She explained that each PPP project typically includes three phases, and improving the success rate of PPP initiatives requires thorough research and scrutiny from the outset.

“It is necessary to identify and select suitable projects for this investment model, assess full lifecycle costs, and allocate risks appropriately,” Nga said. “The next phase requires a competitive and transparent bidding process, while the final phase must involve effective contract enforcement to ensure reliability.”

Expert Tuan Chu said that attracting private capital is not simply about raising funds, but about creating a safe and sustainable environment that inspires investor confidence.

“It is necessary to offer more attractive financial incentives to reduce investor risk,” he said. “These may include tax exemptions, preferential financial programmes, and revenue-sharing models. Reducing the financial burden in the early operational stages can increase the appeal of aviation infrastructure projects.”

More than seven years after Van Don International Airport – the country’s first airport developed under the PPP model – was put into operation, no other PPP airport projects have been successfully implemented.

Over that time, several projects were proposed but ultimately stalled. In 2022, the northern province of Lao Cai broke ground on Sapa Airport under the PPP model, but an investor has yet to be selected. Meanwhile, the investor for Phan Thiet Airport terminated the contract in 2023 after years of delayed construction.

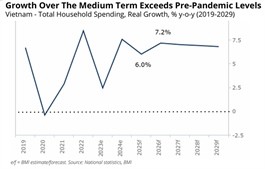

Despite such setbacks, private investors remain interested in the PPP model within the domestic aviation sector, which continues to post double-digit annual growth and high demand for expansion. The government aims to raise the total airport capacity to 275.9 million passengers by 2030, but the state budget is expected to cover just 65.8 per cent of the required investment. As such, drawing in private capital remains a significant challenge.

In late June, the MoC sent a document to the National Assembly delegation of Gia Lai province regarding a proposal to supplement the medium-term public investment plan for the 2026–2030 period, covering five key transport infrastructure projects – including the proposed $506 million expansion of Pleiku Airport.

For the civil aviation portion of the project – including terminals, parking areas, and other facilities – Airports Corporation of Vietnam is responsible for investment in line with national planning. If it is unable to balance its capital sources, Gia Lai may study and propose a plan to mobilise social resources for airport development and submit it to the prime minister for consideration.

Pleiku Airport currently accommodates medium-range aircraft such as the A320 and A321, serving domestic routes that connect to major political and cultural centres nationwide. The airport’s capacity is currently 600,000 passengers per year.

In 2024, several new airport proposals were put forward. These included Quang Tri Airport, with a total investment of more than $232 million. The proposed investor – a joint venture between T&T Transport Infrastructure Investment and Development and CIENCO 4 – plans to operate the airport within two years. The proposed design targets a capacity of one million passengers and 3,100 tonnes of cargo annually, with the passenger figure expected to double by 2046.

Lawyer Tuan Nguyen said, “These moves show that the domestic market continues to attract private businesses. However, further enabling conditions are needed to enhance the appeal and turn proposed projects into successful ventures.”

Expert Tuan Chu added, “The government should consider raising the foreign ownership cap in aviation infrastructure projects to 49 per cent, in line with levels allowed in regional markets such as Thailand and Indonesia. This would make Vietnam a more competitive investment destination in the eyes of international investors.”

- 16:54 01/08/2025