Vietnam’s capital market remains active despite lack of IPOs

Vietnam’s capital market remains active despite lack of IPOs

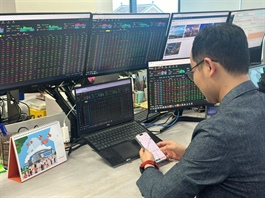

Vietnam’s capital market is gaining strong momentum, fuelled by a wave of new listings and board transfers, setting the stage for a vibrant season of initial public offerings (IPOs) ahead.

Photo: Shutterstock |

Southeast Asia’s IPO market saw a solid first half in 2025, with 53 deals raising over $1.4 billion and pushing total market capitalisation to $7.7 billion. While that’s fewer IPOs than the 67 seen in the same period last year, overall proceeds were slightly higher and valuations stronger, according to Deloitte’s Southeast Asia Mid-Year IPO Snapshot released on July 11.

Despite a dip in the number of deals, the region’s IPO market showed resilience, thanks to three standout listings: Eco-Shop Marketing Berhad in Malaysia, and Indonesia’s PT Bangun Kosambi Sukses Tbk and PT Yupi Indo Jelly Gum Tbk. Each debuted with a market capitalisation of over $1 billion, together raising around $495 million.

By comparison, the first half of 2024 saw only one IPO of similar scale – Thailand’s Credit Bank Public Co., Ltd. – which debuted with a $1 billion market cap and raised $208 million.

June brought a wave of optimism to Southeast Asia’s IPO scene, with several large Main Board filings –among them, a listing expected to be Singapore’s biggest in a decade. According to Deloitte, this uptick reflects growing investor confidence and sets the stage for a more vibrant second half of the year.

According to Tay Hwee Ling, Deloitte's Southeast Asia Accounting and Reporting Assurance leader, "The first half of 2025 saw a measured rebound in the region's capital markets, underpinned by stabilising macroeconomic conditions and renewed momentum in larger IPOs, particularly in Malaysia and Indonesia. Despite cautious sentiment, issuer interest is gradually returning – especially in markets that offer regulatory certainty, sufficient investor depth, and regional expansion appeal."

Vietnam recorded no new IPOs in the first half of 2025, but market activity stayed lively. Four companies moved from the Unlisted Public Company Market to the main boards on the Hanoi and Ho Chi Minh stock exchanges, while two previously unlisted public enterprises also made their debut. Vinpearl JSC listed more than 1.79 billion shares on the Ho Chi Minh Stock Exchange on May 13, with a total par value of over VND17.93 trillion (around $689 million).

- 10:11 15/07/2025