VIB sees strong first half performance with profit exceeding $190 million

VIB sees strong first half performance with profit exceeding $190 million

Vietnam International Bank (VIB) continues to show steady momentum in 2025, driven by strong credit growth and a focus on asset quality.

|

On July 28, VIB reported a pre-tax profit of more than VND5 trillion ($190.8 million) for the first half of 2025, marking a 9 per cent increase on-year. Credit growth reached 10 per cent during the period, pushing total assets beyond VND500 trillion ($19.1 billion). The bank noted its asset quality remained stable and well-managed, supporting sustainable performance across core business segments.

VIB’s total assets stood at more than VND530 trillion ($20.23 billion) on June 30, up 8 per cent since the start of the year. Total credit surpassed VND356 trillion ($13.6 billion), rising 10 per cent on the back of solid performance across retail banking, small- and medium-sized enterprises (SMEs), corporates, and financial institutions.

Retail banking saw strong growth, fuelled by flexible loan products, advanced digital services, and a customer-focused strategy. A key highlight was the launch of a VND45 trillion ($1.7 billion) home loan package, which allows borrowers to repay just VND1 million ($38) in principal each month for the first five years on a VND1 billion ($38,176) loan – an option designed to make homeownership more affordable for young buyers.

The package offers a fixed interest rate starting from 5.9 per cent per annum, along with instant AI-powered approval, flexible repayment terms, and no early repayment fees. Meanwhile, in the SME and corporate and institutional segments, VIB pursued a selective credit growth strategy, prioritising support for working capital and operational needs in response to the current low-interest-rate environment.

Customers deposits grew steadily by 10 per cent, reaching over VND304 trillion ($11.6 billion), specifically, current accounts and savings accounts (CASA) and Super Account increased 51 per cent compared to the beginning of the year, reflecting the effectiveness of VIB’s funding strategy to optimise idle cash flow.

Launched in early 2025, the Super Account has attracted over 500,000 customers, broadening VIB’s base of high-value clients for banking products and services. Aligned with its vision to become a smart financial partner, VIB is fast-tracking digital transformation and offering flexible, tech-driven solutions to boost service efficiency and support sustainable deposit growth.

Asset quality improved further in the first half of 2025, with VIB’s non-performing loan ratio falling to 2.54 per cent – a 0.14 percentage point drop from the previous quarter. This reflects the bank’s disciplined credit strategy and focus on high-quality borrowers. VIB’s loan portfolio remains well-secured, with over 75 per cent of lending concentrated in the retail and SME segments. More than 90 per cent of retail loans are backed by fully legal real estate assets, primarily in major urban centres.

Category 2, or 'at-risk', loans continued to decline, reflecting VIB’s proactive approach in spotting and managing early credit risks. The adoption of Resolution 42 is expected to further support the bank’s efforts in resolving bad debts and reinforcing its financial stability amid market headwinds.

In the second quarter of 2025, VIB also paid out a 7 per cent cash dividend, as approved at its AGM. The bank maintained strong risk management across key indicators: its capital adequacy ratio under Basel II was 12 per cent, well above the 8 per cent minimum; the loan-to-deposit ratio was 77 per cent, below the 85 per cent ceiling; medium- and long-term loans funded by short-term deposits stood at 23 per cent, under the 30 per cent limit; and the Net Stable Funding Ratio under Basel III reached 111 per cent, surpassing the 100 per cent threshold.

By the end of the first half of 2025, VIB reported total operating income (TOI) of over VND9.7 trillion ($370 million) and pre-tax profit exceeding VND5 trillion ($191 million), up 9 per cent on-year. Net interest income contributed more than VND7.7 trillion ($294 million), reflecting the bank’s continued focus on retail lending with competitive rates and well-collateralised customers.

Aligned with government efforts to support economic recovery, VIB kept lending rates at reasonable levels. The net interest margin remained stable at 3.4 per cent, reinforcing the bank’s sustainable profitability.

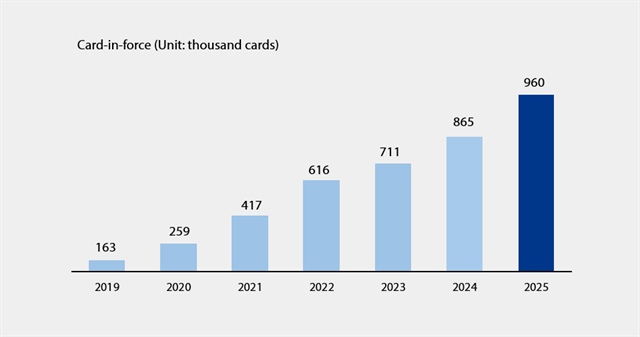

Non-interest income remained a strong driver of growth, accounting for around 21 per cent of TOI in the first half of 2025. This was largely fuelled by fee and service-based activities. As of June 30, VIB had nearly one million active cards, with total spending coming close to VND68 trillion ($2.6 billion), up 15 per cent on-year.

Newly introduced digital banking services – including bill payments, international transfers, and tuition and insurance payments – along with customised packages for corporate clients, also added significantly to the bank’s service income.

|

Operating expenses fell 1 per cent on-year in the first six months of the year, reflecting VIB’s continued focus on process optimisation and cost efficiency. At the same time, credit risk provisions declined by 49 per cent, supported by a strong buffer built up in prior quarters through prudent risk management.

As part of its ongoing focus on digital innovation and personalised financial services, VIB recently introduced two new products: Super Pay, a smart payment solution, and Super Cash, a flexible lending tool. These offerings form part of the bank’s broader strategy to enhance its digital ecosystem and improve user convenience and financial management.

|

VIB’s new digital offerings aim to improve customer convenience and control over personal finance. Super Pay introduces three core features within the MyVIB app: PayFlex, which allows users to choose payment sources; PayEase, enabling instant instalment conversions; and PaySafe, providing enhanced transaction security. Super Cash, available via the Max by VIB app, gives customers flexible access to credit – up to VND1 billion ($38,176) – with the ability to shift limits between credit cards and cash loans. The process is fully digital, with transparent interest rates and no early repayment penalties.

With a growing suite of digital products – including Super Pay, Super Cash, Super Account, and Super Card – VIB is steadily advancing its goal of building a comprehensive digital financial ecosystem, offering customers greater flexibility and control over their finances.

The bank’s first-half performance reflects the effectiveness of its strategy focused on operational efficiency, prudent risk management, and digital innovation. Backed by a strong financial base, a well-secured credit portfolio, and an expanding digital platform, VIB is well-positioned to sustain its growth momentum in the second half of the year while delivering long-term value to customers, shareholders, and the broader economy.

- 18:40 28/07/2025