Rising selling force weighs on VN-Index in last minutes

Rising selling force weighs on VN-Index in last minutes

Liquidity on the southern bourse soared, highlighting a significant sell-off, while foreign investors continued to make substantial purchases.

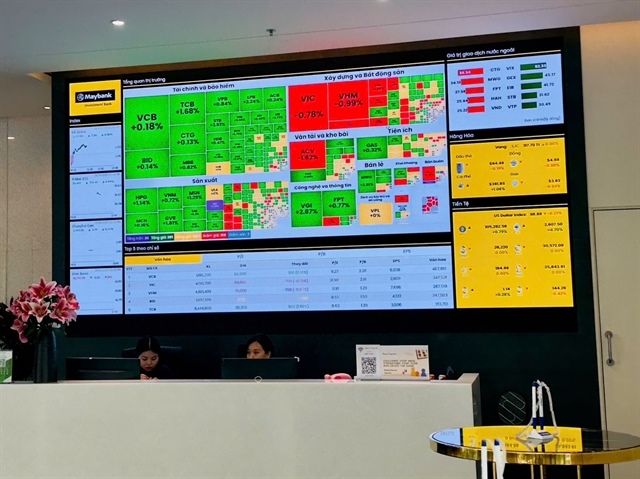

A digital screen showing stock movements at a securities firm. — Photo baotintuc.vn |

Benchmark indices fell slightly on Thursday, as investors unexpectedly flooded the market with sell orders in the afternoon session.

Liquidity on the southern bourse soared, highlighting a significant sell-off, while foreign investors continued to make substantial purchases.

On the Ho Chi Minh Stock Exchange (HoSE), the VN-Index decreased 2.63 points, or 0.19 per cent, to 1,381.96 points. This snapped the index's four-day streak of rallying.

The morning enthusiasm dissipated rapidly, as buying interest remained robust but was overshadowed by even stronger selling pressure. The VN-Index's correction this afternoon was driven not only by declining blue-chip stocks but also by a weakening overall market breadth.

The southern market's breadth was negative, with 168 ticker symbols declining while 146 ticked up. However, liquidity surged by 47.3 per cent from the previous session to more than VNĐ33 trillion (US$1.26 billion).

The VN30-Index, which tracks the 30 biggest stocks on HoSE, also went down. It closed the day at 1,481.2 points, down 1.56 points, or 0.11 per cent. Sixteen stocks in the VN30 basket decreased, while 14 inched higher.

The benchmark VN-Index hit a session high at 1,392.39 points earlier on news regarding the trade deal between Việt Nam and the US.

On Wednesday, US President Donald Trump said the United States has reached a trade agreement with Việt Nam (without details yet), pulling off the administration’s third significant deal ahead of a self-imposed July 9 deadline.

According to Maybank Securities (MBKE), this development is a positive indicator that could stabilise the financial market and set the stage for foreign capital to re-enter Việt Nam in the latter half of 2025.

The securities firm continues to recommend focusing on dividend-paying stocks and sectors bolstered by investment frameworks and stimulus packages, including information technology, logistics, aviation, real estate, consumer goods and steel.

Phạm Lưu Hưng, chief economist and director of SSI Research, described this as a very positive signal, particularly as Việt Nam emerges as the third-largest partner of the US and may reach a preliminary agreement on tariffs, an important step toward enhancing its international trade standing.

"If the new tariffs are accompanied by favourable origin rules, this could create a stable foundation rather than just a temporary solution," Hưng said.

On the Hanoi Stock Exchange (HNX), the HNX-Index fell 0.69 points, or 0.3 per cent, to end Thursday at 230.93 points.

Foreign investors continued to net buy a significant amount of domestic stocks on the main exchanges. They net bought nearly VNĐ2.3 trillion on HoSE and VNĐ141.47 billion on HNX.

- 16:44 03/07/2025