Securities firms hike fees amid new VAT rules

Securities firms hike fees amid new VAT rules

From July 1, several previously VAT-exempt brokerage services are subject to a 10 per cent VAT rate, prompting firms to revise their service charges accordingly.

Investors track the market's movements on a trading floor of MB Securities. — VNA/VNS Photo |

Securities companies have begun rolling out fee adjustments across various client services following the implementation of an updated Value-Added Tax (VAT) law.

From July 1, several previously VAT-exempt brokerage services are subject to a 10 per cent VAT rate, prompting firms to revise their service charges accordingly.

VAT Law 48/2024/QH15, passed by the National Assembly in November 2024, mandates that activities such as securities depository, custody, withdrawals, transfers, derivatives clearing, and margin account services now fall under taxable services.

To comply, many securities companies, including Saigon-Hanoi Securities JSC (SHS), Viet Dragon Securities Corporation (VDSC), Vietcombank Securities (VCBS), VNDirect Securities Corporation and others, have adjusted fee schedules for depository, custody, account transfers, position blocking, derivatives clearing and margin asset management.

SHS increased its custody fee for stocks, fund certificates, and covered warrants from VNĐ0.27 to VNĐ0.297 per unit per month. The depository fee for corporate bonds rose from VNĐ0.18 to VNĐ0.198 per unit, with monthly maximums climbing from VNĐ2 million (US$76.44) to VNĐ2.2 million.

Withdrawal fees on custody now stand at 0.22 per cent of total value (up from 0.2 per cent), with minimum charges rising from VNĐ50,000 to VNĐ55,000 while the maximum from VNĐ1 million to VNĐ1.1 million per transaction.

VCBS and VDSC have both confirmed that from July 1, they will collect an additional 10 per cent VAT on custodial services, margin asset management, derivatives clearing, position blocking, and securities transfers.

Authorities assert that the reform addresses systemic inequities in tax collection, ensuring that individual shareholders—especially those with significant holdings or executive perks - pay timely taxes. During 2016-2024, personal income from capital investment amounted to nearly VNĐ52 trillion, but taxes on dividends and share-based rewards represented only VNĐ1.3 trillion, or just 2.5 per cent of total taxable receipts, highlighting considerable gaps in collection.

Comparisons were drawn to international standards in countries like Thailand and India, which levy a 10 per cent tax upon dividend or bonus distribution.

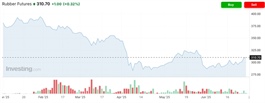

Market reaction has been mixed.

Some investors express frustration over rising transaction costs. This is particularly concerning for long-term investors and strategic shareholders who receive stock bonuses, since the immediate tax obligation upon receipt could disrupt financial planning and investment cash flow.

Meanwhile, regulatory authorities argue the updates, covering both VAT adjustments and revised personal income tax timing, will promote fairness and discipline in tax administration.

- 08:02 03/07/2025