Coteccons (CTD) leads Vietnam’s construction sector on Fortune Southeast Asia 500

Coteccons (CTD) leads Vietnam’s construction sector on Fortune Southeast Asia 500

Coteccons has once again been named among the Fortune Southeast Asia 500, the prestigious annual ranking compiled by global business magazine Fortune that highlights the 500 largest companies in the region.

This marks the second consecutive year Coteccons has made the list, reaffirming its leading position in Vietnam’s construction sector with 2024 revenue reaching VND21.04 trillion ($805.3 million), post-tax profit of VND310 billion ($11.9 million), and a project backlog of VND37 trillion ($1.4 billion) as of Q3/2025.

As Southeast Asia’s construction industry increasingly demands higher standards in safety management, sustainability, and execution capabilities of large-scale projects, Coteccons has continued to assert its pioneering role through a people-centric development strategy, a safety-first mindset, and a clear ambition to become an industry leader.

Launched in 2024, the Fortune Southeast Asia 500 ranking is published annually and based on companies' fiscal-year revenue.

Fortune’s Southeast Asia 500 ranks the largest companies across Indonesia, Thailand, Malaysia, Singapore, Vietnam, the Philippines, and Cambodia. According to Fortune, these 500 companies represent a dynamic region that contributes approximately 7.2 per cent to global GDP.

The 2025 list, released on June 17, shows the combined revenue of the 500 companies at $1.82 trillion – up 1.7 per cent from last year. The minimum revenue required to make the list dropped by 14 per cent to $349.4 million. The top 10 companies accounted for $660 billion (36 per cent of the total), while the top 20 represented nearly half the list's total revenue at $836 billion.

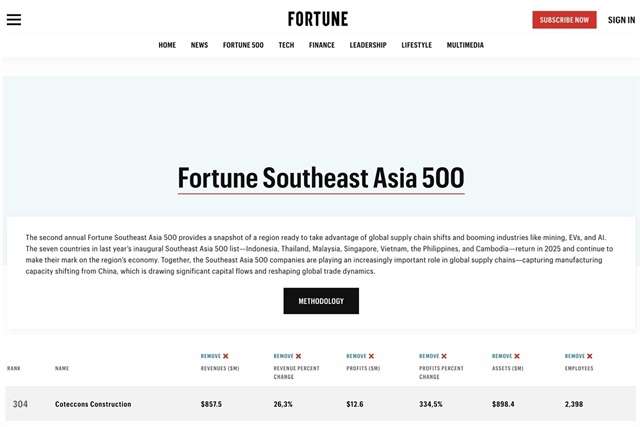

Vietnam is represented by 76 companies this year, with Coteccons ranked as the highest among construction firms. In 2024, Coteccons reported $857.5 million in revenue and nearly $12.5 million in net profit, supported by a workforce of around 2,500 employees.

Coteccons rose 72 places on this year’s list, moving from 376 in 2024 to 304 in 2025 |

This remarkable leap reflects the company’s transformation following a major restructuring four years ago and showcases its resilience in navigating a challenging market.

Coteccons posted a 30.8 per cent on-year revenue increase in 2024, achieving 105 per cent of its annual target. In the first nine months of 2025, consolidated revenue reached VND16.65 trillion ($637.2 million), up 15.2 per cent on-year. Gross profit stood at VND559 billion ($21.4 million) and net profit hit VND255 billion ($9.8 million), up 14 per cent and 5.8 per cent, respectively.

New contracts signed in the first nine months totalled VND23 trillion ($880.3 million), securing a strong pipeline for future quarters. Coteccons’ stock (CTD) has recently been included in the VNDiamond Index on the Ho Chi Minh Stock Exchange (HSX).

These achievements were largely driven by a string of major contract wins, including Cat Ba Central Bay Resort & Commercial Complex, Hon Thom Marine Tourism & Entertainment Complex (Western Village), and The Global City and Masteri Lakeside. This is coupled with key infrastructure and public investment projects such as Vietnam National University-HCMC Development Project, and package 3 of Long Thanh International Airport Phase 1 (airport parking facility).

As of Q3/2025, Coteccons’ total assets stood at VND26.18 trillion ($1 billion). Its 2024 price-to-earnings ratio reached 19.58, among the highest in the sector, despite significant headwinds affecting the construction industry.

Sustainability is core

Construction is a resource-intensive industry, responsible for approximately 40 per cent of global energy consumption and over 30 per cent of greenhouse gas emissions, while employing a massive labour force. As such, construction companies have a profound responsibility to integrate sustainability into every stage of their operations.

Bolat Duisenov, chairman of Coteccons, emphasised, "Sustainability is not just a priority, it is the lifeblood and future of Coteccons. Being named in the Fortune Southeast Asia 500 for two consecutive years is the outcome of a steadfast journey doing good things led by one team with one vision across the Coteccons ecosystem. But no companies can elevate an industry alone. Our ambition is to be a catalyst, connecting and amplifying efforts with partners, subcontractors, engineers, and workers to build a more ethical, efficient, and sustainable construction ecosystem.”

Coteccons is among the few companies in Vietnam that successfully apply the fast-track construction model (simultaneous design and execution), optimising costs and shortening timelines while ensuring exceptional quality. It also strictly adheres to the 3R principles – Reduce, Reuse, Recycle – to minimise environmental impact and seeks suppliers and partners that provide green materials and energy solutions.

|

Commenting on this year’s list, Clay Chandler, Fortune’s Asia executive editor, said, "Fortune’s interest in the region reflects Southeast Asia’s growing importance as an engine of global growth. The region has become a crucial manufacturing and export hub, which is drawing significant capital flows. This momentum has been further fuelled by Trump-era tariffs, which have reshaped global trade dynamics and driven a shift towards Southeast Asia.”

LEGO Vietnam's factory in Binh Duong is being constructed by Coteccons to meet LEED Platinum standards |

This shift has led to a surge in foreign-invested projects in the region. Coteccons, a key contractor and a champion of transparent and sustainable practices, having executed major projects for clients such as Pandora and LEGO, is well positioned to be a trusted contractor in Vietnam for global investors.

- 11:32 19/06/2025