MoF helps Samsung to accelerate administrative procedures and investment expansion

MoF helps Samsung to accelerate administrative procedures and investment expansion

Minister of Finance Nguyen Van Thang received Na Ki Hong, the new CEO of Samsung Electronic Vietnam, on May 20 to discuss issues related to Samsung's investment and business in Vietnam.

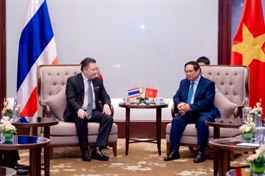

Minister of Finance Nguyen Van Thang and Na Ki Hong, CEO of Samsung Electronic Vietnam |

Minister Thang congratulated Na Ki Hong on his promotion, and said he hoped that Samsung would continue its long-term investment and expansion plans in Vietnam.

South Korea is the largest contributor of foreign investment in Vietnam and second among partners providing official development aid. Samsung Group is the largest foreign direct investor in Vietnam with a remarkable contribution to socioeconomic development, creating more than 90,000 jobs.

"To achieve the target of high growth, Vietnam really needs the contribution of corporations by expanding production, contributing to GDP growth. We hope Samsung will develop, expand investment, build more research and development centres, raise the localisation rate, focus on high-tech industries and semiconductors, and support Vietnam to enter a new era of development," Thang emphasised.

|

Hong said that export turnover in 2024 reached $54.4 billion, equivalent to 14 per cent of Vietnam's total export turnover, with a total investment in Vietnam of $23.2 billion to date.

"With the support of the Ministry of Finance (MoF) and Bac Ninh's provincial government, a display factory to produce OLED equipment segment for televisions and cars worth $1.8 billion has been approved," he said.

Additionally, the CEO shared Samsung's plans for 2025, and asked for support related to three-year additional corporate income tax incentives for factories in Bac Ninh, Thai Nguyen, and Ho Chi Minh City. He also mentioned the issue of a VAT refund for Samsung Electronics Ho Chi Minh City.

|

Thang said that the MoF had reported the matter to all provinces and cities, and the National Assembly for consideration.

Regarding support policies for businesses, the minister said that tax policies and incentives do not discriminate between domestic and foreign investors. The Vietnamese government creates favourable conditions for foreign-invested enterprises to operate within legal regulations.

Every year, the MoF and the South Korean embassy organise a conference for South Korean enterprises on tax, customs policies, and administrative procedures.

"The conference last year received and handled problems and recommendations from South Korean enterprises related to customs and taxes, promptly removing difficulties for them," Minister Thang said.

"The MoF is ready to discuss and handle difficulties, creating stronger conditions for enterprises investing and doing business in Vietnam," the minister added.

- 11:41 21/05/2025