Government approves two-year trial of P2P lending

Government approves two-year trial of P2P lending

Under the pilot, only P2P lending companies licensed by the State Bank of Vietnam (SBV) will be allowed to operate. Foreign banks are excluded from participation.

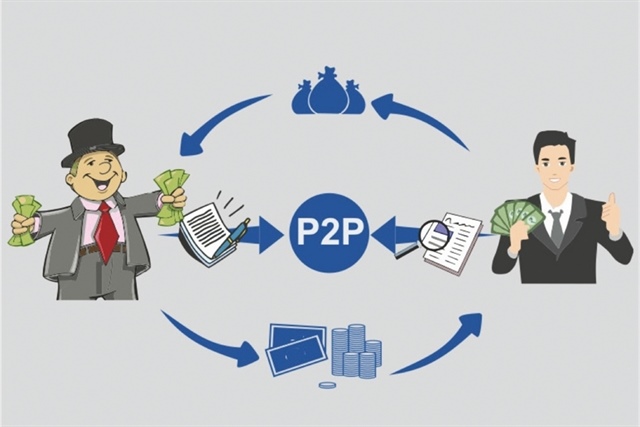

The P2P lending activity that has emerged in Việt Nam in recent years. Photo thoibaonganhang.vn |

Việt Nam will begin a two-year trial of peer-to-peer (P2P) lending, credit scoring, and data sharing through open application programming interfaces from July 1, following the Government’s Decree 94 issued on April 29.

The decree establishes a controlled testing mechanism (sandbox) for fintech activities in the banking industry. Among the approved solutions is P2P lending - a model that connects borrowers and lenders directly via online platforms, bypassing traditional financial institutions.

Under the pilot, only P2P lending companies licensed by the State Bank of Vietnam (SBV) will be allowed to operate. Foreign banks are excluded from participation. While credit institutions and fintech firms may join the trial, participation does not guarantee future compliance with business or investment regulations once formal laws are enacted.

Việt Nam currently hosts around 100 P2P lending companies, many with foreign investment. However, the SBV has raised concerns about transparency and oversight in existing agreements, citing a lack of loan management mechanisms and a heightened risk of disputes.

Besides lending, Việt Nam's fintech landscape includes approximately 200 companies, 90 per cent of which serve the banking sector with services like digital payments, credit scoring, and financial applications. Decree 94 also authorises controlled testing of these technologies, particularly credit scoring systems and data sharing through open application programming interfaces.

The Government says the initiative is intended to foster innovation, enhance transparency, and improve access to low-cost, efficient financial services for individuals and businesses. It also aims to balance innovation with risk management, ensuring consumer protection in emerging fintech markets.

Though the P2P lending activity that has emerged in Việt Nam in recent years, the banking watchdog has warned some firms use the name of P2P lending model to deceive people who lack information, advertise falsely such as high profits, high interest rates to cheat, appropriate people’s money to invest in this model or deceive borrowers about low interest rates, easy lending conditions while applying “exorbitantly high” actual interest rate.

- 11:30 02/05/2025