VIB reports over $92 million in Q1 profit

VIB reports over $92 million in Q1 profit

Vietnam International Bank (VIB) posted a pre-tax profit of over VND2.4 trillion ($92.3 million) in the first quarter of 2025, representing a 7 per cent increase on-year.

According to VIB's business results for the first quarter of 2025 released on April 29, both credit and deposit activities recorded solid growth, with current account savings account balances rising by 17 per cent year-to-date, supporting the bank's strategy to enhance net interest margins (NIM) and optimising funding costs. These efforts have contributed to building a robust balance sheet and maintaining high operational efficiency.

|

As the first bank to hold its 2025 AGM, VIB is also the first to implement a 21 per cent dividend distribution plan, with a 7 per cent cash dividend scheduled for payout in May.

As of March 31, VIB's total assets stood at VND496 trillion ($19 billion). Customer lending totalled VND335 trillion ($12.8 billion), growing over 3 per cent year-to-date. Credit growth was well-balanced across all customer segments, including retail, small- and medium-sized enterprises, corporates, and financial institutions, with the retail loan portfolio maintaining an industry-leading proportion of nearly 80 per cent of VIB's customer lending.

Following a dynamic yet prudent credit growth of 22 per cent in 2024, VIB has continued to lead in retail lending solutions, notably introducing a VND45 trillion ($1.73 billion) home loan package for apartment and townhouse buyers. This package features uniquely low fixed interest rates of 5.9 per cent, 6.9 per cent, or7.9 per cent for 6-month, 12-month, and 24-month terms, respectively, along with an innovative feature customers allowing to borrow VND1 billion ($38,454) and pay only VND1 million ($38.45) in principal monthly. Thanks to these innovative and transparent solutions, VIB was recognised as the “Best bank for home loans in 2025” by Global Brands Magazine in April.

|

Customer deposits surpassed VND282 trillion ($10.8 billion), increasing 2 per cent year-to-date, with retail deposits accounting for over 70 per cent of the total. In Q1, VIB launched the innovative “Super Account”, attracting nearly 200,000 activated accounts within just two months. This product provides superior, innovative benefits to millions of customers and earned VIB the awards of “Best banking account for customer benefits 2025” by Global Brands Magazine and “Best new customer-centric account solution 2025” by Global Business Outlook.

|

At the end of Q1, VIB's non-performing loan ratio stood at 2.68 per cent. Other risk management indicators were maintained at safe and optimised levels: capital adequacy ratio under Basel II was 11.8 per cent (regulatory minimum 8 per cent), loan-to-deposit ratio was 75 per cent (regulatory cap 85 per cent), the ratio of short-term funding for medium and long-term loans was 23 per cent (regulatory cap 30 per cent), and the net stable funding ratio under Basel III stood at 115 per cent (regulatory minimum 100 per cent).

In the first three months of 2025, VIB recorded a total operating income exceeding VND4.6 trillion ($176.8 million), with pre-tax profit over VND2.4 trillion ($92.3 million), in line with the profit target approved at the 2025 AGM. While proactively reducing lending rates to support economic recovery and focusing on high-quality customer segments, VIB has maintained an optimised NIM of 3.6 per cent and achieved interest income of more than VND3.7 trillion ($142.3 million).

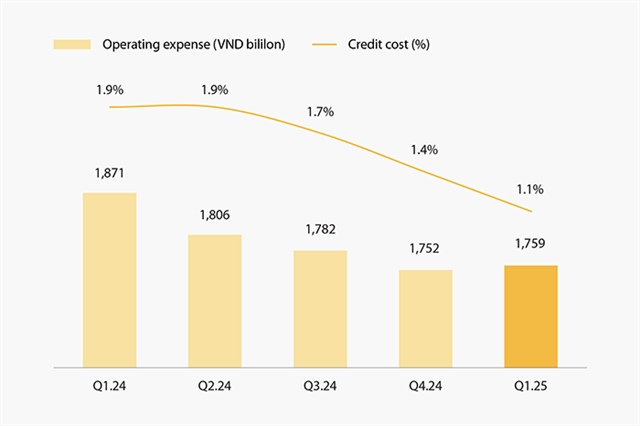

Fee income and debt recovery activities also contributed positively to total revenue. The number of active credit cards surpasses 900,000, with card spending reaching nearly VND33 trillion ($1.27 billion) in Q1, up 17 per cent on-year. Income from write-off recovery contributed to more than VND342 billion ($13.2 million), an increase of 64 per cent on-year. Through enhanced operational efficiency, operating strategies decreased by 6 per cent on-year, while provision expenses dropped by 55 per cent thanks to prudent provisioning in previous periods.

Operating expense of VIB and credit cost from Q1 2024 to Q1 2025 |

At the AGM held on March 27, VIB shareholders approved a 21 per cent dividend plan, including a 7 per cent cash dividend and a 14 per cent stock dividend. VIB plans to pay nearly VND 2.1 trillion ($80.8 million) in cash dividends. Upon completing the stock dividend distribution and a 0.26 per cent employee stock ownership plan issuance, VIB's charter capital is expected to exceed VND34 trillion ($1.3 billion).

With a strong return on equity consistently maintained at a high level over the years, VIB has accumulated retained earnings to strengthen its capital base, supporting the bank's growth plans while ensuring a sustainable, attractive return for shareholders. Altogether, VIB will have distributed over VND8.5 trillion ($326.8 million) in dividends for the 2023-2025 period, placing it among the top private commercial banks in Vietnam in terms of dividend payout ratio.

At the end of Q1, VIB's capital adequacy ratio under Basel II remained high at approximately 11.8 per cent, and the bank aims to maintain an optimal level of 11-12 per cent throughout 2025, well above the minimum regulation.

A VIB representative stated that the bank's leadership closely monitors both domestic and international macroeconomic developments to dynamically adapt its business strategies and best serve its retail, SME, corporate, and financial institution clients. The bank is on track to deliver all 2025 AGM resolutions, including dividend payouts, charter capital increase, 22 per cent credit growth, and achieving a pre-tax profit target of VND11.02 trillion ($423.8 million), up 22 per cent compared to 2024.

- 17:03 30/04/2025