Gold’s surge: safe-haven demand intensifies, but could face corrections

Gold’s surge: safe-haven demand intensifies, but could face corrections

Gold prices have reached historic highs this year, fuelled by escalating trade tensions and mounting fears of inflation. However, recent signs of progress in global trade negotiations could temper investor demand for the metal, raising the prospect of a near-term correction.

Gold has once again captured global attention as prices surged to unprecedented levels in early 2025, briefly touching nearly $3,500 per ounce before stabilising around $3,200-3,400 per ounce. This impressive 30 per cent gain since the start of the year has outperformed most equity indices and other asset classes, reinforcing gold’s status as a preferred safe haven amid a wave of economic and geopolitical turbulence.

Trinh Ha, financial market analyst Exness Investment Bank |

The sharp rally has been driven by multiple factors, particularly the escalating trade tensions involving the new US administration. The United States attempted to impose steep tariffs on China and key allies, which heightened fears of recession and deflation, pushing investors towards safe-haven assets, with gold leading the way. However, recent developments have offered a glimmer of relief. The US and UK reached an initial agreement to ease tariffs on certain sectors, while informal talks between the US and China have resumed, raising hopes for broader negotiations later this year. Still, markets remain cautious, as any meaningful resolution is likely to take time.

Beyond political friction, concerns over the health of the US economy have mounted. Despite the labour market holding steady with unemployment at around 4-4.2 per cent, investor sentiment has been rattled. The University of Michigan’s Consumer Sentiment Index in April dropped to its second-lowest reading on record, while one-year inflation expectations spiked to 6.7 per cent, the highest level in over four decades.

Longer-term inflation forecasts, covering 5-10 years, also surged to 4.4 per cent, a peak not seen since the 1990s. These trends underscore the fragile balance facing the US economy, where persistent inflation risks collide with declining consumer confidence.

These uncertainties have not only ignited speculative demand for gold but have also driven substantial physical demand from central banks and investors alike. According to the World Gold Council, central banks have been among the most active buyers since mid-2022, with countries such as China, India, Poland, and Kazakhstan aggressively boosting their gold reserves.

This reflects a strategic shift away from US dollar-denominated assets amid geopolitical risks and heightened scrutiny of US Treasury holdings. China’s holdings of US Treasury bonds, for example, have fallen from nearly $1.3 trillion in 2015 to approximately $760 billion at the beginning of 2025. At the same time, China has been reducing its exposure to US mortgage-backed securities, redirecting capital into gold and other currencies.

Poland, meanwhile, has emerged as the most aggressive gold buyer, adding 49 tonnes in the first four months of 2025 alone, following an 89-tonne purchase in 2024. This move aims to diversify its reserves amid ongoing geopolitical tensions and stubbornly high domestic inflation, which remains above 4 per cent.

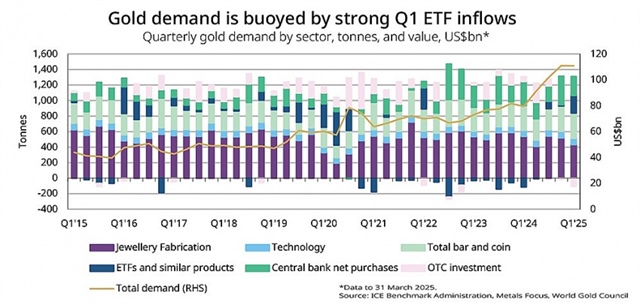

Investment demand has also surged, particularly through gold-backed exchange-traded funds (ETFs). In the first quarter of 2025, ETF inflows accounted for nearly half of 2024’s total demand, reversing the outflows seen last year. Initially, these inflows were driven by North American investors reacting to the escalating US trade war with allies.

|

However, more recently, Asian investors, especially from China and India, have emerged as significant contributors. April marked a record monthly inflow into gold ETFs, as the imposition of retaliatory tariffs by the US pushed investors towards the perceived safety of gold. Additionally, retail demand for physical gold, particularly in Asia, continues to be supported by cultural preferences and growing economic uncertainty.

Looking ahead, there are signs that the trade stand-off may ease, at least in part. The United Kingdom recently secured a partial agreement with the US to reduce tariffs on automotive and metal products. Although this has dampened investor enthusiasm for gold in the short term, it represents a positive signal that broader trade agreements could follow. Should more such agreements emerge, gold prices may face downward pressure as investor sentiment improves and capital shifts towards higher-yielding assets.

Nevertheless, progress on trade negotiations is likely to be slow, leaving tariffs at elevated levels for the foreseeable future. These costs are already weighing on consumer spending by raising final goods prices, adding to inflationary pressures through the second and third quarters of 2025. Combined with declining consumer confidence and a challenging labour market, these factors could undermine corporate earnings, potentially forcing companies to cut jobs to preserve profitability. If this scenario unfolds, fears of stagflation or even a deeper economic downturn could intensify, once again driving investors towards gold.

Under this baseline scenario, gold is expected to trade within the $3,200-3,500 range. However, if trade talks, especially with China, fail to yield meaningful progress, gold prices could accelerate towards $3,700-3,900 per ounce later this year, fuelled by renewed deflationary fears and heightened geopolitical uncertainty.

- 10:20 19/05/2025