Foreign brands keep up their convenience store dominance

Foreign brands keep up their convenience store dominance

With rapid growth and continuous expansion, Vietnam’s convenience store market has become a competitive hotspot with the domination of foreign players.

Nearly five years after entering Vietnam with its first stores in Ho Chi Minh City, GS25, a South Korean convenience store (CVS) chain, expanded to the northern region by launching six new stores in Hanoi in mid-March.

Foreign brands keep up their convenience store dominance |

According to GS25 representatives, these stores feature diverse designs while maintaining local elements. In addition to the South Korean products favoured by young consumers, the chain is also expanding its selection of local Vietnamese goods to better cater to domestic preferences.

“With our diverse store models and designs, GS25 aims to provide a convenient shopping experience while offering a wider variety of choices tailored to the needs of Hanoi’s consumers,” a GS25 representative shared.

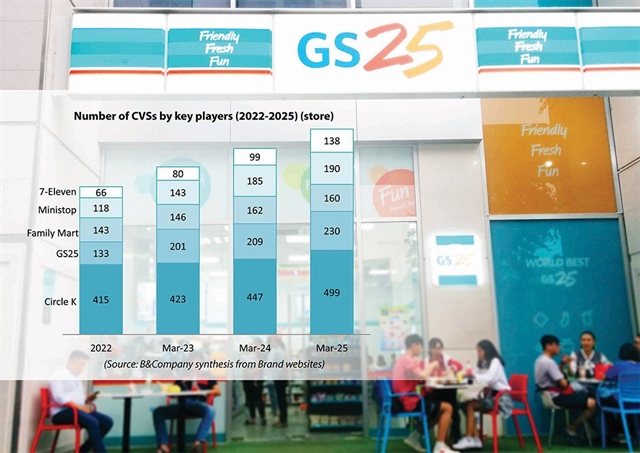

GS25 is currently the second-largest CVS chain in Vietnam, operating over 200 stores across Ho Chi Minh City and Hanoi. The company plans to further expand its network to approximately 700 stores by 2027.

Meanwhile, 7-Eleven confirmed in February that it will soon open its first store in Hanoi. At present, 7-Eleven ranks fourth in terms of scale in Vietnam, operating over 120 stores exclusively in Ho Chi Minh City.

Its entry into the capital is expected to intensify competition, particularly in the 24/7 CVS segment, where Circle K currently holds a near-monopoly. As the first international CVS chain to enter Vietnam, Circle K also boasts the most extensive network, with more than 460 stores nationwide.

With Vietnam’s retail sector rapidly evolving, the aggressive expansion of foreign chains reflects modern consumption trends. However, this growth also poses increasing challenges for local businesses trying to maintain their foothold in the market.

Former chairwoman of the Vietnam Retailers Association, Vu Thi Hau, told VIR, “Investors wishing to expand convenient stores in Vietnam struggle thanks to the considerable time it takes to secure a space and navigate a range of permits. By contrast, obtaining licences and finding sites for stores under 500 square metres is much easier, with lower investment costs.”

Besides that, the success of these foreign convenient stores comes from determining the targeted customers. “For example, GS25 targets young people, office workers, and those seeking quick and convenient options, while Circle K stores have transformed into favoured social spaces on a 24/7 basis,” Hau added.

Vietnam has many conditions to develop convenient shopping channels, with the urbanisation rate currently up to 30 per cent, and the young population accounting for 57 per cent. In particular, the Vietnamese middle class by 2030 will nearly triple compared to today, creating the main driving force for the development of the CVS model.

Dr. Nguyen Duc Tri, an economist from the University of Economics in Ho Chi Minh City, said, “The rapid growth of CVS is inevitable as consumer trends shift towards modern retail formats that offer speed and variety. Despite the potential, players must invest more in technology, customer service, and pricing strategies to retain customers. Several convenient stores used to set the footprint in the market, but they attained unexpected results.”

Several notable names have come and gone in the CVS space, or failed to achieve exponential growth. Family Mart, a Japanese chain, entered Vietnam in 2009 through a joint venture with Phu Thai Group. However, after continuous losses and failed restructuring efforts, the joint venture collapsed in 2013, leading to acquisition by Thailand’s B’s Mart.

Another major failure was Shop&Go, which at one point operated 87 stores across Vietnam. Despite once being the largest CVS chain in the country, it suffered massive financial losses. In 2019, Shop&Go was sold to VinCommerce for just $1.

7-Eleven had initial ambitions of opening 1,000 stores within 10 years, but its expansion has been slower than expected, with nearly 100 stores in Vietnam so far. Another formidable competitor, Ministop, a Japanese chain owned by AEON, has operated in Vietnam since 2015. However, it has yet to establish a presence in northern Vietnam, focusing its 190 stores in Ho Chi Minh City, Binh Duong, and Long An.

According to the Ministry of Industry and Trade’s forecast, the size of Vietnam’s retail market may reach $350 billion by the end of this year, contributing to 59 per cent of the national budget.

- 08:56 11/04/2025