Prime Minister urges banks to prioritize economic support over profits

Prime Minister urges banks to prioritize economic support over profits

One of the key priorities for the banking sector is to support small and medium-sized enterprises (SMEs), as they generate a large number of jobs and contribute significantly to the economy.

Banks need to sacrifice part of their profits to lower lending interest rates and help the economy grow above 8% growth this year, said Prime Minister Pham Minh Chinh during a conference with commercial banks on February 11. The conference came as the Government targets GDP growth of over 8% this year, laying the groundwork for double-digit growth in the coming years.

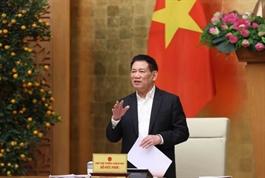

Prime Minister Pham Minh Chinh at the event. Source: VGP |

The Prime Minister said that the banking sector plays a crucial role in maintaining macroeconomic stability, controlling inflation, and promoting growth. He also noted that banks have shared the burden with citizens and businesses by reducing profits to lower lending interest rates.

By the end of last year, lending interest rates had fallen by 1.24 percentage points compared to the end of 2023. The liquidity in the banking system remained ample, meeting the economy’s capital needs, helping to control inflation, and stabilizing the exchange rate. Non-performing loans were kept below 3%, within the target range.

However, Chinh called for banks to further cut costs and sacrifice part of their profits to lower lending interest rates and support the economy.

"Banks must be profitable, but beyond profits, they must contribute to the country's overall benefit," Chinh said.

For 2025, the Government aims to maintain macroeconomic stability, control inflation, and achieve GDP growth of at least 8% or higher. The consumer price index (CPI) is targeted at 4-4.5%.

Achieving this growth requires massive capital inflows from the state budget, businesses, and individuals, he added.

With capital markets like stocks and bonds facing challenges, bank credit will be a critical financing channel for the economy. Typically, to achieve 1% GDP growth, credit growth needs to increase by 2 percentage points. This means that credit will have to grow by approximately 16% this year to achieve the economic growth target.

Public investment is one of the key drivers of economic growth. However, according to Minister of Transport Tran Hong Minh, the capital required for infrastructure projects is enormous.

Beyond the state budget, Minh called for support from the banking sector, as the total investment needed for five types of transportation infrastructure is estimated at US$261 billion by 2035.

Focus on driving credit growth

Regarding infrastructure financing, the Chairman of TPBank Do Minh Phu, said that the bank has financed several BOT projects, including the Cam Lam - Vinh Hao and Huu Nghi - Chi Lang expressways, contributing to the goal of completing 3,000 km of highways this year.

Last year, TPBank's credit growth reached 20.25%. The bank lowered interest rates for about 92,000 customers, with a total reduction of $79 million on a loan portfolio of $7.63 billion.

SBV Governor Nguyen Thi Hong speaks at the conference. |

To ensure growth this year, Phu suggested that regulators gradually reduce and eventually eliminate the system of credit growth quotas (room system) for individual banks. This proposal was echoed by Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu in a report to the Government earlier in the day.

In response, Prime Minister Chinh instructed the Government Office and the SBV to address the recommendations. He also called for solutions to clear long-pending projects of private companies and support small and medium-sized enterprises (SMEs).

The Prime Minister reminded banks to operate within the law, combat corruption, and prevent misconduct. He pointed out that recent violations in the bond market partly stemmed from bank mismanagement, and urged the sector to review and reinforce ethical business practices.

"We must eliminate bad actors from the banking system. Banks cannot force customers into hardship or exploit them for profit," Chinh said, adding that bank regulators must strengthen supervision and enforcement.

SBV Governor Nguyen Thi Hong reiterated that the banking sector would focus on promoting credit growth, controlling inflation, and supporting the economy to achieve GDP growth of 8% or higher. Accordingly, monetary policy will be flexible, leveraging growth drivers while managing non-performing loans and boosting digital transformation.

Delegates at the event. |

Hong said that credit growth will be adjusted dynamically based on actual economic conditions. If inflation remains low, the SBV may increase credit issuance to stimulate growth. Conversely, if risks emerge, credit policy will be tightened to ensure macroeconomic stability, she noted.

“One of the key priorities is to support small and medium-sized enterprises (SMEs), as they generate a large number of jobs and contribute significantly to the economy. Additionally, the SBV will expand consumer credit, as increased consumption drives production,” said Hong.

The Prime Minister assigned Deputy Prime Minister Ho Duc Phoc to oversee and instruct the SBV to draft legislation incorporating Resolution 42 on bad debt resolution and submit it to the National Assembly in May. The Government will also revise regulations on increasing the capital base of state-owned commercial banks to make them more competitive with private banks.