The ideal time for a new financial hub

The ideal time for a new financial hub

The establishment of an international financial centre in Ho Chi Minh City is a vital step amid Vietnam’s rapidly evolving economy. Truong Bui, managing director for Roland Berger in Vietnam, analyses the city’s role as the nation’s premier economic and financial hub.

On January 4, the Ministry of Planning and Investment and the people’s committees of Ho Chi Minh City and Danang revealed an action plan on building regional and international financial centres (IFCs) in Vietnam. This decision is not only an important step for the two cities, but also a major national strategy aimed at making Vietnam a significant financial hub for the region and beyond.

Truong Bui, managing director for Roland Berger in Vietnam |

Strategically positioned in Southeast Asia and bolstered by its increasingly advanced transport infrastructure, Ho Chi Minh City is solidifying its role as the nation’s premier economic and financial hub. As of late 2024, Ho Chi Minh City contributed over 22 per cent of the country’s GDP with a total of $4.85 billion in foreign direct investment, showcasing its pivotal role in the country’s economic landscape. It hosts the nation’s highest concentration of financial institutions, accounting for a quarter of total national capital mobilisation and nearly 30 per cent of outstanding loans.

Specifically, the Ho Chi Minh Stock Exchange captured an impressive 95 per cent of total market capitalisation and contributed over 54 per cent to national GDP.

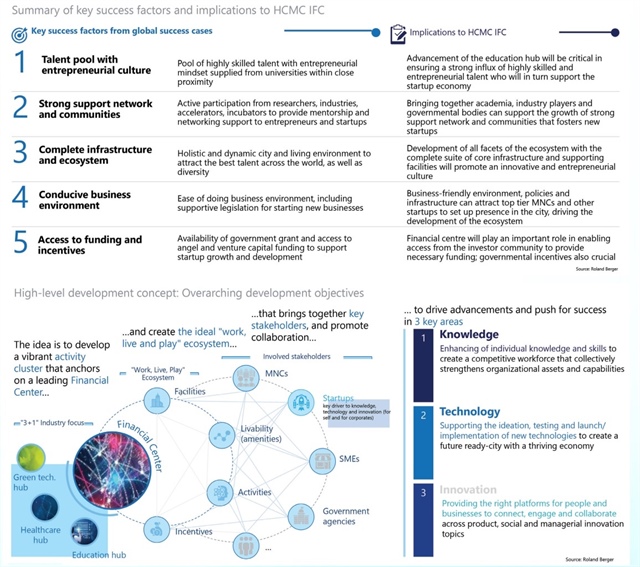

According to Roland Berger’s expertise, Ho Chi Minh City can learn from successful models such as Singapore, Hong Kong, Dubai, and Dublin, while adapting to the city’s specific conditions and realities.

For instance, Singapore focuses on developing asset management and fintech industries, Hong Kong implements policies to attract international banks, and Dubai stands out with its free trade zone policies and incentives.

Serve as a driving force

Roland Berger suggests that Ho Chi Minh City should establish a clear and practical development roadmap for its IFC, starting with building a solid financial foundation in the city centres, then transitioning into a regional centre, and ultimately becoming a global hub.

The IFC in Ho Chi Minh City will follow a 1+3 model, with its core being an international hub and three supporting hubs focused on green industries, healthcare, and education and training, creating a comprehensive financial ecosystem. This centre will concentrate on developing core financial products, including monetary markets and banking systems, stock markets, corporate bond markets, and commodity markets.

Ho Chi Minh City’s financial centre will not only symbolise economic growth but also serve as a driving force for knowledge, technology, and innovation. Supported by government incentive policies and significant investments in modern infrastructure, the centre will foster a vibrant ecosystem where multinational corporations, small- and medium-sized enterprises, and startups can collaborate and thrive.

This foundation will enhance workforce capabilities, strengthen organisational capacities, and bridge the gap between the business community and government. It will provide an environment where innovative ideas can be transformed into reality. Moreover, it will pave the way for breakthroughs in products, governance methods, and the convergence of advanced knowledge and technology.

Ho Chi Minh City must focus on several key enablers to realise its ambition of becoming a comprehensive IFC. Firstly, a highly skilled workforce with exceptional expertise is the foundation, requiring the city to establish leading schools and educational institutions within the area.

Concurrently, the city should build a modern community accompanied by startup accelerator programmes to foster innovation in finance, creating a living and working environment for top financial professionals.

Next, comprehensive upgrades to transportation connectivity are essential, ensuring smooth transit between the financial hub, Tan Son Nhat and Long Thanh international airports, and the regional transportation network. Investment in ICT infrastructure and data centres is also crucial to ensure data security and drive fintech innovation.

Finally, a business-friendly environment with attractive incentives is indispensable, ranging from startup support and attracting multinational corporations to facilitating access to financial resources. These factors will serve as a powerful catalyst for Ho Chi Minh City to attract investment and achieve sustainable development.

|

The time for strong policies

Drawing from our strategic consulting expertise and lessons from leading IFCs, Ho Chi Minh City should decisively implement groundbreaking policies, innovative strategies to draw in developers and investors, and general incentives to shape itself into a world-class IFC in Vietnam.

Firstly, the city could consider introducing exceptional tax incentives, such as reducing corporate income tax to 10 per cent for 15 years, offering full tax exemptions for the first four years, and reducing tax by 50 per cent for the following nine years. Similar to the models of Dubai and Dublin, tax exemptions and reductions for fund management entities will encourage leading investment funds to establish a presence in the centre and promote green finance with support from the World Bank and the State Bank of Vietnam.

Secondly, in terms of attracting developers and investors, Ho Chi Minh City can take inspiration from Dubai by developing modern infrastructure within a 25km radius and integrating cutting-edge technology to create optimal development conditions.

Additionally, fintech companies should be given priority through infrastructure support and tax incentives, modelled after Switzerland’s approach to fostering an innovative ecosystem.

Finally, general incentives should focus on attracting international talent. For instance, Ho Chi Minh City should adopt a fast-track visa programme, granting senior professionals visas within 15 days, or waiving licensing fees for the first year, as seen in Busan in South Korea. These policies and incentives will not only give Ho Chi Minh City a competitive edge but also position it as a modern financial hub, leading in fintech and green banking across the region and globally.

With these strategic steps and actionable solutions, we believe that Ho Chi Minh City can aspire not only to become Vietnam’s first international financial hub but also to establish its position on the global financial map, symbolising innovation, creativity, and sustainable development in the new era.