VinaCapital funds performed well in 2024

VinaCapital funds performed well in 2024

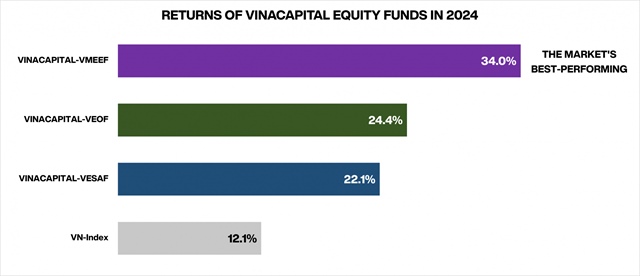

The 2024 funds market report released by fmarket, a marketplace for open-ended funds in Vietnam, revealed that the VinaCapital Modern Economy Equity Fund (VINACAPITAL-VMEEF) was the best-performing open-ended fund in the market last year, with a return of 34 per.

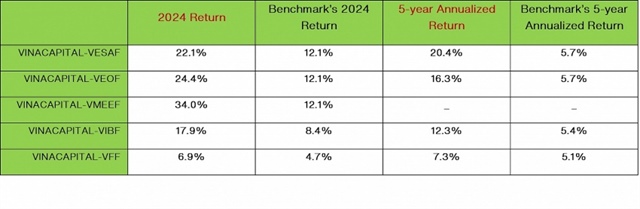

Other funds managed by VinaCapital also significantly outperformed their respective benchmarks over both 1-year and 5-year periods, highlighting the company's expertise and resilience in the investment market.

The equity-focused funds, VINACAPITAL-VESAF and VINACAPITAL-VEOF posted impressive returns, far exceeding their benchmark, the VN-Index.

Other funds, including the balanced VINACAPITAL-VIBF and the bond-focused VINACAPITAL-VFF, also delivered strong results, surpassing their respective benchmarks. The table below summarises their performance as of December 31, 2024.

|

The equity fund VINACAPITAL-VDEF, launched last June, also posted a return of 4.9 per cent by year-end, outperforming its benchmark, the VN-Index, which recorded a return of just 1 per cent over the same period.

On a 5-year annualised basis, the equity funds VINACAPITAL-VESAF and VINACAPITAL-VEOF remained the top performers in the market, securing the No.1 and No.3 positions, respectively.

|

VinaCapital's six open-ended funds saw significant growth in assets under management, vales at over VND 7.8 trillion ($326.8 million) by the end of 2024, a remarkable increase of 124.6 per cent on-year.

With more than 88,800 investors by year-end, VinaCapital open-ended funds have become the preferred investment vehicle for many. Brook Taylor, CEO of VinaCapital Fund Management JSC, believes that 2024 was a pivotal year for VinaCapital as it continued to focus on delivering value and sustainable growth for investors.

"Our open-ended funds have outperformed expectations, a testament to the resilience of the Vietnamese market and our strong investment philosophy. This performance underscores our leadership in the investment sector and reflects our strategic alignment with Vietnam's dynamic economic growth," said Taylor.

VinaCapital open-ended funds have consistently outperformed their benchmarks, thanks to a strategic approach that combines in-depth market research, sound risk management, and a focus on high-quality, long-term investments. The company's investment team remains agile as they adapt to changes in the market environment and identify sectors poised for growth. In particular, VinaCapital has focused on industries benefiting from Vietnam’s rapid economic development, such as technology, infrastructure, and consumer goods.

The company's ability to navigate the complexities of both the equity and fixed income markets has proven essential in delivering solid returns for its investors. Moreover, VinaCapital’s disciplined investment philosophy and adherence to a thorough, research-backed process have helped mitigate the risks associated with market volatility, allowing the funds to maintain consistent performance even during challenging market conditions.

For investors seeking reliable, high-performance funds, VinaCapital open-ended funds offer a compelling choice, backed by years of expertise, a disciplined investment approach, and a proven track record of outperformance.